2022 FCC Beverage Report: Demand shifting from retail to service

The annual FCC Beverage Report highlights opportunities and risks for Canadian beverage manufacturers. It includes an annual sales forecast for 2022, product sales performance, and a gross margin rate index.

Industries featured in the report are:

Breweries

Wineries

Distilleries

Soft drinks and other non-alcoholic beverages

Dairy and fruit/vegetable-based beverages are covered in our food report under the dairy and fruit and vegetable manufacturing industry sections.

The COVID pandemic shifted consumer purchases from food service to retail, limiting a revenue stream with usually strong margins for most beverage manufacturers. In 2021, consumers started to shift their purchases back to the service industry; however, lingering restrictions and higher production costs reduced profitability.

Here are three key observations from this year’s report:

1. Beverage manufacturing sales increased in 2021

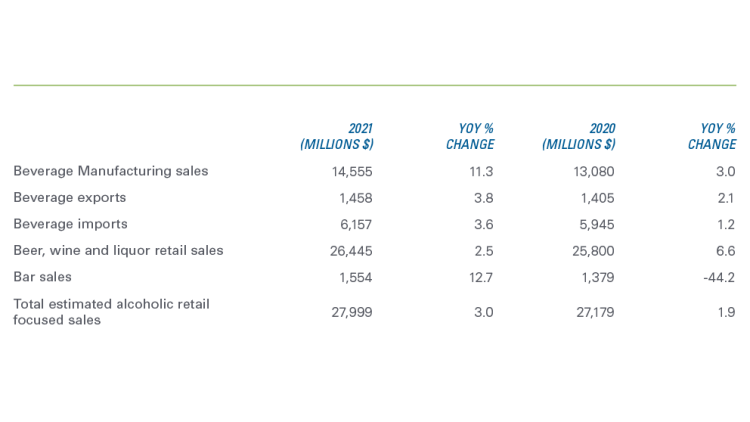

Increased foodservice volumes and continued retail growth boosted total sales 11.3% YoY to $14.5 billion in 2021 (Table 1).

Beverage manufacturing sales are projected to decrease 1.0% in 2022, driven by:

Broad inflation is shifting consumers’ choices

Elevated wholesale/retail inventory levels limiting downstream sales

Shift towards service-based sales where consumers tend to drink fewer alcoholic beverages than at home

FCC Economics expects sales declines coming from larger alcoholic businesses focused on retail, with smaller operations (who represent a minority of total revenues) benefiting from growth in the service industry and a return to selling direct to consumers. Companies with a diversified portfolio of beverages catering to different audiences will outperform (e.g., beer and seltzer, caffeinated and non-caffeinated).

Table 1: Manufacturing sales and exports grew in 2021 YoY

Source: Statistics Canada

2. Industry gross margins expected to improve

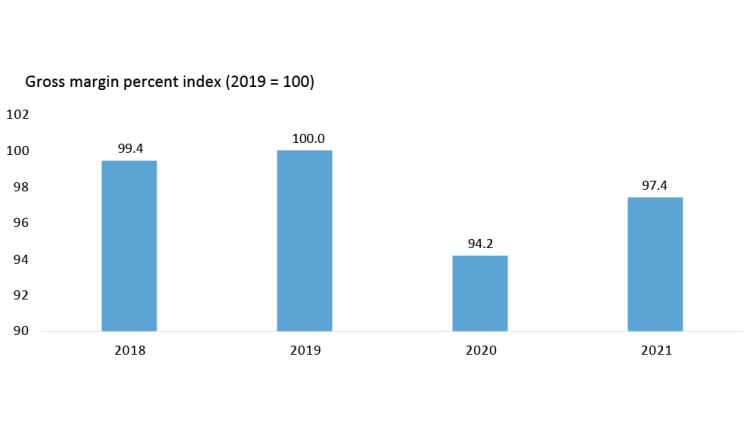

Supply-chain disruptions lowered the availability of key packaging and raw inputs, driving up costs. Despite growing topline sales, gross margins struggled to regain 2019 levels (Figure 1). Strong competition in the alcoholic beverage sector makes it difficult to pass on higher costs, resulting in beverage inflation lagging food inflation.

We expect margins to improve in 2022 as consumers are willing to pay higher prices for beverages, assuming costs don’t continue to rise. Bar, taproom, wine tasting rooms and restaurant sales are also often at a higher margin than retail. Non-alcoholic companies successfully pass on cost increases with little impact on volumes year-to-date and overall supporting margins.

Figure 1: 2021 beverage gross margin rates remained below pre-COVID levels

Source: Statistics Canada, FCC Economics

3. Beer remains the number one alcoholic choice among Canadians but also faces pressure

Beer sales at the retail level for the 2020/21 year declined 1.4%, with total litres sold falling 2.3%. Total beer volumes have now declined for five consecutive years. Canadian breweries have taken market share from internationally produced beer over that timeframe, although their volume has also declined, just at a smaller rate. Overall, beer’s market share compared to wines and liquor fell by two percentage points to 36%. Gains in distilled beverages came from growing demand for hard seltzers, which many breweries are shifting focus towards to offset declines in market opportunities for beer.

Table 2: Beer lost retail market share in Canada in the 2020/21 marketing year

Source: Statistics Canada (Apr 2020 – Mar 2021)

Performance does not line up with calendar manufacturing sales due to timing and inventory levels at wholesale and retail store levels.

Bottom line

While 2021 was a good year for beverage manufacturers with high volumes or pricing power, it was difficult for smaller operations and those dependent on tourism. These operations are now benefitting from economic re-opening in 2022. Conversely, rising interest rates could make a difficult environment for businesses with cash flow issues.

Low retail inflation relative to rising input costs is a trend to monitor. Look for data-driven ways to boost margins, manage inventory, product mix and pricing strategies. Find ways to maintain or grow market share by connecting with Canadian consumers, through tourism or capitalizing on their desire for niche and “locally produced.” The alcoholic beverage market is competitive; however, product innovations, including seltzers, pre-mixed drinks, non-alcoholic drinks, etc., are supporting growth.

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.