2021 Food and Beverage Report: Mid-year update

A lot has changed since our 2021 Food and Beverage Report in March, yet the pandemic continues to be the headline:

Foodservice sales have rebounded along with the re-opening of the economy and stronger household incomes.

Higher agricultural commodity and material prices are challenging profitability.

Workforce shortages continue to be an issue, and unfilled orders (up over 42% YoY) are slowing the growth in sales.

All said, food and beverage manufacturing sales have been strong amid challenging conditions, and the outlook remains positive.

Food and beverages manufacturing sales forecast

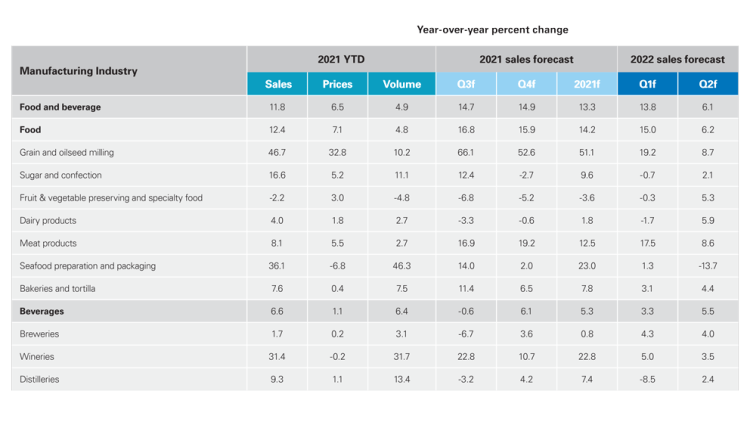

According to Statistics Canada, food and beverage manufacturing sales have increased 11.8% YTD thru July. Sales should continue to be strong in Q4 assuming the economy isn’t disrupted by rising COVID cases. We project sales to increase 15.9%, finishing the year up 13.3% before decelerating into Q2 of 2022 (Table 1). A big catalyst for this additional growth is consumers getting back together with extended family for the holidays. It also breaks down the drivers of 2021 YTD sales into a volume index and price index.

Table 1: Food manufacturing sales are supported by both strong demand and higher prices

Sources: Statistics Canada, FCC.

Leading this sales growth is grain and oilseed milling. Demand is up, with volumes up 10% and selling prices up over 32%. Into Q4 and 2022, sourcing product and keeping up will be key after the summer drought lowered crop yields in western Canada.

Weaker price inflation (and even some deflation) was registered for seafood, bakeries, dairy, and beverages, even as these sectors have experienced strong growth in sales. Beverage demand outside of wine appears to have reached a short-term peak, and there exist oversaturation and inventory concerns in the seltzer and beer markets. Sugar and confection are seeing similar growth and benefiting from a stronger preference towards convenience. This growth is expected to slow as we head into cooler weather.

Meat manufacturing has recorded softer volume growth. Higher sales are driven by price inflation. Some consumers are shifting back consumption purchases to beef from chicken and pork as prices of the latter have increased more than beef recently. Sales are expected to pick up in Q4 on higher prices and finish the year with a strong holiday season.

The fruit and vegetable and specialty food manufacturing sectors are the only industry projected to record declining sales in 2021. Consumers are no longer stocking up on frozen products and shifting back to fresh foods.

Trends to watch

Labour constraints

Canadian job vacancies increased with the re-opening of the economy because of the struggles businesses face hiring qualified employees. Many businesses are significantly increasing wages or offering overtime to meet workforce needs. Wage costs have continued to inflate at a stronger pace than selling prices in many food industries, pressuring margins.

Exchange rate versus food retail prices

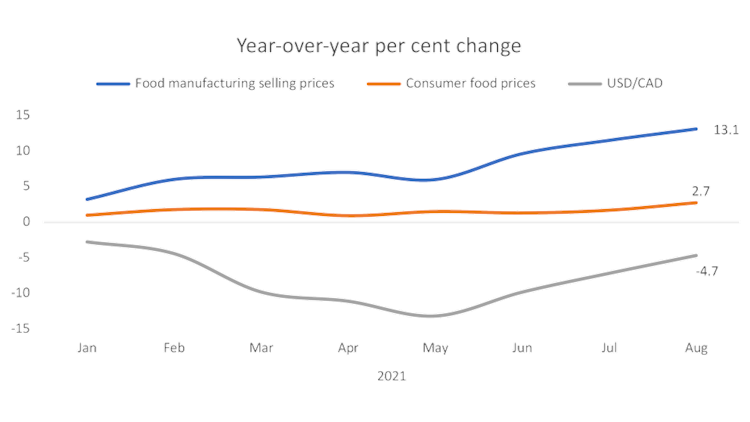

The unit value of imported food has decreased as the loonie trended upward in the first half of 2021. This has prevented some inflationary pressures in domestic food manufacturing from elevated agricultural commodity prices (Figure 1). Headline CPI measured YoY was up 4.1% in August. Food was up 2.7% but saw a larger month-over-month increase.

The recent decline in the loonie could increase prices for imported food inputs and push food inflation higher into Q4 and 2022 if domestic manufacturing prices stay elevated. A lower loonie is good news for exporters.

Figure 1: Higher consumer foods prices as loonie lowers and processing prices rise

Source: Statistics Canada.

Domestic food consumption growth

The household saving rate was 14.2% in Q2 compared to the pre-COVID 5-year average of 2.1%. This additional savings equates to potential pent-up spending of $178B, expected to occur in part over the next year. Food manufacturers should expect some of this money to be spent on higher quality and value-added foods as consumers look to eat healthier diets and focus on sustainability. If pre-COVID consumption patterns return, consumers should spend an estimated additional $28.0B for food services and $1.6B in food and beverage stores.

We’re projecting sales to continue growing at a rapid pace. This results from robust food demand driven by higher household disposable income and inflation driven by a tight supply of available labour, materials and commodities. However, we also expect inflation to subside as disruptions in supply chains ease heading into 2022.

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.