Grain and oilseed milling: 2025 FCC Food and Beverage Report

The following information is from the 2025 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture read the full report.

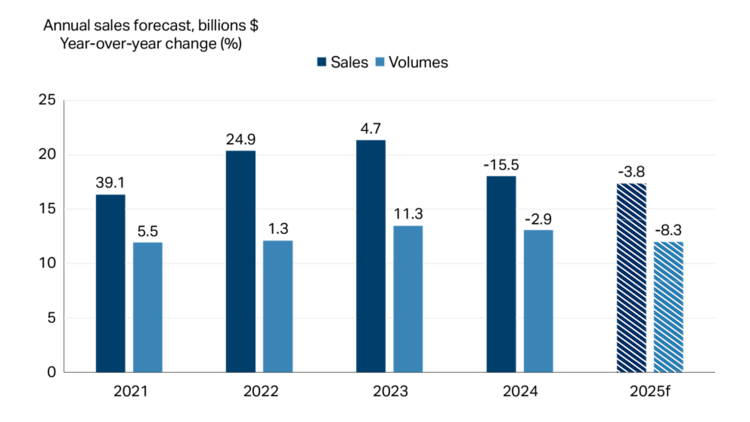

After a strong four years, including two years of double-digit year-over-year growth, lower prices translated to a -15.5% drop in sales in 2024. The sector is heading into another year of declines, with sales projected down -3.8% and volumes (that is, sales adjusted for inflation) down -8.3% (Figure 1).

Figure 1: Lower grain and oilseed milling sales expected in 2025 after strong growth in recent years

Total sales and volumes (in $, billions) are on the vertical axis and shown by the height of each bar. The number above each bar is the year-over-year growth as a percent. Volumes are sales deflated by a price index (202001=100).

Sources: FCC Economics, Statistics Canada

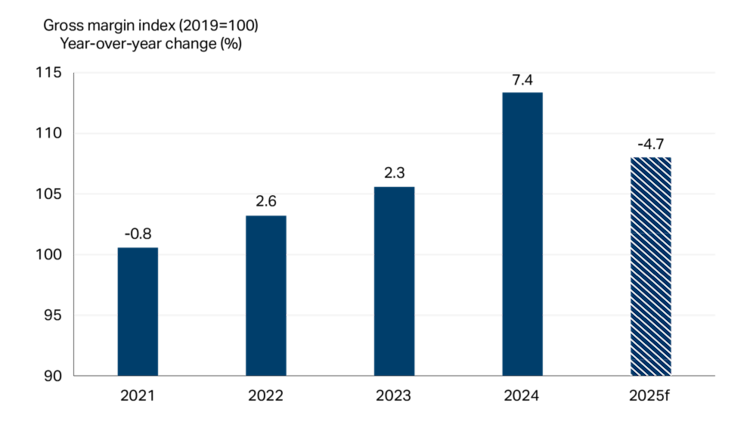

Despite lower sales in 2024, grain and oilseed milling still registered a large margin increase thanks to lower prices for key inputs like wheat, soybeans and canola. In 2025, we forecast these margins to fall slightly but remain up from 2023 (Figure 2). Margins could fall further in 2025 if global trade disruptions persist, causing weaker demand, particularly for oilseed products.

Figure 2: Margins forecasted down in 2025 but remain strong

Sources: FCC Economics, Statistics Canada

Market insights: Biofuels demand uncertain in 2025

Biofuels rely on renewable feedstocks including vegetable oils, animal fats or used cooking oil. While the biofuel market in Canada remains relatively small, significant attention has been directed towards the U.S. in recent years. This results from U.S. federal and state policies that have spurred biofuel production through various incentive programs.

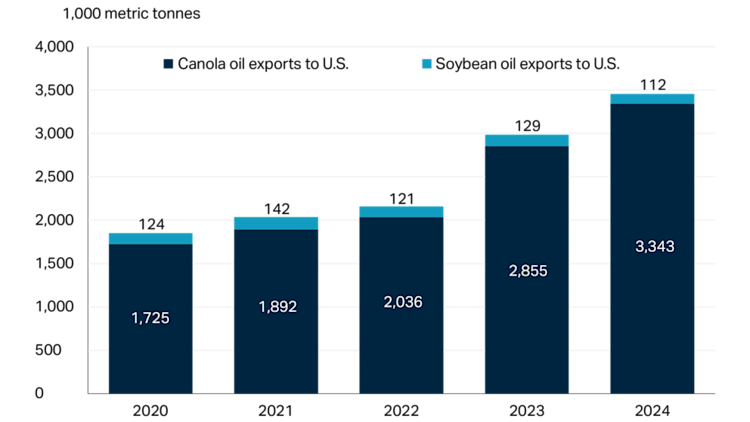

U.S. imports of biofuel feedstocks have grown significantly over the past five years, and Canada’s grain and oilseed milling sector has benefited from that growing demand. Between 2020 and 2024, Canadian canola oil exports to the U.S. increased 94%. A notable increase occurred in 2023 when the U.S. included canola oil as an eligible feedstock into their biofuels tax credit program (Figure 3). This policy change also led to a significant shift in the use of canola oil in the U.S., with industrial uses now accounting for over half of canola use, compared to just a quarter before the announcement. Canada accounted for 91% of the U.S. canola imports in 2024.

Figure 3: Canadian vegetable oils respond to demand for biofuels feedstocks in the U.S.

Source: Statistics Canada

However, the demand from the U.S. biofuels market in 2025 looks hazier compared to just a few months ago.

For starters, there’s uncertainty surrounding fuel eligibility for the Clean Fuel Production Credit (45Z Tax Credit) in the U.S. This program is currently under review by the new U.S. administration, leaving biofuel producers and feedstock suppliers (like Canada) in a difficult position. This lack of clarity contributes to uncertainty, with the construction of two major biofuel production facilities in Canada on hold. As such, demand for soybean and canola oil has suddenly become more difficult to gauge. Those oils are key inputs into U.S. biofuel production and key outputs of the Canadian grain and oilseed milling sector.

Further complicating the situation for 2025 is the U.S. decision to withdraw the eligibility of imported used cooking oils as a feedstock and the potential for trade disruptions for Canadian exports. Without the use of imported used cooking oil, the demand for vegetable oils is likely to increase to fill the gap. However, trade disruptions could make Canadian exports more expensive to U.S. buyers, adding another layer of complexity to the market.

Other trends to watch

The grain and oilseed milling industry stands out from other food and beverage manufacturing sectors, doubling productivity in the last 20 years. The sector’s ability to maintain strong productivity growth going forward will be key in determining margins.

Rising consumer demand for alternative flours and grains, gluten free options, and products with specific nutritional benefits will likely continue opening opportunities for manufacturers targeting niche segments.

While the sector is in a good financial position heading into 2025, approximately 60% of sales head to the U.S., the second largest in the food and beverage manufacturing sector. This means that the grain and oilseed milling sector is more vulnerable to trade disruptions compared to other sectors.