Food and beverage sector performance a mixed story: 2024 mid-year update

As we approach the last quarter of 2024, we look back on our 2024 Food and Beverage Report to see how food and beverage manufacturing has actually performed so far this year. As well we provide forecasts for the remainder of 2024 and early 2025 and highlight trends to watch going forward.

Sales update

FCC Economics continues to expect sales to fall in 2024, although not as much as what we had estimated in the Food and Beverage Report earlier this year. We’re now expecting a 0.7% drop in 2024 nominal sales, i.e. the value of sales measured in dollars. Our original estimate was more pessimistic at -1.4%.

The food and beverage manufacturing sectors had contrasting fortunes in the first half of the year. Nominal sales increased 1.5% for food manufacturing and declined 6.6% for beverage manufacturing compared to the same period in 2023 (Table 1). The drop in beverage manufacturing was even more severe in real terms i.e., after removing the effects of inflation, with volumes down 11.6%.

Table 1: Food manufacturing sales up in first half of 2024, with declines likely in the second half*

*Values rounded

Sources: Statistics Canada, FCC Economics

Looking forward, total food and beverage nominal sales are expected to fall short of the same periods in the previous year, declining 2.1% in H2 2024 and 0.2% in H1 2025. But much of that weakness is due to weakening prices, as volumes sold fare better than nominal sales i.e., -0.9% and +1.1% over the same two periods.

Nominal sales will vary across food manufacturing sub-sectors and some manufacturers will benefit from rising prices to grow revenues while others will lean on increasing volumes. Grain and oilseeds and sugar and confectionery are two sub-sectors to watch. After large gains, mainly due to inflationary pressures, grain and oilseeds will see sales drop off closer to the long-term historical trend, as lower commodity prices work their way through the supply chain. Sugar and confectionery products should see large sales growth in H2 2024 and H1 2025 with prices and volumes expected to rise as higher input costs (e.g., sugar prices) are passed on to consumers, and demand for snack foods continues to climb.

For beverage manufacturing, growth will be led by non-alcoholic soft drinks, contrasting with the stagnating sales of alcoholic beverages (Figure 1). Wine sales for instance, are expected to continue their descent towards 2019 levels, after unsustainably large gains over the last few years due to elevated demand during the pandemic that subsided as lockdowns ended. Brewery sales will also continue to struggle this year, reflecting multi-year trends of declining per capita beer consumption. So much so, that some affected retailers are trying to find new sources of revenues. The Beer Store in Ontario, for example, is offering alternatives such as snacks and energy drinks to drive customers into the store. Distilleries are in a better position than wineries and breweries to boost sales this year due to opportunities to tap into the growing ready-to-drink market and loosening restrictions in Ontario.

Figure 1: Wineries and breweries expected to record decline in nominal sales in 2024

Sources: Statistics Canada, FCC Economics

So where are margins heading?

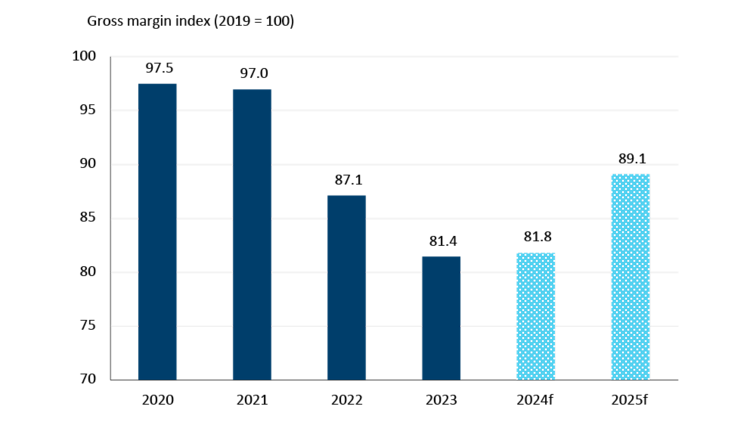

Food and beverage manufacturing gross margins remain under pressure this year (Figure 2). Our gross margin index is still anticipated to improve slightly, up 0.5% on average this year, but slightly below our earlier predictions of 1.5% (largely because of persistently high input costs like wages and benefits). Margins are expected to improve significantly in 2025 as costs continue to moderate, despite lower sales.

