2023 Grains, oilseeds and pulses sector outlook

FCC Economics helps you make sense of the top economic trends and issues likely to affect your operation in 2023. The major trends to monitor for grain, oilseed and pulse operations include:

Tight global supply/demand balances that may be on the verge of loosening

Record-breaking average fertilizer costs

A large rebound in production from 2021’s drought-impacted harvest best characterizes the Canadian 2022/23 crop marketing year (MY). It was a good year to have more crop to sell, as commodity prices continued to rise, and excessively dry conditions plagued several of Canada’s largest competitors. Farm revenues showed steep gains year-over-year (YoY), a rise necessary to keep on top of input prices that seemed to know no limits.

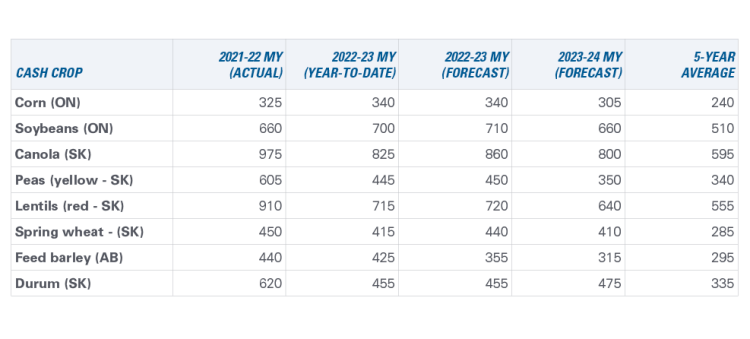

Prices for most principal field crops have already come down from the highs reached in 2022 but remain well in excess of their respective 5-year averages (Table 1). Corn and soybeans are each expected to continue rising from 2021/22 levels in the 2022/23 MY, the only prices to do so. All crops except feed barley will see prices rise relative to year-to-date before falling with the 2023 crop. Despite the decline, they’ll remain above the most recent five-year average.

Table 1: Prices ($/tonne) to fall YoY throughout 2023 but remain historically high

Sources: Statistics Canada, AAFC, USDA, PDQ, CanFax, CME, MGEX and ICE Futures, and FCC calculations.

Marketing Year for corn and soybeans: September 1 – August 31

Marketing Year for wheat, canola, barley, peas and lentils: August 1 – July 31

The good news about crop prices is tempered again by the forecast for high input costs, particularly those for fertilizer and energy. Despite the pressure, margins are expected to remain well above break-even in 2023. Across eastern and western Canada, profitability will fall YoY but will also easily exceed their respective five-year averages. Assuming a wheat/canola rotation in the West, 2022’s expected revenues less total costs stands at $95/acre, falling to $50/acre in 2023. Eastern producers (soybeans/corn) can expect positive margins as high as $100/acre in 2023, with 2022 margins expected at $255/acre.

Wheat

According to the USDA, total global wheat supplies will fall 1% YoY in the 2022/23 marketing year. Global ending stocks are 3.0% below the previous year’s level, and U.S. ending stocks are forecast at 18.3% below their 2021-22 ending stocks levels. That’s based on no growth in global and U.S. production.

Canadian wheat production has risen by 47% YoY (and durum production increased by 79% YoY) to make the 2022/23 crop the third largest on record, with the average quality for CWRS wheat rated higher than the past five-year average.

Global market interest in Canadian wheat may rise this year. Argentinian exports are expected to drop off after their wheat was hit with excessively dry conditions during their growing season. Growth in Canada’s exports to Asia and South America is expected, while U.S. exports have been cut due to a strong dollar and limited drought-impacted supplies. A loonie projected to average US$0.73 in 2023 would help offset discounts in the world market for the large supply of Russian wheat.

Corn

2022/23 corn production in South America is forecast to be higher YoY, even as heat and dryness shrink area and yields in Argentina and Brazil. But global corn production overall is projected to be 4.9% lower YoY. The USDA estimated U.S. production at 349 MMT versus 383 MMT a year earlier. They also forecast supply falling more than use, with the season-average corn price expected at US$6.70 per bushel.

It’s a different story in Canada, where 2022/23 corn production is estimated to be at a new record level and 4% higher YoY and 5% higher than the previous five-year average. However, even here, we’ll see total supply fall by 14% from the record high seen in 2021-22 as the pace of corn imports drops sharply YoY. Statistics Canada forecasts carry-out stocks to fall 13% from last year’s record high, although they’ll remain slightly higher than the previous five-year average.

Soybeans

The world will see more soybeans in the current MY, with global ending stocks estimated to increase 5.4% YoY. The drought that has levelled South American corn production has also impacted the region’s soybean production, most notably in Argentina. Brazil’s dominance in the global soybean trade is expected to continue. U.S. production is forecast to be 4.2% lower YoY, and their ending stocks are projected to be nearly 25% lower than last year.

Canadian soybean production is up slightly YoY in the 2022/23 MY. But although carry-out stocks are forecast to be up 17.8% YoY, they’re 22.2% lower than the five-year average.

Canola

The drought in 2021 was particularly hard on canola. The world canola stocks-to-use ratio in 2021-22 was the lowest since 2003-04, while Canada’s ratio was close to the record low set in 2012-13. The current MY has helped to regain some stability. Despite unexpected low yields in Alberta and Manitoba, StatsCan estimates that 2022-23 canola production is 32.1% higher YoY. Not surprisingly, the total supply is forecast to increase by 22.6%. A larger supply will lead to stronger exports, and the crushing industry is expected to function at capacity, given the robust demand for canola oil. Under this scenario, carry-out stocks are slated to fall 8.6% YoY.

