2022 farmland values trended higher amid higher interest rates, elevated input prices and strong cash receipts

Inflation was the defining economic issue of 2022. The war in Ukraine, supply chain challenges, labour shortages and higher interest rates have been major disrupters in the agri-food supply chain. The agriculture industry hasn’t been shielded from inflation as farm input prices climbed along with commodity prices. The resulting increase in farm cash receipts and limited supply of farmland available for sale led to increases in farmland values. FCC reports an average increase of 12.8% in cultivated land values for 2022. This post summarizes trends observed in cultivated land, and the full FCC Farmland Values Report also presents trends in irrigated land and pastureland values.

Provincial trends

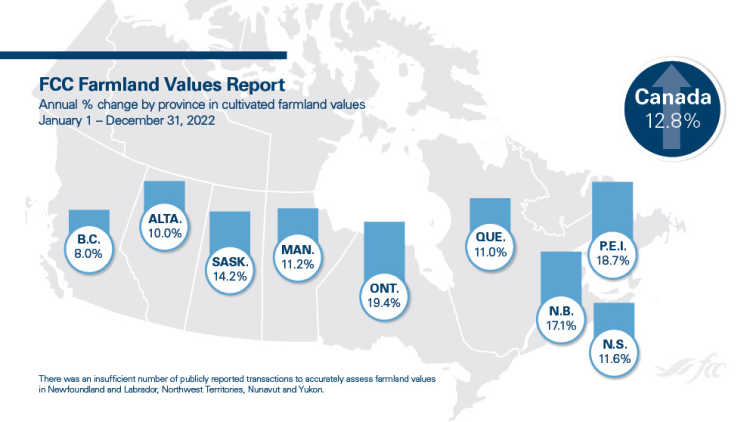

Our analysis covers the period of January 1 to December 31, 2022. The highest increase in average farmland values was observed in Ontario at 19.4% (Figure 1), followed by two Atlantic provinces, with an 18.7% growth in Prince Edward Island and a 17.1% increase in New Brunswick.

The Saskatchewan average farmland value increase was also above the national average at 14.2%. Nova Scotia, Manitoba and Quebec recorded similar increases, with 11.6%, 11.2% and 11.0%, respectively.

Finally, Alberta and British Columbia recorded the lowest relative average increases, with 10.0% and 8.0%, respectively.

Figure 1. Average cultivated farmland value increases for 2022

Source: FCC computations

Farmland values are always tied to supply and demand

Farmland availability

The tight supply of farmland for sale is a major driver of the farmland market. The outlook for agriculture is positive, and thus farmland owners have few incentives to put farmland for sale. Any neighbouring farmland parcel coming up for sale can generate significant buyers’ interest considering that this may happen only once in a lifetime. Farm size and the resulting economies of scale remain a driver of profitability, which can make this neighbouring parcel fit well within the strategic plan of a potential buyer.

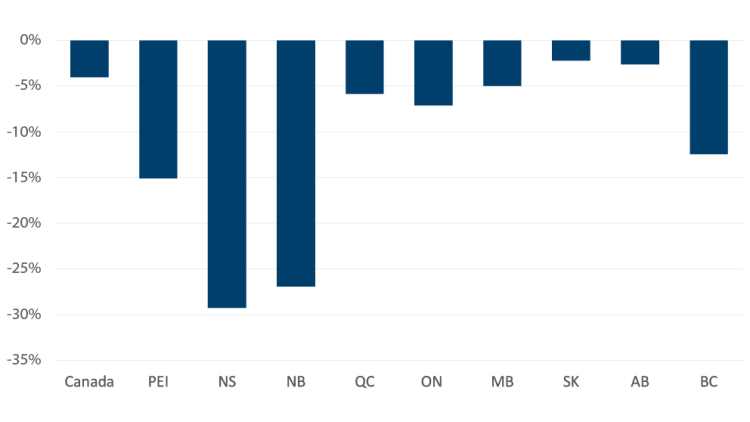

As documented in Statistics Canada's Census of Agriculture, a decline in farm areas over time is an additional supply factor. For example, Prince Edward Island, New Brunswick and Nova Scotia recorded declines of 15%, 27% and 29%, respectively, in farmland areas over the last 10 years (Figure 2). The decline in total farm area is smaller in other provinces but still noticeable everywhere. This leads to more limited availability of farmland which can contribute to higher prices.

Figure 2. Total average farmland area lost from 2011 to 2021

Source: Statistics Canada Land tenure, Census of Agriculture historical data

Farm cash receipts

Crop receipts climbed 14.1% in 2022, driven by improved weather conditions over 2021 and strong commodity prices. Demand for farmland that is well situated can help agricultural producers develop and expand their operations at a time when demand for ag commodities is robust. Farm input prices recorded major increases along with commodity prices, but profit margins have been favourable. Higher borrowing costs slowed the demand for farmland but were offset by higher revenues.

Non-traditional buyers

The presence of “non-traditional” buyers in the market can drive the overall demand for farmland. These buyers may be individuals, groups or other entities looking to buy farmland without the intent of farming.

It is next to impossible to determine the extent of the presence of non-traditional buyers in the farmland market as there’s no single database across the country that contains all the relevant information. Leveraging the large dataset of cultivated land sales that we assembled for 2022, we could establish that between 9% and 15% of cultivated farmland sold was purchased by non-traditional buyers. Agricultural producers and farm operations make the large majority of purchases.

Note that transactions do not need to occur for the presence of these buyers to influence land values. The mere presence of non-traditional buyers in a market might lead to more competition in buying farmland.

Bottom line

FCC has been reporting consecutive increases in average farmland values for 30 years. Farmland prices are near historical highs when compared to farm income. Recent increases in interest rates raise the financing cost of purchasing farmland. We’ll investigate these factors in next week’s blog post. Producers must build and maintain a risk management plan considering possible economic changes to ensure budget flexibility if commodity prices, yields or interest rates shift. Market conditions can change rapidly, which can impact farmland values.

Watch for the FCC 2022 rental rate analysis releasing on April 11, 2023. The 2022 FCC Fruit land analysis will be released in May 2023.

Article by: Lyne Michaud, É.A., Senior Analyst, Valuations