2021 Cattle and hog sector outlook: navigating economic uncertainty to boost red meat sales

FCC Economics helps you make sense of the top economic trends and issues likely to affect your operation in 2021. The three major trends to monitor for cattle and hog operations include:

China’s efforts to rebuild its pig herd

Rising feed costs

Growing strength in demand for red meat

2020 was uneven across the red meat livestock sectors, a trend we expect to continue in 2021. Farrow-to-finish operations will continue to witness pressures on margins, while isowean/weanling operators will see a turnaround in profits. Profitability throughout the cattle sector will also vary. Cow-calf margins should be strong while feedlot operators and backgrounders may struggle to break even, especially in the first half of the year.

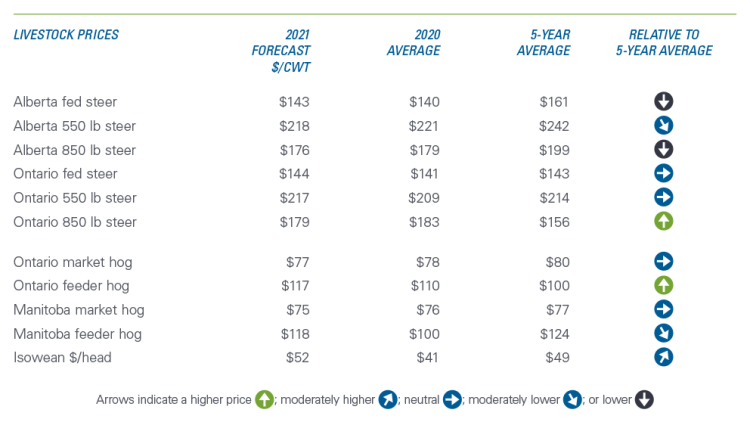

In Canada, there were large regional differences in livestock prices in 2020. Both Manitoba and Ontario market hogs were sold at roughly the 5-yr average, where they’ll likely remain in 2021 (Table 1). But Ontario feeder hog prices averaged $110 — above the 5-yr average — and are expected to climb again this year. In contrast, Manitoba feeder hogs will remain stable within the range of their 5-yr average, although they’re expected to gain year-over-year (YOY). The profitability of farrow-to-finish operations will be challenged by elevated feed costs (see below). Isowean operations should be profitable after a very volatile 2020.

Table 1: Livestock prices are expected in the next 6 months to be stable or rise

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations.

Prices for marketed and backgrounded cattle will also reflect an east-west divide. Western fed steers and backgrounders will fetch prices either roughly in line with last year’s prices or will rise modestly. But they’ll remain well below the 5-yr average. In Ontario, those prices will be higher than the 5-yr average.

Expenses: Low interest rates to partially offset rising feed and labour costs in 2021

Interest rates are expected to remain low as the Bank of Canada does not expect to increase its policy rate until 2023, providing opportunities to lock in low rates for long-term debt. COVID’s disruptions have produced a worrying K-shaped economic recovery: some sectors have enjoyed economic prosperity while others have been challenged with worsening wage gaps and unemployment. With higher unemployment in many of the jobs sought by farm workers, ag wages were 1.8% lower than a year earlier. As impacts from COVID start to fade over the second half of 2021, the expected economic growth opportunities will likely spur rehiring within the oil and energy sectors, a big competitor for ag labour. It could reignite inflationary pressures on agriculture wages by 2 to 3% annually.

Canadian feed barley is forecasted to rise 6.0% YOY to average $258/tonne. Corn is expected to be 3.7% higher on average at $219/tonne. Both supply- and demand-side factors will continue to push both prices above their respective 5-yr averages. On the supply side, La Nina-derived weather patterns formed last year and may persist throughout the 2021 growing season. Reductions in yields and volumes are being monitored from Argentina, Brazil, Australia and the U.S. Should either volumes or quality of the South American spring and summer crop be over-forecasted, it will further pressure stocks and drive-up prices for U.S. crops in the fall.

Demand from China’s rapidly expanding commercial pig production capacity for soy and corn imports is perhaps the biggest factor this year, estimated at 100 million and 17.5 million metric tons, respectively. With recent Chinese domestic corn prices almost twice as high as U.S. corn, their imports lag only the European Union for 2020/21 (October-September). It’s a trend driving feed costs exacerbated by spiking demand elsewhere and possible export quotas imposed by major producers.

Limited growth in North American hog and cattle production

Hog production slowdowns throughout North America early in 2020 due to packer closures created a backlog of animals, which resulted in lower prices and negative margins. Slaughters fell well below the 5-yr average in April. The temporary glut produced by COVID was made worse by a pre-existing large supply in U.S. hogs.

