2020 Outlook: Canada’s dairy sector

FCC Economics helps you make sense of these top economic trends and issues likely to affect your operation in 2020:

Slow production growth

Expanded market access to foreign dairy products

Robust domestic demand for dairy products

Higher milk price and input costs

Dairy in 2018-19 (August to July) had a year of adjustments. Total butterfat production in Canada stagnated at 380 million kg between 2017-18 and 2018-19. Butterfat production declined 1.3% in the P5 milk pool, but increased by 3.2% in the Western Milk Pool (WMP).

The P5 production decline stems from production-limiting measures. This was partially motivated by butter inventories exceeding the industry target, despite disappearance of butterfat growing at a steady pace.

A 1% increase in quota was issued in the P5 effective February 1st. Large butter inventories should limit future increases in production. But production could climb as producers bring forward production from credit days.

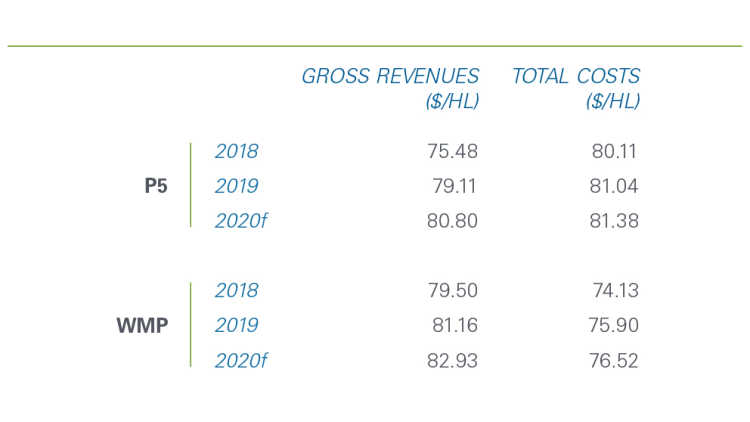

Domestic revenues for butterfat marginally increased in 2019, while revenues for proteins and other solids non-fat (SNF) increased by 13% and 4%. This increased milk revenues by 4.8% in the P5 and 2.1% in the WMP. Estimated average costs increased by 1.2% in the P5 and 2.5% in the WMP. Average net returns in 2019 increased by $2.70 per hl in the P5, while the estimated average net return in the WMP declined by $0.11 per hl.

Three factors explain our forecast for a moderate increase in milk revenues in 2020:

The Canadian Dairy Commission announced a 1.93% increase in the butter support price effective, February 1.

Stocks of butterfat are high and will limit growth in revenues.

The U.S. price for skim milk powder (SMP) grew by nearly 30% in 2019 and is projected to increase by 20%.

Balancing these three factors, we expect revenues to increase by 1.69 $ per hl in the P5 and by 1.77 $ per hl in the WMP.

Our grains and oilseeds outlook for 2020 suggests flat feed prices and a small decline in interest rates. We expect costs to increase by 0.34 $ per hl in the P5 and 0.62 $ per hl in the WMP, leading to producer net returns to improve in both regions: growing by 1.35 $ per hl in the P5 and 1.15 $ per hl in the WMP.

Table 1. Estimates of dairy farm revenues and costs

Sources: Calculations by FCC are based on cost of production estimates from the Canadian Dairy Commission and Government of Alberta and data from the Dairy Farmers of Ontario, Statistics Canada and USDA. Calculations for gross revenues do not include the butterfat premium and penalties for over-quota production.

Trends to watch in 2020

1. Consumer demand for dairy products expected to remain strong

Dairy retail prices grew by 1.4% in 2019 compared to 6.3% for beef, 0.7% for pork, 4.5% for chicken and 3.3% for eggs. We expect the African Swine Fever (ASF) outbreak in China to widen the gap between pork production and demand, leading to inflationary pressures on prices for animal proteins. Although retail sales of tofu, meat and dairy alternatives climbed by 25% in 2019 (Nielsen data), and are expected to keep growing, they’re still small compared to sales of animal proteins. We expect dairy products to be priced competitively relative to substitutes in 2020.

2. Market access to foreign dairy products expands

The implementation of the Canada-U.S.-Mexico Trade Agreement (CUSMA) is expected in the second half of 2020. Volumetric increases in import quotas for most dairy products in the first six years of the agreement are estimated to provide U.S. dairy exporters access to 3.6% of the Canadian dairy market. This is to be followed by a 1% annual increase in market access in the next 13 years. CUSMA also includes possible modifications to the Canadian dairy pricing model, which can ultimately impact producer milk revenues.

Finally, Canada agreed to limit exports of skim milk powder and baby formula. By year two, Canada will be able to export 35,000 MT of skim milk and 40,000 MT of infant formula. Exports above these levels will be subject to an export charge.

The CETA and CPTPP trade agreements will each be in year three of implementation in 2020. The CETA quotas for EU cheese have yet to be filled entirely, but EU imports are expected to increase. A similar outcome is expected, with imports coming from CPTPP partners. The federal government committed to pay $1.75B in compensation to dairy producers over eight years.

3. Balancing domestic consumption and production is a delicate exercise

Large butter stocks, accumulated production credits and increased market access under CETA, CPTPP and CUSMA limit the potential for increases in production in 2020. The figure below summarizes the balance between demand and supply. It shows an increase in the quarterly stock-to-use ratio for butter from January 2017 to October 2019. The higher the ratio, the less likely production will be required to increase to meet demand.

Figure 1. Quarterly stocks of butter climb relative to domestic disappearance

Data source: Statistics Canada table 32-10-0109.

4. Global and Canadian economic resilience to be tested

Trade tensions weighed on the global economy in 2019, which is estimated to have grown at 2.9% in 2019, its weakest performance since 2008-09. Many central banks (led by the U.S. Federal Reserve) proceeded to lower interest rates as insurance against a possible global slowdown. The International Monetary Fund (IMF) projects economic growth will rebound to 3.3% in 2020, but only if trade tensions continue to ease.

The Bank of Canada chose to remain idle in 2019 and January 2020, likely concerned that any easing in financial conditions could disrupt the delicate balance between household spending and debt. Unemployment stayed low - a positive for workers that benefited from significant wage gains, but a continued struggle for businesses looking to hire.

Financial markets place a higher probability on a cut to the overnight rate than a hike in 2020. And that’s where our assessment lands. We expect one rate cut in 2020 to support the resiliency of the Canadian economy.

The loonie gained value against the U.S. dollar in 2019, starting the year under US$0.74 to finish just under US$0.77. The momentum carried into 2020. Uncertainty should be a major theme of global financial markets in 2020, and thus we project the loonie to return towards the US$0.75 level in 2020. The loonie appreciated against the Euro in the last couple of years. The Euro/CAD exchange rate in 2020 hinges on the faith of the trade negotiations between the EU and UK post-Brexit.

Check our blog for a regular update of this 2020 outlook for dairy. You’ll also find an outlook for the grains and oilseeds, red meat, and food processing sectors.

Download PDF versionArticle by: Sébastien Pouliot, Principal Economist