Canadian food shopping habits are changing: 2024 FCC Food and Beverage Report

The following information is from the 2024 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. For the most recent FCC Food and Beverage report, click here.

2023 was a lean year for Canadian food and beverage manufacturers, but the overall outlook for 2024 is more positive. There are sector-specific headwinds to be cautious of as consumer shopping habits change amid still-high inflation and elevated interest rates. However, population growth and stabilizing – in some cases, falling – input costs are providing optimism for margin improvement for 2024.

Canadian food shopping habits are changing

The high inflation of the last two years and the corresponding interest rate increases meant to combat it are stretching household budgets. The spending of the massive amount of savings accumulated during the pandemic has slowed as household budgets tighten amid a slowing economy, and debt-servicing levels (as a percentage of disposable income) are at a record high. This has left less for consumers to spend on discretionary and higher-priced items. Many consumers say the impact of high interest rates are just beginning to affect their spending.

In 2023, Canadians spent less on average on food and beverages. There's a lot to unpack with this observation. In 2020 and 2021, Canadians were flush with cash as pandemic restrictions and lockdowns limited spending options. One of the few ways people could spend their money was at the grocery store. In 2020 alone, per capita food and beverages expenditures at the grocery store jumped 6.4% year-over-year (YoY). In context, in the fifteen years before the pandemic, this number increased by only 0.5% per year. The average amount spent on food at the grocery store declined in 2021 (relative to the large increase in 2020) but was still 5.3% higher than in 2019. However, by 2023, it had fallen to the lowest point since 2013. In the restaurant and bar space, per capita spending has rebounded since the steep decline seen at the onset of the pandemic but is now only back to the level observed nearly a decade ago.

Spending more or less money on food doesn't necessarily mean people are purchasing more or less food (though it doesn't exclude that as a possibility). Changing shopping habits also need to be considered. As food prices rose in 2022 and 2023, consumers began purchasing more sale items, purchasing less expensive brands, shopping more often at low-cost retailers, and yes, cutting back on the amount of food purchased. According to the Agrifood Lab at Dalhousie University, we should expect these behaviour shifts to continue. For example, in 2024, over four in ten (43%) Canadians say they'll be watching for sales and promotions, while over one in five Canadians (21%) say they'll opt for generic or store-brand products.

Opportunities for food and beverage manufacturers in 2024

Changing shopping habits doesn't necessarily mean fewer opportunities for food and beverage manufacturers. According to the International Food Information Council, when asked what influences a consumer's decision to purchase a food product in 2023, taste remains the top consideration, and price is the second consideration. However, the share of respondents listing price as a factor increased since 2021. With consumers' price sensitivity becoming more prominent over the past few years, processors modified package sizing and substituted less expensive inputs where possible. Healthiness, convenience and sustainability round out the top five considerations when purchasing food. Innovating and meeting these consumer demands will drive sales in 2024.

Canada's growing and increasingly diverse population is providing additional opportunities. On October 1, 2023, Canada's population was estimated at 40.5 million. Over one million people entered the country in the first nine months of 2023. That's a lot more mouths to feed. With most of the population growth stemming from international immigration, the country's food preferences are becoming more diverse, offering opportunities to food manufacturers to serve niche – but growing – market segments.

Our projections for 2024

FCC Economics projects that food and beverage manufacturing sales will fall 1.4% in 2024, from $164.9 billion to $162.6 billion. Gross margins, however, will improve slightly, with our gross margin index up 1.5% on average. Gross margin estimates vary greatly across sector; some will perform better than the average and others will perform worse.

One wildcard in our forecasts is the U.S. economy's resiliency, given that 80% of our food and beverage exports went to the U.S. in 2023. Should the U.S. economy continue outperforming expectations, export growth could surprise to the upside and turn the projected small sales contraction forecast into small growth.

While this may seem counterintuitive, the reasons behind the outlook are simple. Much of the sales growth in the last three years has been fuelled by inflation as manufacturers aimed to pass on increases in input costs to the best of their ability to protect margins. In 2023, input costs began to stabilize and, in some cases, outright declined. Many commodity prices are significantly lower today than in the last two years, fuel and transportation costs are lower, and packaging cost growth has slowed. Wage growth has remained hot, although the falling job vacancy rate suggests a moderation is in the cards later this year. We expect these trends to hold in 2024. All told, the decline in the cost of goods sold will be larger than the decline in sales, providing a small margin boost this year.

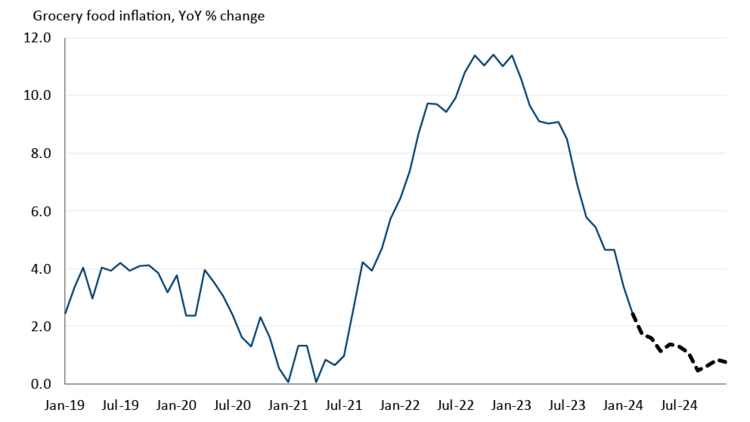

The lessening impact on inflation should also provide relief at the grocery store. FCC Economics forecasts that the inflation rate for food purchased at the grocery store will fall below 2.0% by spring and stay roughly between the 1.0% to 2.0% range for the remainder of the year (Figure 1). We expect food price increases beyond this year to stabilize around its pre-pandemic level.

Figure 1: Grocery food inflation rate will continue to decelerate in 2024

Sources: Statistics Canada, FCC Economics

The FCC Food and Beverage Report 2024 provides sales and margin forecasts for each sector and a Spotlight segment highlighting each sector's unique challenges and opportunities.