Agriculture in a changing climate

At the heart of the agriculture industry are coffee shops where farmers gather to chat. I believe the unwritten rule is to start every meeting with a discussion about the weather. There is a reason for that. While there are many factors, the weather plays a large part in the success of the agriculture industry, and Canada’s agriculture industry is susceptible to climate change. The earth is warming, and many experts agree that we will continue to see more extreme weather events and warmer temperatures. The Aquanomics model by GHD, a global engineering and architecture service firm, projects a loss of $108 billion to the Canadian GDP from 2022 to 2050 caused by droughts, floods, and storms. Flooding could cost the economy $30 billion by 2050. The model predicts that manufacturing and distribution will be the hardest hit at $50 billion in total output losses, with agriculture 5th on the list at $3 billion in output losses by 2050. Regardless of the economic impact, the agriculture industry could be in for some changes, which is nothing new.

Impact to Production

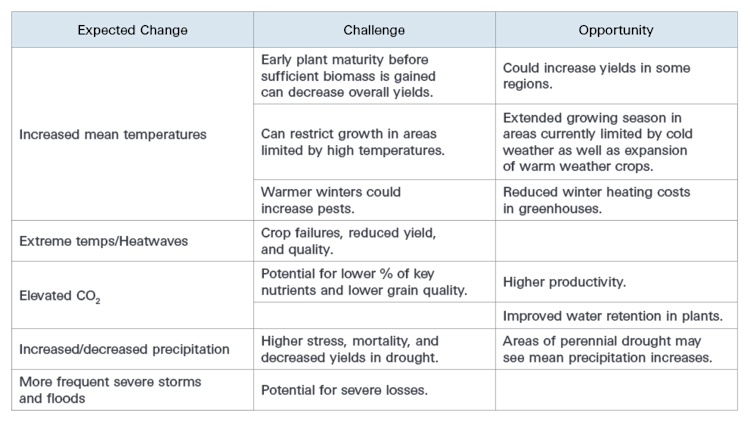

The impacts to the agriculture industry could be numerous and will present challenges as well as opportunities. It is predicted that high-latitude countries such as Canada will see more warming than the global average. This is in part due to more southern locations already being ice-free. Land is less reflective than ice, so there will be more change as ice melts in northern regions. The table below shows a few of the potential impacts.

Table 1: Challenges and opportunities in a changing climate

Source: Climate change impacts on agriculture - Agriculture Canada

Financial Impact on Producers

With a shift in climate affecting the growing season, a producer’s finances have the potential to be impacted in a few different ways highlighted below.

Commodity prices

Prices are susceptible to shifts in supply. An increase or decrease in potential acres for certain varieties could impact the supply. Increased losses due to storm frequency could also be significant.

Land Values

A recent article by our economists indicates that the current ratio can impact farmland values. Should certain areas see weather conditions improve or deteriorate profitability for extended periods, current ratios could be impacted, and land values in turn.

The impact of reliable moisture is immediately evident when we look at cultivated land values from our Farmland Values Report. The average value of irrigated land in southern Alberta is $16,600/acre while the average dry land value in the same region is $5000/acre. In West Central and Southwest Saskatchewan, the average irrigated acre is $6500/acre. Average Dry land values in West Central and Southwest Saskatchewan are $2500/acre and $2900/acre respectively. Irrigable acres selling for roughly two and three times more than dry land show that reliable moisture is sought after. Its not a stretch to think that a shift in rainfall patterns could impact future values. There are more factors affecting farmland values than just water, but its clearly part of the equation.

Insurance premiums

The Frequency of severe storms, pest damage, droughts, and flooding are expected to increase with a warmer mean temperature. The impact of weather volatility can already be seen in the insurance industry. Many producers are buying 80% coverage for high-value crops and payouts are increasing. A couple of trends can be observed from the table below. The first 5 years show premiums and payouts being close to balanced, while the last 5 years show payouts well above premiums. Premiums have started to increase; however, they are still lagging the payouts. Some of the increases in premiums and payouts could be attributed to inflation so they have been compared to expenses, which have also been inflated. A similar result is observed. The premiums have remained near 2% of expenses while the last 5 years of payouts have increased. They have been above 5% for the last three years. As with land values, there are several factors at play including prices and coverage levels. Frequency of weather events isn’t the only variable; Although If these trends continue, the premiums are likely to increase.

Table 2: Crop insurance payouts and premiums (billions)

Year | Crop and Hail Premiums | Crop and Hail Payout | Farm Expenses | Premium as % of Expenses | Payout as % of Expenses |

|---|---|---|---|---|---|

2014 | 0.98 | 0.78 | 44.6 | 2.2% | 1.7% |

2015 | 0.93 | 1.10 | 46.0 | 2.0% | 2.3% |

2016 | 1.02 | 1.02 | 46.6 | 2.2% | 2.2% |

2017 | 1.02 | 1.23 | 48.3 | 2.1% | 2.5% |

2018 | 0.95 | 0.89 | 51.2 | 1.8% | 1.7% |

2019 | 0.95 | 1.41 | 54.5 | 1.7% | 2.6% |

2020 | 1.00 | 1.7 | 55.9 | 1.8% | 3.0% |

2021 | 1.11 | 3.75 | 61.2 | 1.8% | 6.1% |

2022 | 1.53 | 4.9 | 73.1 | 2.1% | 6.7% |

2023 | 1.70 | 3.88 | 74.9 | 2.2% | 5.2% |

Opportunity

Whatever challenges or opportunities present themselves; openness to change could be key. Whether northern regions are able to expand their crop rotations, or southern regions are able to do more with less water, the most successful will be those who can adapt and adopt new farming practices. I can’t think of a group more suited to the challenge. Canadian producers are proven stewards of the land. Many have already implemented management plans to reduce financial risk. Practices to increase soil health and reduce emissions are now common place. The Candadian agriculture industry has a long history of ingenuity. This gives confidence that with support from industry partners, such as FCC and the Canadian government, we are well situated to tackle challenges going forward, and take advantages when opportunity knocks.

Article by: Kurri Carlson, Business Intelligence Analyst