The USDA-FAS projects Canadian cattle production to be flat YOY in 2021. The YOY declining trend in calf crop production seen in 2020 will start to reverse in 2021, but without recording any gain. The YOY slide in total supply that began in 2020 will continue in 2021, as Canadian slaughters are expected to stabilize but not grow. As U.S. beef production rebounds, Canadian cattle exports will increase 5.3% YOY in 2021.

Trends to watch in 2021

1. The legacy of ASF and China’s efforts to rebuild its hog herd

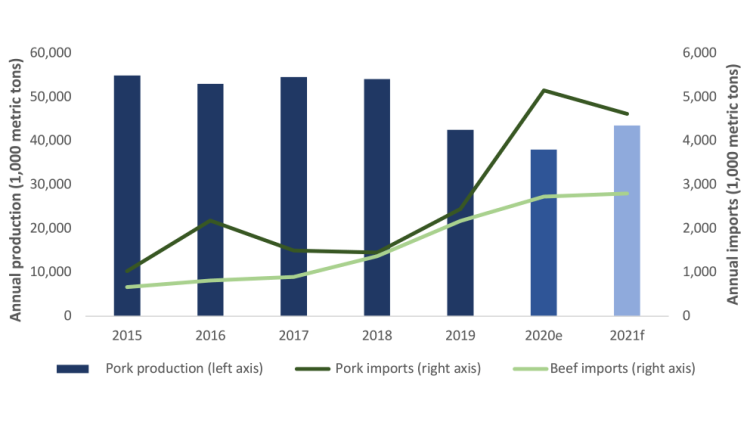

Having already re-built much of their hog herd and looking to complete its recovery, China will be the primary driver of livestock markets throughout the year ahead. According to the USDA-FAS, China’s 2020 pork production fell by 30% from 2018 to 38 million metric tons due to African Swine Fever’s lingering effects. It’s expected to reach 43.5 million metric tons in 2021.

However, the USDA estimate of Chinese pork production bumps up heavily against the country’s official statistics, which report a 3.3% YOY drop in pork production in 2020 that followed a 21% YOY drop in 2019. They estimate 2020 production at 41.1 million metrics tons, prompting speculation about a possible rebound in 2021 higher than the USDA forecast (Figure 1).

Figure 1: ASF helped boost Chinese imports of pork and beef

Source: USDA.

2. Crop production progress in a year of La Nina and major weather events

La Nina weather patterns produce severe moisture anomalies (both too much and too little), with possible repercussions this year on crop production (e.g., corn yields) in South America, Australia and the U.S. Along with Argentina’s brief suspension of export registrations for old crop corn sales during January and February, the major weather events that will strike other large producing and consuming countries will produce even greater market volatility and further drive feed prices.

3. Domestic red meat demand will be stronger - barring further COVID disruptions

Across North America in 2020, COVID disrupted supply chains by shutting meat production plants and producing a backlog of animals for slaughter. Canada appears to have largely eliminated the backlog, but further shutdowns are possible.

On the upside, COVID’s influence on global demand for red meat is expected to weaken as overall economic growth recovers from the shock sustained in 2020. Forecasted at 4% in 2021, that growth will drive new meat sales.

Here at home, widespread foodservice shutdowns in 2020 lowered both beef demand (a relatively greater preference for beef over other meats) and beef consumption (actual purchases of beef). The FCC Economics’ beef consumption index was 2.4% lower in Q3 of 2020 YOY. The demand index was unchanged. That means Canadians’ beef consumption fell because of relatively larger gains in beef prices (compared to other meats) and declining household incomes, not because consumers preferred the other food options they may have bought. If beef retail prices come down in 2021, especially relative to other meat prices and as incomes stabilize, we can expect higher consumption.

We can also expect to see a release of pent-up demand for more red meat and more expensive cuts of meat arising from Canadians’ recent uptick in savings. As COVID hit in 2020, quarterly savings rates skyrocketed (Figure 2), with a current savings rate at a high not seen since the early 1990s. Figure 2 shows the dizzying swing from 2019’s extraordinarily low savings to 2020’s extreme highs.

Figure 2: With cash in hand, how will Canadians spend?

| Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | |

|---|---|---|---|---|---|---|---|

| Household saving rate (%) | 0.6 | 1.4 | 1.6 | 2.0 | 5.9 | 27.5 | 14.6 |

Source: Statistics Canada.

With all the extra cash available, a reopening of the foodservice and hospitality sectors in 2021 may lead to some Canadians splurging on food purchases. The red meat sector may benefit from the additional demand. An important caveat: if the vaccine rollout hits snags or successive waves of the virus emerge, the setback will slow domestic red meat consumption recovery.

Check back on our blog for a regular update of this 2021 cattle and hog outlook and outlooks for the grain, oilseed, pulse, broiler, dairy, and food processing sectors. An in-depth analysis of interest rates, currencies and GDP will be released in early March.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.