2023 economic trends: Grain and oilseed milling

This information is shared from the 2023 FCC Food and Beverage Report – highlighting the opportunities and challenges for Canadian food manufacturers by industry. To get the bigger picture – read the full report.

Stronger crop yields and domestic population growth are key drivers

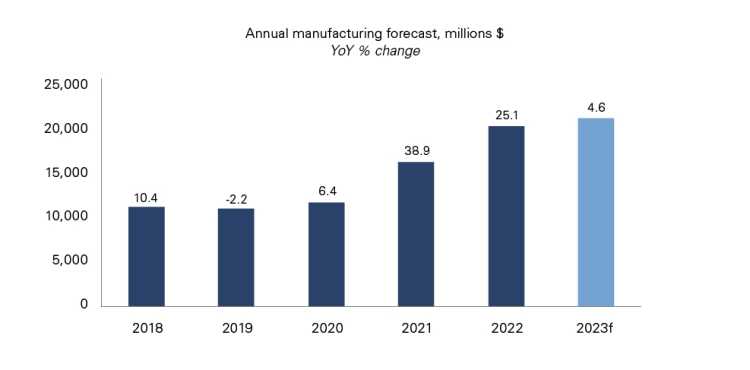

FCC Economics projects sales from the grains and oilseeds milling industry to increase 4.6% in 2023 (Figure A.1).

Figure A.1: Grain and oilseed milling sales expected to increase 4.6% in 2023

Sources: FCC Economics, Barchart, Statistics Canada, Moody’s Analytics

Sales growth is projected to be strongest in the first half of the year, increasing 15%. As 2023 unfolds, that growth will likely subside and dip below zero in Q4 from lower prices. Because industry prices are correlated to commodity prices, YoY higher crop yields in 2022 pressured some crop prices lower, leading to decreased costs for the industry. This is expected to eventually lead to lower selling prices. The USDA has wheat and oilseed global supply increasing in 2023.

Volume growth may depend on continued export growth to the U.S. and China – but that’s uncertain. The lower exchange rate in 2022 made Canadian products more attractive in a high-cost U.S. environment, making it easier for businesses to successfully increase prices. Chinese imports of Canadian grain and oilseed products increased a whopping 117% YoY since August after China lifted a ban on Canadian canola and started to ease their domestic pandemic policies. Representing 15% of all Canadian sales, the growth rate will unlikely continue. Weaker economic growth globally could also lower export opportunities. Instead, volume growth will likely be tied to Canadian factors such as population growth and retail prices.

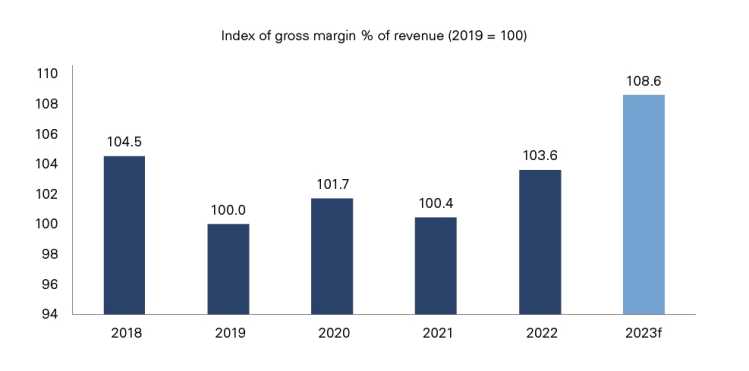

Gross margins are expected to strengthen in 2023 after seeing some growth in 2022 (Figure A.2). Much like sales, margin growth is expected to be greatest in the first half of the year. Crop prices have fallen more than manufacturing selling prices, leading to strong margins expected to erode as 2023 progresses.

Figure A.2: Gross margins projected to strengthen in 2023 amid downside risks

Sources: FCC Economics, Statistics Canada

How we got here: Record prices drove sales growth in 2022

Sales increased 25% in 2022 (Table A.1). Gains were largely a result of record prices, which increased 23%. The war in Ukraine and the 2021 North American drought pressured grain and oilseed prices higher. Strong demand allowed businesses to pass on higher costs to customers, and higher foodservice volumes drove the remaining balance of higher sales.

Table A.1: Grain and oilseed product sales continued their strong growth in 2022

Source: Statistics Canada

Retail grocery volumes declined in 2022 as more people ate at restaurants compared to the pandemic-impacted 2021, and higher grocery prices shrunk consumer purchases. According to data from Nielsen IQ, grain and oilseed product prices at grocery stores inflated 13% in 2022 YoY. Margarine led inflation of food items at over 32%, with sales values increasing 25% while volumes declined 6%. Flour was one of the only categories with positive volume growth, rising 3%. Edible oil prices rose 21% as volumes declined 5%.

Industry wages were above average, yet employee weekly earning growth in 2022 was below the average of food manufacturing overall (rising only 1.5% YoY). That compares favourably with 2020, when sector employee earnings rose nearly 20% as businesses increased wages during the pandemic.

Bottom line

With strong demand for flour and edible oils from downstream food and beverage manufacturers, retail and foodservice, the grains and oilseeds milling industry is poised for growth.

Consumer interest in convenience and sustainability (for example, sourcing more local grains and oilseeds) drove the success of this year’s domestic consumption.

Healthy grain and oilseed products continue gaining traction at home and abroad, and Canada’s manufacturing capacity is positioned to expand.

Food and beverage processing consumers and customers are forcing everyone in the food industry to understand that sustainability matters.