2022 Dairy sector outlook

FCC Economics helps you make sense of the top economic trends and issues likely to affect your operation in 2022.

2022 FCC Ag Economic Outlook

Watch a recording of the 2022 FCC Ag Economic Outlook that reviews the major drivers and trends to look for in the year ahead.

We consider the following will be influential drivers of dairy farm profitability in 2022:

Increased input costs

Demand for dairy products

Import of dairy products

Macroeconomic conditions

Following an eventful 2020, we hoped for some market monotony in 2021. Nonetheless, significant events impacted the dairy sector. The most notable events include the sharp increase in feed costs brought by a surge of world crop prices, a drought in the Prairies and floods in British Columbia. 2021 was also a year of transition with the enlargement of revenue pooling between all dairy producers in Canada and expansion of import quotas under CUSMA.

There was optimism for production to grow significantly in 2021. Early signals were positive, and the P5 increased production quotas by 1% in April and 1.5% in June, which followed a 2% quota increase in December 2020. The P5 also announced a series of incentive days between June and November 2021. However, given the state of demand, import volumes and unfilled credit days, the P5 cancelled the incentive days and cut production quota by 1% in December 2021. Despite the setbacks, Canadian milk production increased 2.1% YoY in November.

The Canadian Dairy Commission (CDC) announced late October 2021 an increase in the butter support price effective February 1. At the time, projections were that this would increase the milk price by 8.4%. This decision is in response to the sharp increase in production costs, most notably from higher feed prices. Although the price hike will support dairy farm profitability, it will dampen prospects for production increases in 2022. We forecast dairy receipts to increase 8.9% in 2022 based on a significant increase in the farmgate price and a modest increase in volumes. A higher farm price follows from the increase in the butter support price, while the quantity forecast is motivated by the sluggish demand and slower growth in sales from higher prices.

The table below summarizes revenues and costs data for 2020 and 2021 and our forecasts for 2022. Feed costs increased steeply in 2021 (+27% in P5 and +20% in the WMP). Inflation for other variable costs was more modest (+3% in P5 and +2% in the WMP). Prices are forecast to grow by more than 7% in 2022, with moderate growth of variable costs, signalling improved profitability.

Table 1: Estimates of dairy farm revenues and costs

Gross revenues |

Feed costs ($/hl)** |

Other variable costs ($/hl)** |

||

|---|---|---|---|---|

| P5 | 2020 | 80.05 | 23.82 | 43.78 |

| 2021 | 82.53 | 30.30 | 45.22 | |

| 2022f | 88.46 | 33.43 | 46.15 | |

| WMP | 2020 | 83.18 | 31.31 | 34.35 |

| 2021 | 82.43 | 37.57 | 35.09 | |

| 2022f | 88.58 | 39.15 | 35.59 | |

Sources: Calculations by FCC based on cost of production estimates from the Canadian Dairy Commission and Government of Alberta and data from the Dairy Farmers of Ontario, Les Producteurs de Lait du Quebec, Alberta Milk, Statistics Canada and USDA.

*Gross revenues are based on data reported by producer groups, which differ from Statistics Canada data used in calculating dairy receipts.

**The calculations use different definitions of cost categories for the P5, and WMP and therefore values are not directly comparable.

Our forecasts do not consider the third round of compensation from the federal government for CETA and CPTPP, and compensation details for CUSMA should be announced later this year.

Trends to watch in 2022

1. Production costs

Have feed costs peaked? That’s a million-dollar question for sure. Our grains, oilseeds and pulses outlook shows that it might indeed be the case. Signs point toward lower prices for corn and soybeans in the fall pending normal crop yields. In eastern Canada, 2021 hay production was good, which will help keep production costs down until summer harvest. In Western Canada, the drought cut hay yields by about 35%, and those provinces must import hay from Eastern Canada and corn from the United States to feed dairy and beef cattle. We will have to wait for the spring to see the state of the fields to know whether hay production will recover in 2022.

We must also keep an eye on other production costs. Our forecasts show moderate growth of other variable costs if inflation does not become rampant in 2022. Labour costs, given ongoing shortages, could become a rapidly growing expense to dairy farms.

2. Demand for dairy products

We are in uncharted territory with the large farmgate price increase that will take effect on February 1st. We do not expect retail prices for dairy products to grow as much as farm prices. Nonetheless, inflation for dairy products in 2022 should be higher than the 5-year average, and the question is how this will affect food purchasing decisions.

