Q4 2021 foodservice and grocery update

The world will be marking the second anniversary of COVID on November 17. The pandemic triggered events that eventually led to a dramatic shift in consumer shopping habits, so it’s fitting to discuss the foodservice and grocery trends heading into 2022.

The (double) shift in food consumption patterns

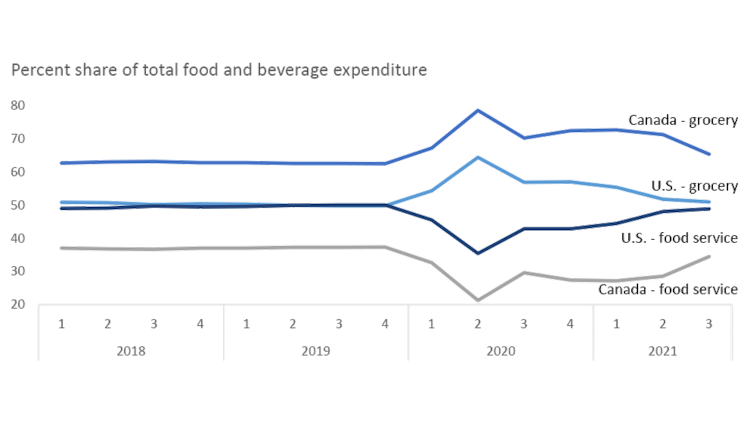

Pre-pandemic, foodservice as a percent of total food expenditures slowly increased in both Canada and the U.S. Over 50% of U.S. food expenditures were from foodservice compared to 37% for Canadians in 2019. Ten years ago, foodservice expenditures represented 44% of total food expenditures in the U.S. and 32% in Canada.

This trend changed with COVID. Restaurants were forced to close, and consumers flocked to grocery stores with newfound passions for baking. This was particularly hard on full-service restaurants, with fast-food sales less impacted with drive-thru options.

As 2021 closes, we’re starting to see foodservice spending recover and grocery expenditures return to pre-pandemic levels as consumers desire convenience with the re-opening of economies (Figure 1). In July, 49% of food spending was on foodservice in the U.S. and over 34% in Canada.

Figure 1: Foodservice sales looking to continue the pre-COVID trend of eating into grocery sales

Sources: FCC Economics, Statistics Canada, Federal Reserve Bank of St. Louis.

A deeper dive into food and drink service sales

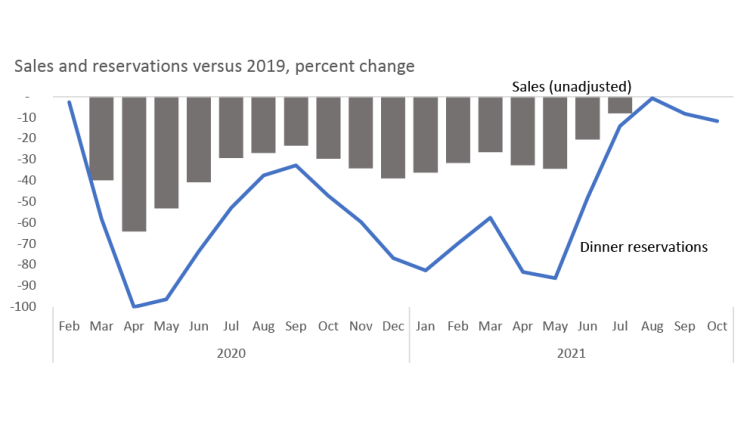

Foodservice sales remained below pre-COVID levels through July, although increased throughout the summer (Figure 2). July sales were up 28.5% versus 2020 and -4.0% versus 2019. Full-service restaurant sales increased 40.6% in July YoY but remained down 4.8% versus 2019. Bars sales continue to struggle, with sales down 17.6% compared to 2019, as the fourth wave caused increased restrictions. Based on reservation data, it’s expected that overall foodservice sales reached pre-COVID levels in August. However, reservations have recently softened.

