Sugar and confectionery products: 2024 FCC Food and Beverage Report

The following information is from the 2024 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. For the most recent FCC Food and Beverage report, click here.

Sugar and cocoa prices to take a bite out of profitability

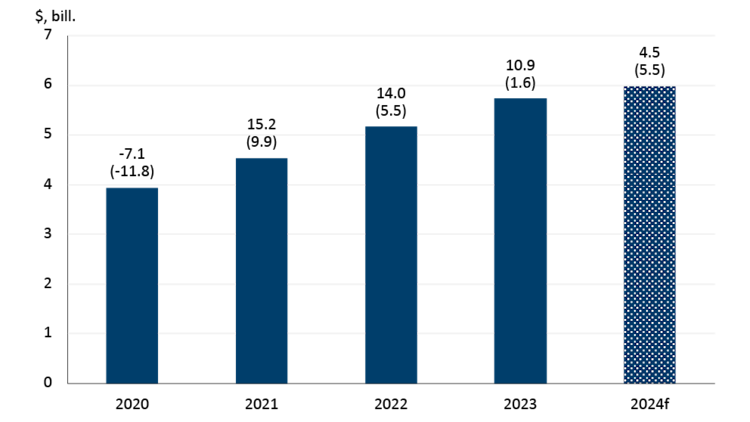

At first glance, one would expect sugar and confectionery product manufacturers to have a good year given our forecasts of sales and volume increases (4.5% and 5.5%, respectively) in 2024 (Figure 1). However, the sector faces significant headwinds heading into the year.

Figure 1: Sugar and confectionery product sales and volumes are expected to grow in 2024

Total sales (in $, billions) are on the y-axis. The top number above each bar is the year-over-year growth in sales measured in dollars. The bottom number above each bar (in parentheses) is the year-over-year growth in volume sold. Volumes are reported sales deflated by a price index (January 2020 = 100).

Sources: FCC Economics, Statistics Canada

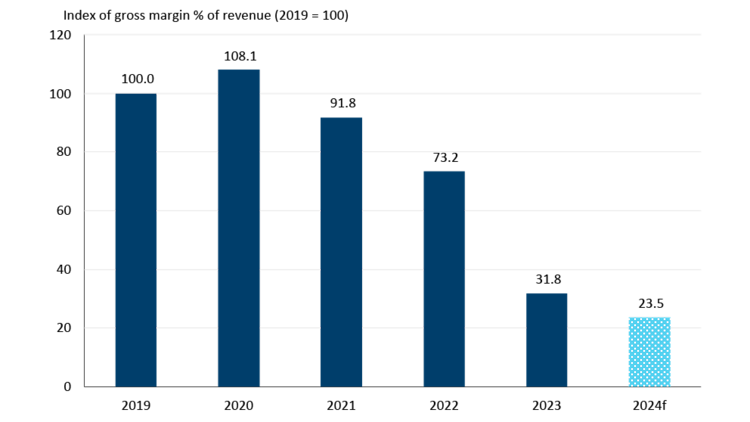

In 2023, margins were pressured as raw material and labour costs increased more than sales (Figure 2). This will remain the case in 2024, particularly for sugar and cocoa prices, as highlighted in the Spotlight section below.

Figure 2: Sugar and confectionery margins under extreme pressure in 2023, 2024

Sources: FCC Economics, Statistics Canada

FCC Economics spotlight: global sugar and cocoa supplies tight heading into 2024

Global sugar prices rose to their highest level since 2011 last year, mainly due to lower global supplies after unusually dry weather damaged sugar cane harvests in India and Thailand, the world's second- and third-largest sugar producers. Both countries have export restrictions in place that are expected to extend into 2024. Sugar prices have eased somewhat off their highs in 2023 but remain elevated.

Sugar cane can be used to make refined sugar or ethanol. Incentive programs in Brazil – the world's largest producer of sugar cane – have pushed sugar cane into ethanol at a roughly 50/50 split between sugar and ethanol use. However, the recent high sugar prices are diverting more cane into sugar refining over ethanol. This could boost sugar supplies more in 2024, putting downward pressure on prices. Brazil is expected to have record sugar cane, soybean and corn crops this year. Terminals exporting sugar and sugar cane also handle other exports, including corn and soybeans, and given all the expected production, the United States Department of Agriculture is expecting logistical bottlenecks in Brazil.

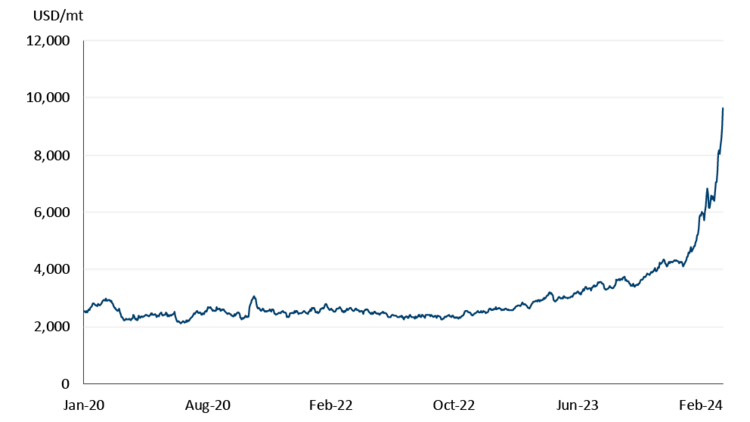

Meanwhile, cocoa prices hit a high in 2023 not seen in 46 years – and prices continue to accelerate. Cote d'Ivoire and Ghana are the world's largest cocoa producers (accounting for 44% and 14% of global production, respectively) and were impacted by El Nino last year, limiting the region's cocoa bean production. These production challenges don't appear to be waning, and futures markets are pricing this in, with cocoa futures up nearly 130% since January 1 alone as of the time of writing (Figure 3).

Figure 3: Cocoa futures going hyperbolic to begin 2024

Source: Barchart

High sugar and cocoa prices will impact profitability in 2024. Manufacturers will have to absorb some of these increases as tighter household budgets limit how much can be passed onto the consumer. Still, demand should remain relatively robust as research has shown consumers tend to treat themselves to smaller and lower-cost indulgences during difficult economic times.

Other trends to monitor in 2024

Candy manufacturers' innovative responses to consumer preferences continue to evolve, including offering consumers "experience-rich" immersive tours of manufacturing facilities, premium bulk candy, vegan sweets, and candy made with natural ingredients, reduced sugar content, and/or fortified with vitamins and minerals.

With consumers looking for environmentally friendly products, there's a move towards sustainable packaging for bulk candy (for example, biodegradable materials, reducing plastic use and packaging designs that encourage recycling).

Canadian sugar refineries announced plans to upgrade and/or build new plants in 2023 and early 2024, highlighting the sector's long-term growth.