Lentils and peas

Better growing conditions in western Canada produced better yields (68% higher YoY) for dry peas in 2022, which have boosted production by 52% in the 2022/23 MY. Although supplies are still low because of the poor 2021 crop, Canadian YoY supply growth of 35% will support gains in exports. Strong export demand is expected from Bangladesh and India. Carry‑out stocks should also rise, pressuring prices which are expected to fall throughout the MY.

Growth in yields also helped raise lentil production by 43%, enough to increase supply but only by 24% after small carry-in stocks from 2021/22. Despite the above-average quality and lower carry-out stocks, the Canadian lentil crop will likely record prices on average lower YoY in the 2022/23 MY.

Trends to monitor in 2023

Are the tight global supply/demand balances about to loosen?

The January WASDE made clear that the December 1 carryout levels of corn, soybeans and wheat – the world’s largest traded crops – were lighter than expected. Corn and wheat were each down 7% year-over-year (YoY), and soybeans were 4% lower. Before the January WASDE report, the market had expected increased production estimates for all three. The news was bullish.

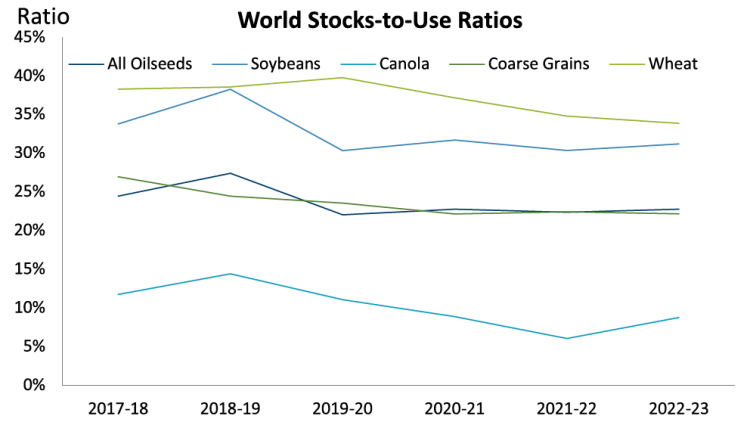

While that has contributed to higher prices early in 2023, the forecast shows some easing of the pressures felt last year with either a halt or reversal in most stocks-to-use ratio trends (Figure 1). With favourable yields in 2023, supply/demand balances are likely to align more closely to historical trends, which is a big reason underlying some price declines.

Figure 1: Crop stocks-to-use ratios show a decline and a possible easing of pressure beyond 2022/23

Source: USDA WASDE

There are caveats on the availability of production, however. Any resumption of supply chain disruptions, especially out of the Black Sea region, threatens this outlook, as does any further weather-related damage to South American or European crops. On the other hand, with global economic growth weakening, demand for commodities could fall broadly or in key regions, pulling the supply/demand balances higher and pressuring prices lower. Chinese demand is a wild card as they shift their COVID policies, and economic activity remains uncertain.

Inflationary pressures on fertilizer

After three years of severe supply shocks and dramatically rising prices, fertilizer markets remain destabilized. Prices across Europe will continue to be volatile, limiting further EU fertilizer production. EU natural gas prices will set the floor price for global ammonia and other fertilizer products in 2023.

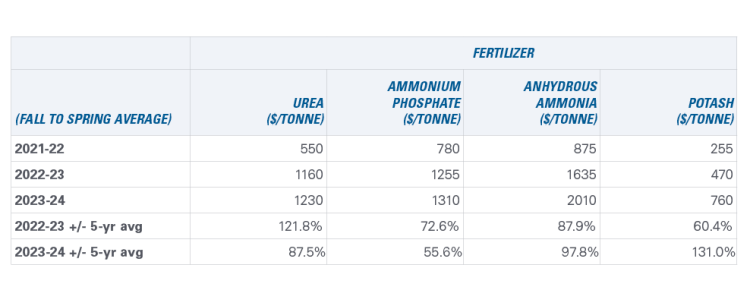

Average Canadian fertilizer prices are set to break last year’s record-setting increases for all four types (Table 2). That can be tied directly to low distillate stocks hampering production. U.S. distillate stocks (for example, diesel and heating oil) declined in September, October and November of 2022 to levels not seen since the 1950s, pushing diesel prices significantly higher. Global supplies will likely tighten further with the EU embargoes on imports of Russian diesel starting in February 2023.

Table 2: Average fertilizer prices ($/tonne) to break last year’s record

Sources: Alberta Farm Inputs, World Bank, FCC calculations.

Bottom line

While current prices reflect continuing tight supply/demand balances for many major crops, prices received later this year are forecast lower. That’s almost certain to happen if production in 2023 is close to historical trends and assuming no major demand shocks. But as crop prices weaken throughout the second half of the 2022/23 crop year, crop input prices may not retreat as much from their highs. The scenario speaks directly to producers’ bottom lines, underscoring the need for well-planned risk mitigation strategies.

Check our blog for 2023 outlook updates for grains, oilseeds and pulses, cattle and hogs, dairy, and food processing sectors. And watch for in-depth analysis and projections for interest rates, currencies and GDP in early March.

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.