2023 Dairy outlook update: blended prices down on U.S. milk glut

This is the second of three quarterly updates to our 2023 Outlook for the dairy sector published in January. Last week we updated our grains, oilseeds and pulses outlook, and next week we’ll update the outlook for cattle and hog.

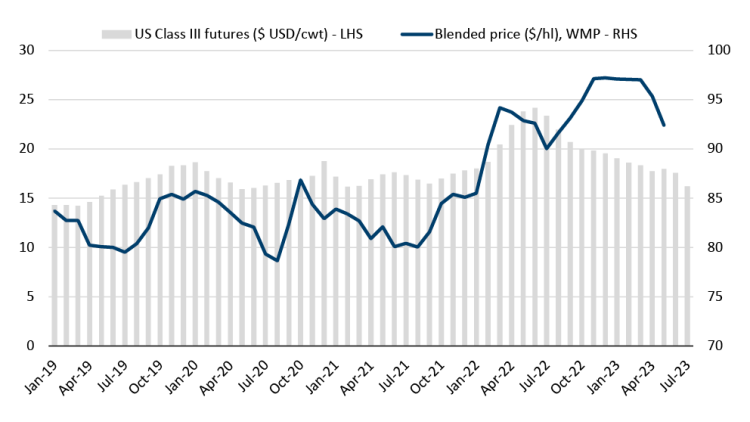

Market dynamics in the U.S. dairy industry are beginning to pressure the income of Canadian dairy producers. American milk production is at a record high, and processors cannot keep up. This is putting downward pressure on U.S. milk prices and consequently, Canadian milk prices. Approximately 12% of Canadian butterfat production (by weight) goes into Class 5 milk, and Class 5 milk prices are exposed to changes in U.S. prices. Canadian producers ‘rode the wave’ of strong U.S. milk prices in 2022 but are now beginning to see downward pressure on domestic prices as the U.S. situation worsens. In May 2023, the average blended price in the Western Milk Pool (WMP) was $92/hl, unchanged from May 2022 despite two Canadian Dairy Commission increases in the butterfat support price. The biggest reason: U.S. Class III milk prices declined 30% during that time.

Figure 1: U.S. milk prices weighing on blended prices in Canada, limiting impacts of recent support price increases

Sources: Alberta Milk, Barchart, FCC Calculations

Class III milk futures are flat (approximately $16/cwt) for the remainder of 2023, nowhere near the highs of $24/cwt seen in June 2022.

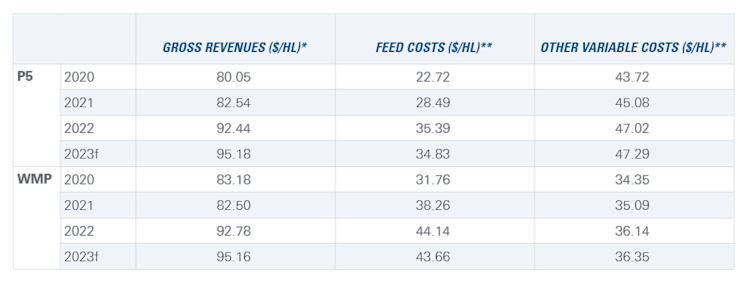

As a result of these developments, our forecasts for dairy revenues have been revised downward. Table 1 summarizes revenues and variable costs data for 2020 to 2022 and our latest forecasts for 2023 (note that we do not include capital costs and producer labour costs as these vary greatly between operations).

Table 1: Estimates of dairy farm revenues and variable costs

Sources: Calculations by FCC based on the cost of production estimates from the Canadian Dairy Commission and Government of Alberta and data from the Dairy Farmers of Ontario, Les Producteurs de Lait du Québec, Alberta Milk, Statistics Canada and USDA.

*Gross revenues are based on data reported by producer groups, which differ from Statistics Canada data used in calculating dairy receipts.

**The calculations use different definitions of cost categories for the P5 and WMP; therefore, values are not directly comparable.

Trends to watch in 2023

In January, we identified the following items as influential factors to monitor in 2023.

1. Elevated input costs

Feed remains an issue for dairy producers across the country. Increasing drought and pest concerns on the Prairies – particularly in Alberta – are creating uncertainty about silage quality and quantity this year. First cut of hay was better in the central and eastern Prairies but the limited amount of moisture since the spring is leaving second cut uncertain. In the East, price remains an issue. Corn conditions started the growing season poorly in the U.S. Midwest but have improved recently, leaving the direction of feed costs a risk for the year ahead.

