2024 Cattle and hog sector outlook

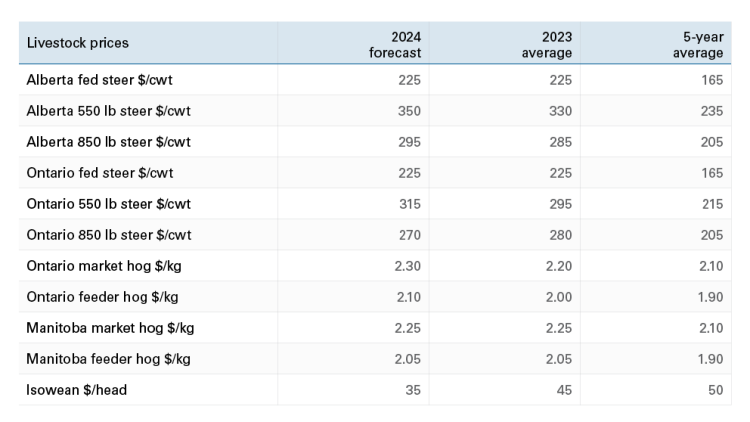

Although they’ve recently fallen, cattle prices for all categories except Ontario 850 lb. steers are expected to either stabilize or rise slightly year-over-year (YoY) in 2024. That’s good news for a sector that saw 550 lb. steer prices rise over 37% in 2023. Eastern and Western fed steers will remain at their 2023 average in 2024.

Isowean prices are forecasted lower YoY, but Manitoba prices for feeder and market hogs will stay at 2023’s average prices. There’s some good news in the East where hog prices will likely trend higher YoY.

Table 1: Livestock prices to stabilize or trend higher in 2024

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

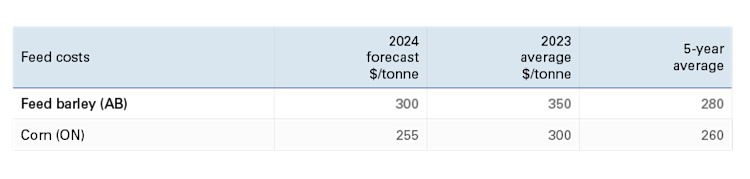

With cattle prices largely stable YoY, margins in the cow/calf sector are expected to still be well above the five-year average. Helping profitability this year (unlike 2023) are abating feed costs (Table 2). Feedlot profitability, however, is likely to be challenged in 2024 as hay prices remain stubbornly high. Southern Alberta hay prices are currently double what they were in 2020.

Table 2: Feed costs forecasted to offer a reprieve

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

Isowean margins are forecast to be close to breakeven in the East with less pressure in Manitoba boosting Western profitability slightly higher. Farrow-to-finish operations should see noticeable YoY improvement in the East and West.

Trends to monitor

The top economic trends likely to impact cattle and hog operations in 2024 include:

Feed availability

Global and domestic demand for pork

The costs of expanding the Canadian beef herd

Feed availability

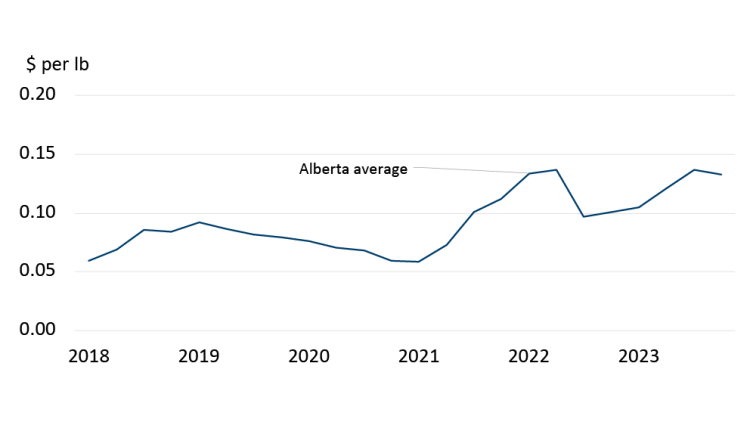

While barley and corn prices have fallen YoY, easing pressure on livestock margins, feed availability will continue as a trend to monitor in 2024. Despite having fallen, barley prices are still elevated well above their five-year average (Table 2). And estimates of hay prices throughout Alberta show a steady increase in 2023 and into 2024 (Figure 1), as last year’s drought conditions severely hampered alfalfa production.

Figure 1: Little respite in alfalfa hay prices expected heading into 2024*

Source: Agriculture Financial Services Corporation (AFSC)

*The annual average of first and second cuts across all Alberta regions.