The lone bright spot in foodservice is limited service (or fast-food) sales. Demand for foodservice remains strong, and consumers are meeting their needs through convenience-type locations. For the first time during COVID, limited-service food sales increased versus 2019 in July, up 3.5%. It’s expected that limited-service sales will continue to outpace restaurants into 2022.

Figure 2: Dining reservations briefly reached pre-COVID levels before the fourth wave

Sources: FCC Economics, Statistics Canada, Open Table.

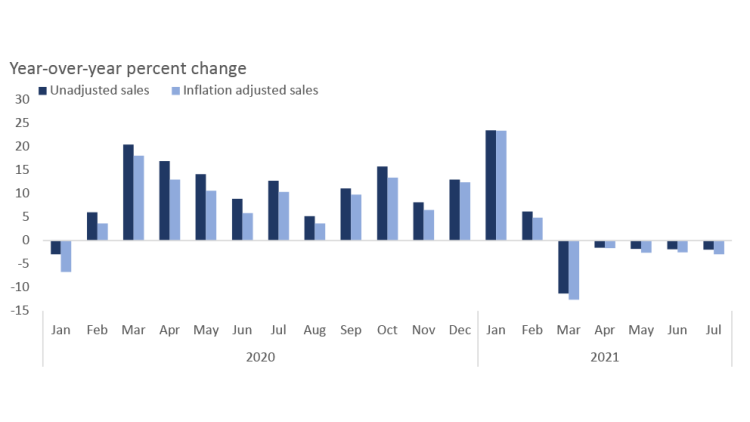

The impact of inflation on grocery sales

Grocery sales are up 0.8% in 2021 thru July despite being down for the last five consecutive months. YTD gains are partially a result of strong sales growth in January compared to the pre-COVID sales level in 2020 (Figure 3). Inflation also contributes to higher sales as the increased costs from supply chain disruptions and production challenges are passed on to customers. Retailers have turned an expected down year into a growth story. Removing the impacts of inflation, sales have declined 0.2% YTD. Removing Jan/Feb numbers and the COVID-driven inflation adjustment means sales have declined an estimated 4.5%.

Though grocery isn’t struggling. Sales remain elevated versus 2019, well above historical growth levels. With consumers demanding convenience, retailers have been increasing investment to adopt this preference. This includes focusing on ready-to-eat meals, eliminating check-out time, partnering with delivery services, expanding e-commerce options, and expanding smaller shop locations.

Figure 3: Grocery sales have declined as consumers shift back to foodservice

Sources: FCC Economics, Statistics Canada.

Trends to watch into 2022

Labour challenges

Grocery and foodservice establishments continue to experience labour challenges, impacting their service levels. The latest quarterly job vacancies data shows that vacancies are up 63.2% over the 5-year pre-COVID average for food and beverage stores and up 34.9% in foodservice. In total, over 98,000 jobs remain unfilled across these two sectors.

Inflation and interest rates

Headline inflation was 4.1% in August, while total food prices rose 2.7%. Grocery food prices were up 2.6%, and restaurant food increased 3.2%. Labour and wages continue to be an issue for restaurants along with commodity inflation, leading to higher prices. Food inflation is expected to continue rising into 2022, given cost pressure, supply chain issues and workforce challenges. Long-term bond yields have recently increased as inflation continues to rise. For example, the 10-year bond yield rose above 1.5% in October for the first time since May. Sustained inflationary pressures could force the hand of the Bank of Canada to lift its policy rate sooner than expected (currently projected in the second half of 2022).

As 2021 enters its final months, foodservice recovery was not as strong as expected. However, there remains optimism for Q4 and into 2022. Consumers have shown that there remains a strong demand for restaurants and ready-to-eat meals. Once COVID restrictions ease some more, the expectation is that foodservice sales continue to eat into grocery’s market share.

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.