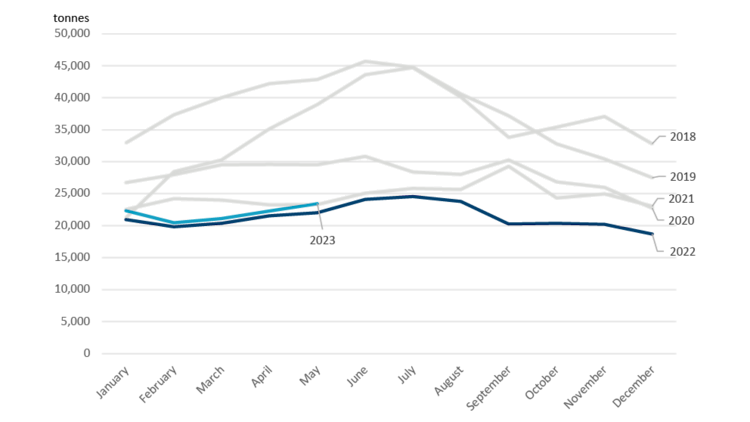

2. Butter stock levels

Total butterfat production has been strong so far this year with production in each month of 2023 higher than in any comparable month from the last five years. Increased butterfat production to date has resulted from increased efficiency rather than an increase in quota or incentive days. However, in May, the P5 announced an additional two incentive days for the summer. This brings the total number of incentive days for the P5 to nine incentive days for the year. Only two incentive days have been announced for the WMP (September and October), but these are the first incentive days since 2019. All incentive days for 2023 occur between May and November, a period of lower production and higher demand, resulting in historically low butter stock levels.

Figure 2: Butter stocks trending up but still historically low

Sources: Statistics Canada table 32-10-0001

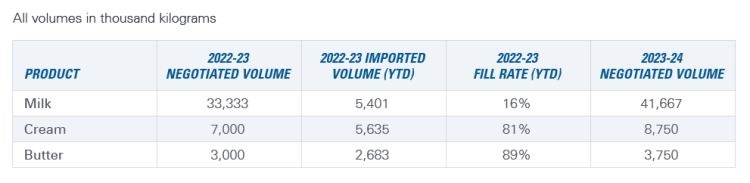

3. Imports of dairy products

A new dairy year starts in August and, with it, a new window for dairy imports under the Canada-United States-Mexico Agreement (CUSMA) that operate on a dairy year basis. As per the agreed-upon schedule, the tariff-rate quotas will increase this upcoming dairy year (see Table 2). Canada could see a surge of butter imports this fall if these tariff-rate quotas are front-loaded (that is, filled at the beginning of the dairy year, which is the second half of the calendar year), which is certainly possible given lower butter stocks and stable demand. Milk, cream and butter are the three main dairy products with tariff-rate quotas on a dairy-year basis. The U.S. has been taking advantage of incrementally increased access for butter and cream, with fill rates above 80% in each of the last three years.

Table 2: Fill rates for cream and butter under CUSMA high

Source: Global Affairs Canada

The New Zealand / Canada CPTPP dispute panel hearings occurred in June. The complaints filed by New Zealand are like the ones the U.S. had under CUSMA, disputing Canada's allocation of tariff-rate quotas to processors. The panel will report its findings in September.

4. Retail price inflation

The overall inflation rate fell to 2.8% in June, yet food prices continued to increase at a stubbornly high rate (9.1% for food purchased from grocery stores). This is true across nearly all food categories, including dairy products.

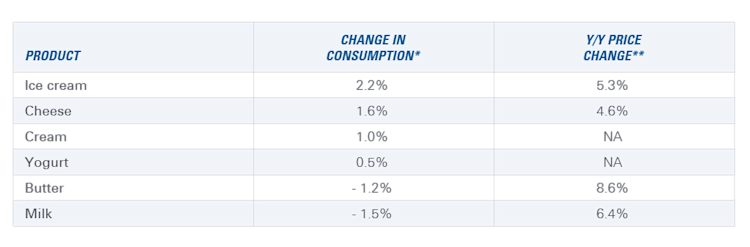

The Canadian Dairy Commission reports that trends in consumption of dairy products over the last 12 months have been mixed across products: increases for some (ice cream, cheese) and decreases for others (milk, butter).

Table 3: Dairy product price increases yet to stifle demand in a meaningful way

Sources: Canadian Dairy Commission, Statistics Canada table 18-10-0004

*Over the 12 months ending April 2023, compared to the same 12-month period ending April 2022

**As of April 2023

The price of butter has increased 27.1% over the last two years, yet consumption has only fallen 1.2%. One reason is that the price of margarine – an imperfect substitute for butter – has soared 52.2% over the last two years.

Bottom line

The U.S. milk glut is keeping a lid on Canadian blended prices. Revenue on a per unit basis ($/hl) is down, but quantities are up – and should stay elevated, given upcoming incentive days – as the race to replenish butter stocks continues. This bodes well for moderate total revenue growth for 2023. Feed availability in the west and feed costs in the east will continue to be an issue for profitability over the remainder of 2023.

Senior Economist

Graeme Crosbie is a senior economist at FCC. His focus areas include macroeconomic analysis and insights and monitoring and analyzing Canada’s food and beverage industries. Having grown up on a dairy farm in southern Saskatchewan, he occasionally comments on the health of the dairy industry in Canada.

Graeme has been at FCC since 2013, spending most of that time in risk management. Graeme holds a master of science in financial economics from Cardiff University and is a CFA charter holder.