It’s worth pointing out that margins will vary greatly by sector. For instance, alcoholic beverages will struggle more than food and non-alcoholic drinks for the remainder of this year and into next year. Although alcoholic beverage manufacturers have started to see their costs come down this year after three years of rapid increases, it will not be enough to offset the declining demand pressuring sales in wineries and breweries.

Figure 2: Food and beverage manufacturing gross margin index showing improvements

Sources: Statistics Canada, FCC Economics

Trends to Watch

Consumers are tapped out

In theory, slowing inflation and interest rate cuts should be positive for consumers, however prices remain significantly higher compared to four years ago. And so far, this year, consumption trends have been mixed, with services registering decent growth and spending on goods treading water. Even looking at goods, the picture is full of nuances. For example, Canadians are starting to spend more on food and non-alcoholic beverages compared to 2023, but they’re still spending less on alcohol (Figure 3).

Over the next year, consumption is likely to remain under pressure due to high debt servicing (which is restraining household budgets) and a weakened labour market, both of which seem to be more than offsetting the benefits of declining interest rates and lower inflation.

Figure 3: Real household spending on food rises, while alcohol spending sinks

Sources: Statistics Canada, FCC Economics

We are starting to see retailers respond to consumer weakness by focusing on discount stores, private labels, and value-size offerings. A major retailer is even piloting an ultra-discount store in Ontario, offering a smaller selection of household staples at 20% savings.

Temporary Foreign Worker Program

Although job vacancies have dropped from the highs seen during the pandemic, filling jobs remains a challenge for food and beverage manufacturers, many of whom have had to leverage temporary foreign workers, which now account for nearly 15% of the sector’s workforce (Figure 4).

The TFWP faced criticism this year for being misused, leading to stricter hiring rules under the low-wage stream, which is where food manufacturing hires temporary foreign workers from. At this point, food processing sectors are protected from the changes. However, the Government left the door open to additional changes to the program in the coming months.

Figure 4. Use of temporary foreign workers in food and beverage manufacturing, 2017 to 2023

Sources: Statistics Canada, FCC Economics

Grocery Code of Conduct

In July, all major grocery retailers signed on to the Grocery Code of Conduct (Code). Gaining their support was a required step in being able to move forward to fully implement the voluntary industry-led code. The Code is expected to be implemented by June 2025 with the goal to improve transparency, certainty, and fair dealing across the grocery supply chain.

There are still many details to work out but what we do know is that the Grocery Code Adjudication Office (GCAO) will oversee the management of the Code. The GCAO will be a voluntary membership-based organization made up of businesses involved in selling directly to grocery retailers, wholesalers, and distributors. Sales between primary and further processing, for example, would not be subject to the code.

Bottom Line

We continue to expect overall food and beverage sales to decline slightly this year. The sector is expected to see soft sales in the second half of this year and into the first half of 2025 as inflationary pressures, largely responsible for sales growth over the past three years, ease and consumers remain under pressure due to high debt servicing (which is restraining household budgets) and a weakened labour market. Food and beverage manufacturers will also have to deal with rising labour costs, which are pressuring margins.

Amanda Norris

Senior Economist

Amanda joined FCC in 2024 as an Economist. She has expertise in the food and beverage industries, but also does research on supply management and consumer trends. Amanda comes from Agriculture and Agri-Food Canada where she amassed a wealth of economic, technical and industry knowledge through various positions including policy advisor, project lead and Economist.

Amanda holds a master’s degree in Food, Agricultural and Resource Economics from the University of Guelph. She is also a Board member of the Canadian Agricultural Economics Society where she promotes outreach and the importance of agriculture and food research.