2022 Food and Beverage Report: Mid-year update

A lot has changed since our 2022 Food and Beverage Reports earlier this year:

Inflation and interest rates have risen faster than initially expected

Global economic growth forecasts have weakened

Profitability is challenged due to rising input costs

Workforce talent continues to be an issue

Food and beverage manufacturers remain well positioned amid challenging conditions, and the outlook remains positive.

In this virtual presentation, J.P. Gervais, FCC VP and Chief Economist, examined changes in trends since FCC published its 2022 Food Report and 2022 Beverage Report.

Sales projected to grow and remain strong

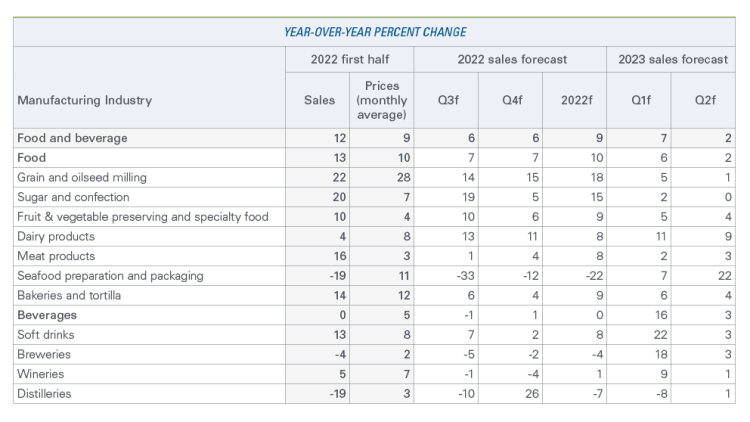

Food and beverage manufacturing sales have increased 12% during the first half of 2022. Sales growth is expected to slow into Q4 as inflationary pressures ease, global economic growth moderates and Canadian consumer savings dwindle. We project sales to increase 6% in the second half, finishing the year up 9% (Table 1).

Table 1: Food manufacturing sales are being supported by higher prices

Sources: Statistics Canada, FCC Economics

Leading this sales growth is grain and oilseed milling. Despite sales up 22%, volumes are estimated to have declined, primarily the result of lower crop yields in 2021.

The impact of higher prices on consumer demand is evident in some industries. We estimate that sales volumes declined for dairy, seafood and all alcohol manufacturing industries in the first six months of 2022. While inflation in some categories, like breweries, is below average, we’re seeing consumers forced to cut purchases based on inflation in other areas. Of these industries, we forecast that seafood, breweries and wineries will see sales slip in 2022. Seafood sales have been weaker due to lower exports to the U.S. and Japan.

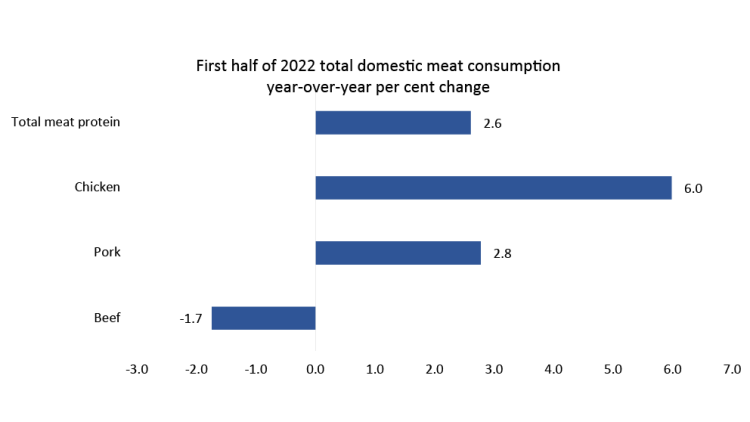

Meat manufacturing price inflation slowed to an estimated 3% in the first half of 2022 after rising 8% in 2021. Total meat consumption has risen in 2022 due to strong demand for chicken and pork, while consumers have cut back on beef consumption (Figure 1). Beef exports have remained strong, offsetting weaker domestic demand. In Q3-to-date, we are seeing more positive trends in red meat, and we expect consumption and sales to rise further in 2023.

Figure 1: Meat consumption rose in 2022, led by increases in chicken and pork

Sources: FCC Economics, AAFC

Other industries with healthy volume trends include sugar/confection, fruit/vegetable preserving, specialty foods, soft drinks and bakeries. Sales of these industries are forecasted to finish the year strong.

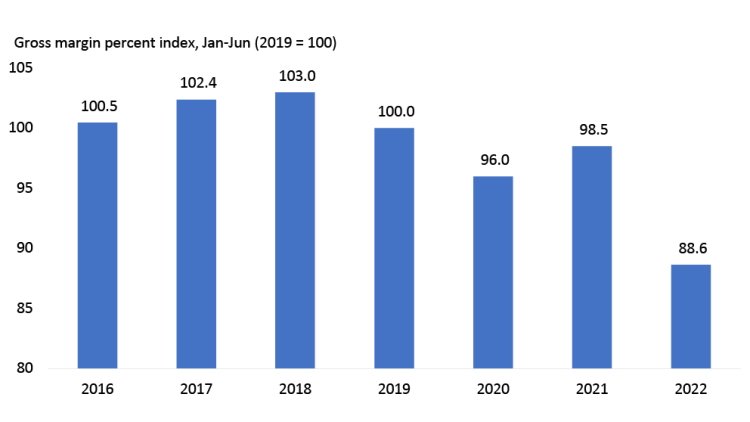

Margins are softening

With consumers focused on purchasing lower-margin basics in the face of higher retail prices and input costs remaining elevated relative to selling prices, manufacturing gross margins have been under pressure. FCC Economics’ gross margin index in food manufacturing fell nearly 10% during the first half of 2022. With commodity prices declining, we anticipate margins will start to improve, although projections of weaker economic growth over the next 12 months will continue to be a headwind.

Figure 2: Food and beverage manufacturing gross margins fell significantly in the first half of 2022

Sources: FCC Economics, Statistics Canada

Trends to watch through the remainder of 2022

Global economic growth projected to decline

The OECD’s forecast is for global GDP to grow 3.0% in 2022 and 2.8% in 2023, a downgrade from their earlier projections. Our biggest trading partner in the U.S. has had two consecutive quarters of negative GDP growth, even as consumer spending was up 1.5% in Q2. Growth over the next few quarters is expected to be moderate as recession fears persist. China’s GDP is expected to grow ~3%, well below their historical growth rate.

Labour constraints

Job vacancies continue to plague many industries, including food manufacturing. The most recent data (June) showed more job vacancies than unemployed people, forcing businesses to increase compensation to attract talent.

Food manufacturing employee weekly earnings are up on average 11.5% in the first six months compared to a year ago, while manufacturing selling prices are up 9.9%, pressuring margins.

Domestic food consumption growth

Last year, the story was about pent-up post-pandemic demand and how elevated household savings would benefit foodservices. While this played out, for the most part, it was muted by inflation. Subsequently, grocery food sale volumes are estimated to be down roughly 6% in Q2 2022, although this is partially explained from consumers continuing to shift purchases back towards restaurants and fast-food. As the rate of inflation slows, we expect consumers to return to normal shopping habits. The household saving rate fell to 6.2% in Q2 versus 14.5% in Q2 last year. Yet, savings are surprisingly resilient considering inflation and interest rate increases and were doubled what they were prior to the pandemic at the end of Q2.

Kyle Burak

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.