Fruit and vegetable preserving and specialty foods: 2024 FCC Food and Beverage Report

The following information is from the 2024 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. For the most recent FCC Food and Beverage report, click here.

Consumption shifts from fresh to canned and frozen food

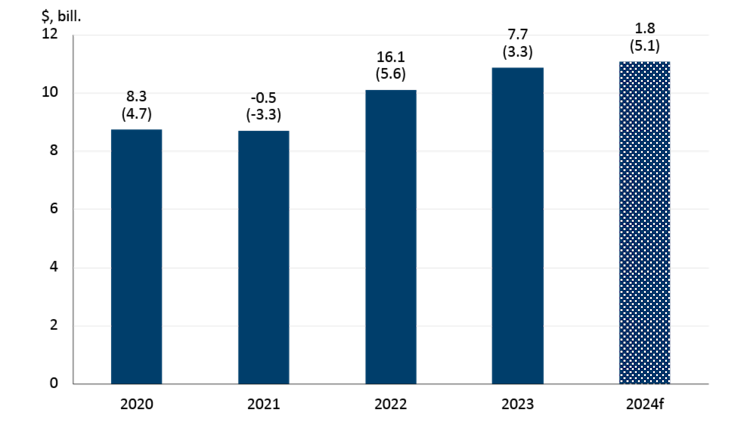

After two strong years, fruit and vegetable preserving and specialty food manufacturers should expect another, with sales (1.8%) and volumes (5.1%) forecast to increase (Figure 1). Less favourable economic conditions tend to drive consumers to canned and frozen goods as Canadians look to save money and reduce food waste.

Figure 1: Fruit and vegetable preserving and specialty food sales volumes to increase in 2024

Total sales (in $, billions) are on the y-axis. The top number above each bar is the year-over-year growth in sales measured in dollars. The bottom number above each bar (in parentheses) is the year-over-year growth in volume sold. Volumes are reported sales deflated by a price index (January 2020 = 100).

Sources: FCC Economics, Statistics Canada

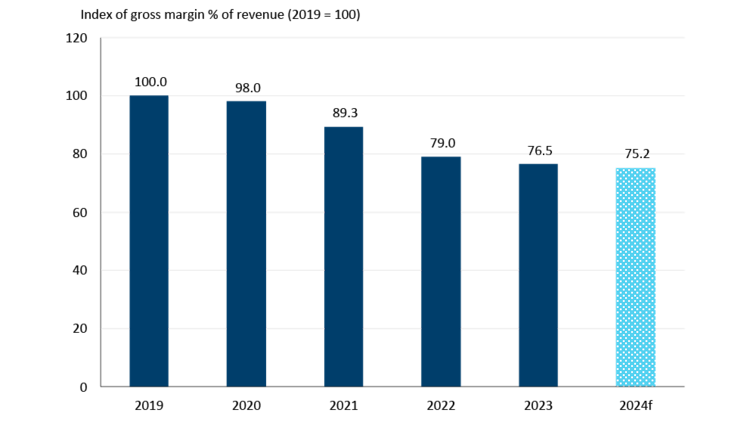

However, in 2024, there will be stiff competition from private-label canned and frozen goods. In addition, raw input costs, packaging costs and higher wages will collectively increase slightly more than nominal sales, limiting margin improvement in 2024 (Figure 2).

Figure 2: Fruit and vegetable preserving and specialty food margins to remain flat in 2024

Sources: FCC Economics, Statistics Canada

FCC Economics spotlight: Shifting to less expensive canned and frozen goods in turbulent economic times

Unpacking the outlook for this sector is worth the time, given that it encompasses diverse subsectors, including fruit and vegetable canning/pickling/drying and frozen food manufacturing (frozen fruit and vegetables, frozen dinners and side dishes, frozen pizzas, etc.).

In 2021, when households had more savings and disposable income (and fewer options to spend their money), sales declined as consumers opted for fresh produce over frozen. However, that trend has reversed since 2022, with consumers looking for ways to save money in a tough economic environment. According to a 2022 Caddle survey, nearly 50% of respondents shifted from fresh to frozen products to save money.

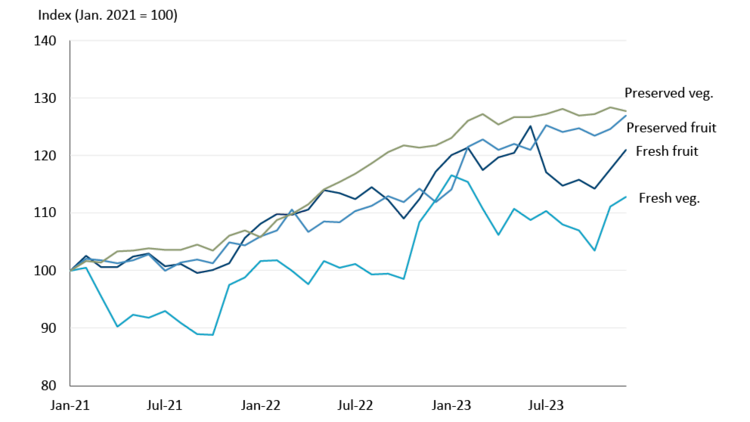

While canned/frozen products are typically lower priced than their fresh counterparts, the prices of preserved fruit and vegetables at the grocery store have increased more than those of fresh fruit and vegetables since 2021 (Figure 3).

Figure 3: Changes in select CPI categories, 2021 - 2023

Source: Statistics Canada

However, this observation doesn't consider three important things.

Food waste costs. Fresh fruit and vegetables in Canada account for 45% of food waste1. Switching to preserved fruits and vegetables could save money in the long run by reducing food waste.

Starting price when these increases took effect. For example, in January 2021, the average price of one kilogram of tomatoes was $6.44; for 796 ml of canned tomatoes, it was $1.45. After converting to equivalent units of measurement, canned products are still relatively cheaper than fresh, even with the former's higher price increases over the last three years.

Packaging and transportation costs. Canned and frozen foods tend to require more packaging material than fresh. Despite a slowdown in some packaging costs in 2023, the aggregate packaging materials index increased 5% in 2023 (see Appendix). One positive was that refrigerated trucking rates fell (-15%) in 2023 as fuel prices fell and more trucks became available amid a general economic slowdown, which should remain the case in 2024 given the weak economic growth projected.

Prepared meals and frozen pizza sales were worth $2.6 billion in 2023 and are one of the country's fastest-growing food segments. According to lpsos Canada, convenience is the primary reason consumers purchase frozen food, particularly for millennials managing their families and work-life balance.

Other trends to monitor in 2024

Health-conscious consumers look for products with health benefits such as lower sugar and sodium and added vitamins and minerals.

Though canned goods have a longer shelf life, this also introduces stiff competition from imports.

One area of growth for this sector is meeting the increasing and changing demands of Canada's rapidly growing ethnically diverse population segments.

1 Source: Food Waste Statistics In Canada