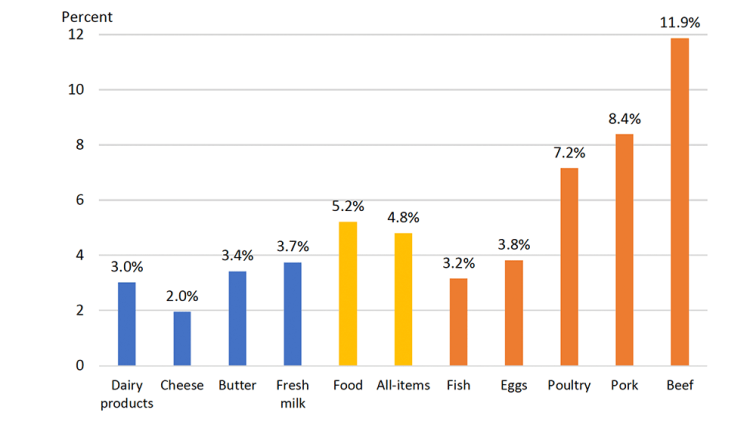

Inflation for dairy products has been lower over the last year than most products, including other animal proteins (Figure 1). This suggests that the demand for dairy products could be in position to absorb the price hike without too much substitution towards other products happening. However, what’s missing in the figure is inflation for plant-based products that compete with milk. According to Nielsen’s data, inflation for plant-based milk alternatives grew by about 1% YoY in December compared to 4.5% for dairy products. If the low rate of inflation on plant-based alternatives continues, we could see an increasing number of consumers switching to those products over milk.

Figure 1: Inflation for selected products between December 2020 and December 2021

Source: Statistics Canada table 18-10-0004

3. Imports of dairy products

A CUSMA dispute settlement panel recently ruled that Canada must revise the allocation of licenses for the import of dairy products. The governments of Canada and the United States have until February 3 to resolve the dispute. Impacts on imports are unknown as it depends on implementing the new allocation rules.

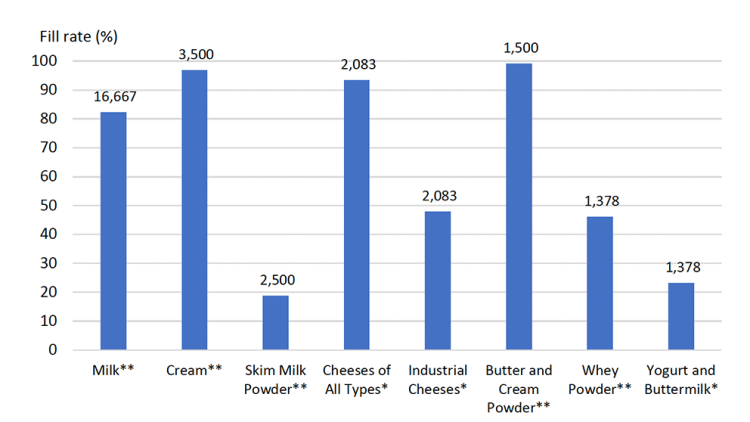

Figure 2 shows products for which there is more room for imports to grow under CUSMA. The products are ranked from left to right according to the size of their import quotas. Import quotas for milk and cream are the largest and were mostly filled in 2020-21. Import quotas for skim milk powder and industrial cheeses are relatively large and not filled entirely. These products have the most potential to see their import volumes rise under the right economic conditions. This abstracts from import volumes growing from the expansion of quotas under the schedules established by CUSMA.

Figure 2: Import quota fill rates for selected products

Source: Utilization data from the Government of Canada.

The labels indicate the negotiated volumes in thousand kg.

* Calendar year 2021

** Marketing year from July 2020 to June 2021

4. Macroeconomic conditions

Inflation is a hot economic topic, and how it evolves will shape the economy in 2022. December data from Statistics Canada show consumer inflation at 4.8%, the highest in 30 years. To tame inflation, we expect the Bank of Canada to raise its policy rate four or five times by 0.25% increments. Dairy farms can expect to pay more interest on their loans in 2022.

Check back on our blog for a regular update of this 2022 dairy outlook and outlooks on grain and oilseed, hog/cattle, broiler, and food processing sectors.

Article by: Sébastien Pouliot, Principal Economist