2022 FCC Food Report: Exploring sugar and confectionary products

This information is shared from the 2022 FCC Food Report — highlighting the opportunities and challenges for Canadian food manufacturers by industry. To get the bigger picture — read the full report.

Introduction

After a difficult 2020, the sugar and confectionery industry had one of its strongest years for revenue growth on record. At the onset of the pandemic, volumes of confectionery products and refined sugar heading to foodservice establishments declined as consumers stocked up on essentials. 2021 saw a shift back towards purchasing candy, chocolate and other feel-good foods. Healthy choices remain a key trend in Canada, but indulgence is not going away.

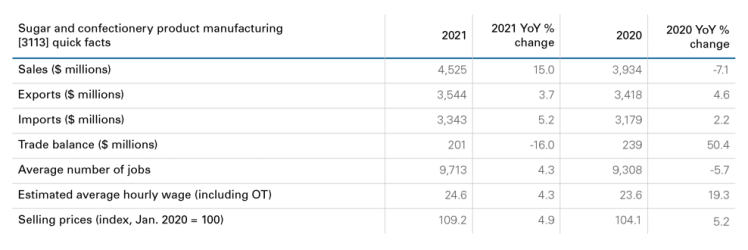

Sales increased 15.0% in 2021 to $4.5 billion (Table B.1). Manufacturing selling prices increased just over 4.9% as the largest contributor to sales was volume growth. Higher cocoa/chocolate prices contributed to inflation, but they also had the largest positive influence on volume gains. Halloween and Christmas seasons boosted confection sales.

Manufacturers responded to increases in demand by increasing employment by 4.3% in 2021. Employment remained below 2019 level but ended the year with gains in Q4. Sales per employees increased over 10% on productivity gains.

Imports grew more than exports in 2021 as Canada increased sugar imports from Brazil nearly 35%. Exports grew a modest 3%, with increased exports to the U.S. and Italy.

Table B.1: Higher volumes boosted sales and gross margin in 2021

Sources: Statistics Canada, FCC Economics

Gross margin

Gross margins increased for the third consecutive year in 2021, driven by strong growth in Q1 and Q2. A higher Canadian dollar helped offset increases in many input prices, including raw cane sugar. This, combined with strong selling prices offset higher labour costs. Results can differ widely depending on the core products produced, but overall, 2021 was a strong year for the industry.

Figure B.1: Gross margins in sugar and confection have been strong during the pandemic

Sources: Statistics Canada, FCC Economics

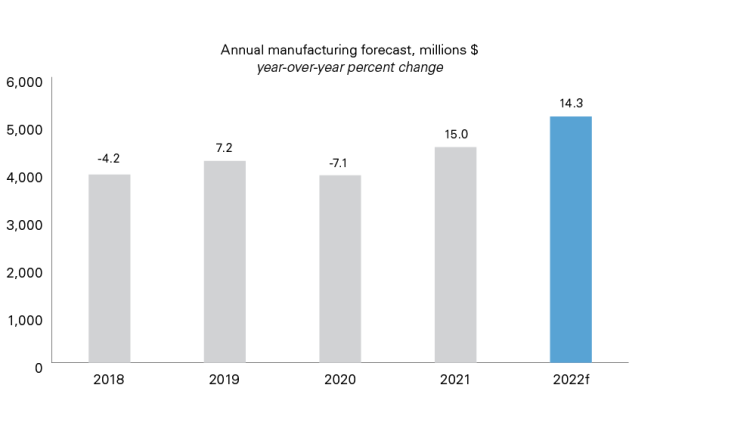

Sales forecast

FCC Economics projects sales to increase 14.3% in 2022. Growth momentum from 2021 is expected to continue into the summer of 2022 before moderating later in the year. Sales in Q4 2022 is expected to in the 0-2% range with the expectation that consumer spending starts to slow. Higher inflation can also nudge consumers away from impulse purchases made at the checkout counter like gum, candies and chocolate bars. Refined sugar exports are also expected to lower in 2022 on higher U.S. production.

Figure B.2: Sugar and confection product sales expected to increase 14.3% in 2022

Sources: Statistics Canada, Barchart, Moody's Analytics, FCC Economics

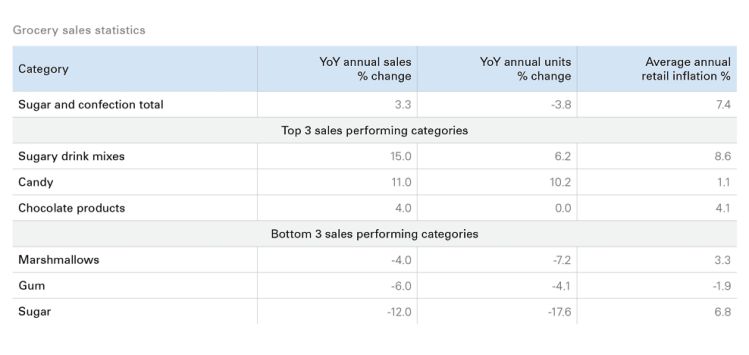

Grocery report

Grocery sales of sugar and confectionery products increased 3.3% in 2021 YoY, beating the total grocery food increase of 0.3% (Table B.2). Sales rebound in sugary drink mixes, candy and chocolate. Above-average inflation in sugar did not offset declines in volumes, and sales declined 12% as households baked less at home (after sales rose over 20% in 2020). However, sales remain above pre-pandemic levels.

Table B.2: Higher prices boosted sugar and confectionery product sales in 2021

Source: Nielsen

Bottom line

As the consumer becomes mobile again, opportunity abounds. For this industry, convenience and indulgence are differentiators for candy, chocolate and other sugary pleasures. Strategic considerations include finding opportunities to capitalize on consumer spending alongside reopening of food services and hospitality.

Record prices and strong demand boosted grain and oilseed milling sales and profitability in 2021.