Demand for pork

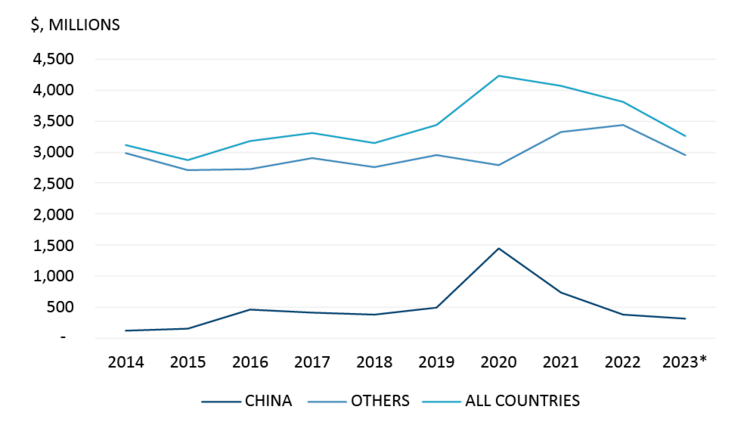

China, the world's largest pork producer, consumer and importer, isn’t keeping with its traditional pace. The country is experiencing slower economic growth and is now facing a third consecutive year of population decline amid low birth rates. USDA forecasts for Chinese imports in 2024 are up YoY, but consumption is forecasted 2.4% down YoY as lowered domestic production (a 3% YoY drop) is expected as a response to weak margins.

Exports to China from the U.S. are expected to fall YoY, as are Canadian exports which, as of 2023 are slightly below levels set in 2017/2018 (Figure 2) and before African Swine Fever decimated the Chinese pork industry and boosted their global imports dramatically.

Figure 2: Canadian pork exports to China taper dramatically post-COVID

Source: Trade Data Online

*includes January - November

Canada’s pork sector has had several challenging years with a long-term declining trend in demand helping to drive lower prices. Recent Canadian price competitiveness has helped boost consumption here, but larger export markets have, since the pandemic started, had to limit red meat purchases in response to boosting their own production and a worsening global economic outlook.

The cost of growing the beef herd

What has to happen to rebuild? Feed costs have retreated from their highs, which helps. But feed availability may continue to be an issue without adequate moisture for hay growth – which El Nino��’s drier weather may challenge this summer. Cow-calf prices and margins are still strong, so that too should help motivate producers to retain heifers.

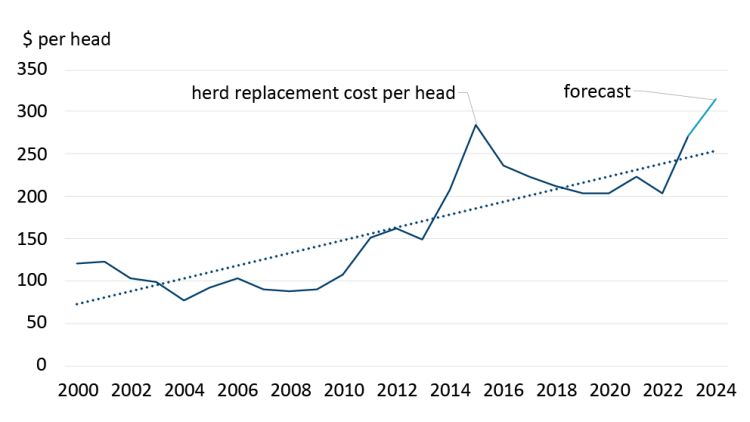

But the simple fact is that herd expansion takes time and money. Assuming a 12% cow replacement rate, the cost is forecast to be above $300 per head in 2024 based upon bred cow and cull cow values. The bottom line is that retention costs producers – and that cost has grown over the last two decades (Figure 3).

Figure 3: Have herd replacement costs made growth too expensive?

Sources: Manitoba Agriculture, CanFax, Statistics Canada and FCC Calculations

In theory, producers would retain heifers, stop shrinking the herd and start growing it if there was enough economic incentive. But what might make it worthwhile may be above what consumers are willing to pay for beef. North American consumption has already dropped in the face of higher beef prices and chances are good it would drop more with the further price hikes necessary to pay primary producers and their supply chains enough. Chinese beef consumption is growing, but their demand is for low-cost Brazilian beef.

The rising costs of growing Canada’s beef cattle herd may, increasingly, fuel greater herd depletion, particularly for smaller or even mid-sized operators. Larger operations will fare better thanks to economies of scale, possibly growing larger due to consolidation. This may create conditions for herds to grow again, although that will take time to unfold.

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.