2025 Broiler and egg outlook: Headwinds combined with optimism

When assessing the outlook for broiler and egg production in 2025, we need to consider the likely slowdown in population growth and the impact that will have on demand. Despite this, there are reasons to be bullish on the sector in 2025. Recent outbreaks of avian flu pose a risk to production (and to consumer price spikes), however record egg production has positioned the sector well to manage short-term supply disruptions. We break it all down in our 2025 broiler and egg outlook.

Setting the stage for 2025

Before turning our attention to 2025, let’s quickly reassess 2024. In our August poultry blog we noted the USDA estimated 2024 Canadian broiler production growth to be 1.7% for 2024. Since that time, the organization has revised that number even lower to 1.0% growth.

We find this estimate hard to believe. First, population growth as of July 1, 2024, was 3.0% higher than it was compared to July 1, 2023. Knowing this, per capita consumption of chicken would need to fall -1.3% for the USDA’s calculation to pencil out. Declines in per capita consumption of chicken have been very rare historically. For example, a -1.3% decline would be the largest decline since 2011 (outside of the shock of 2020). Additionally, slaughter volumes year-to-date (up to and including November) were up 2.2% compared to 2023. Statistics Canada will soon be publishing 2024 results, and we expect those to show production growth of about 2.5%, higher than the USDA’s estimate.

What kind of demand for chicken will there be in 2025?

Production levels are set to meet expected domestic demand. Therefore, to understand production growth, it’s important to understand the domestic demand outlook and the state of the Canadian consumer heading into 2025.

The first thing to note is that population growth is set to slow in 2025 – we’re just not sure at what rate. The Parliamentary Budget Officer estimates a decline of -0.2%. Statistics Canada produces a wide range of population growth scenarios. Their lowest-growth scenario projects a decline of -0.9% while their highest-growth scenario projects growth of 1.5%. The Bank of Canada projects an average growth rate of 1.7% over the next two years.

So, what’s the implication of slower (or even negative) population growth for broiler production growth? While it’s certainly not a positive indication, there are a couple reasons we’re still bullish on chicken demand in 2025.

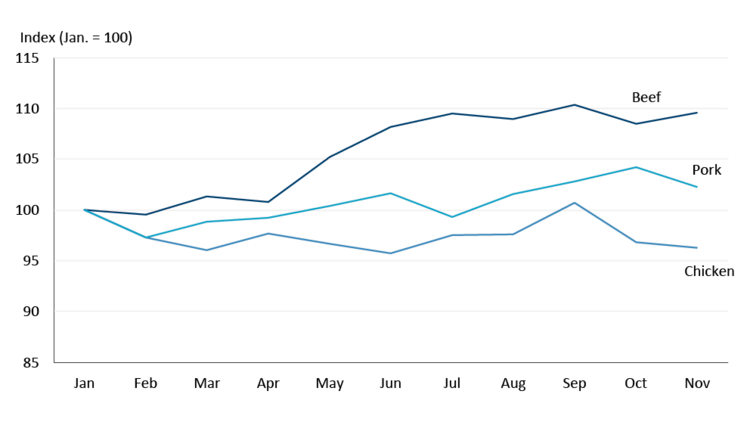

One reason is protein-price competitiveness. All major protein types have seen dramatic price increases since November 2020: retail chicken prices increased 24%, retail pork prices rose 14%, and retail beef prices rose a whopping 39%. However, feed prices peaked in early 2023 and continued to ease throughout 2024. These feed price declines put downward pressure on the farmgate minimum live price for broilers and, later on down the supply chain, retail chicken prices. Since the beginning of 2024, retail chicken prices have actually declined -3.7% while pork (+2.2%) and beef (+9.6%) have increased (Figure 1). We expect retail chicken prices to remain competitive in 2025 as feed costs should remain low given the glut of U.S. corn available.

Figure 1: Major protein retail price changes since January 2024

Sources: Statistics Canada, FCC Calculations

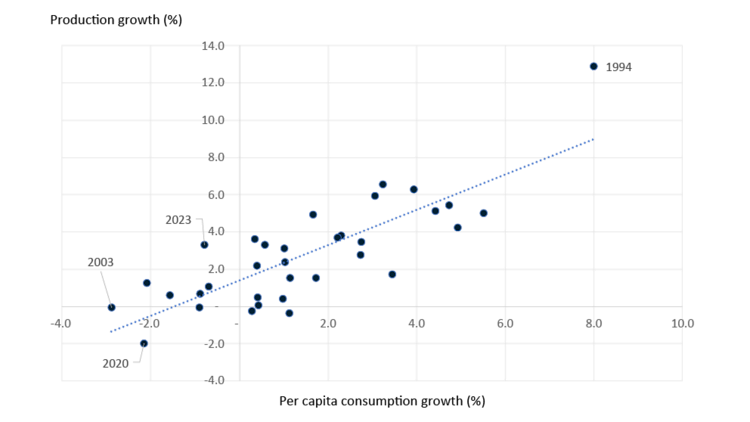

This relative price advantage, if it persists in 2025, could boost per capita consumption. Our analysis shows that for every 1.0% change per capita consumption, total production increases 0.5%, all else being equal. Put another way, if the average person ate an additional 350 grams of chicken it would translate into an extra 7,500 metric tonnes (mt) of required broiler production. Figure 2 below highlights the relationship between per capita consumption and total production changes.

Figure 2: Relationship between per capita consumption growth and total production growth

Sources: Statistics Canada, FCC Calculations

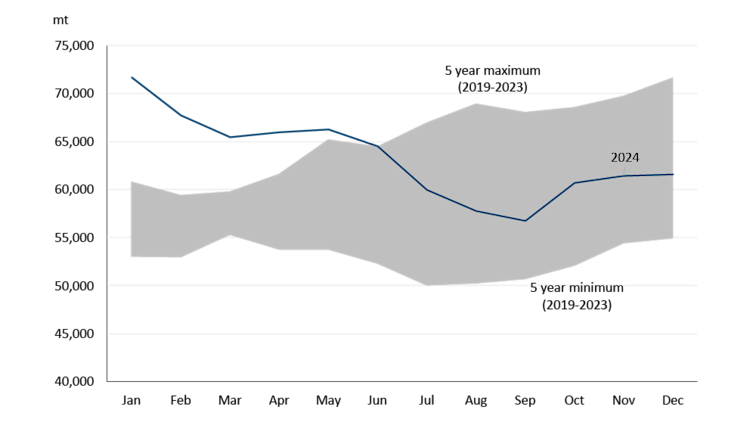

We highlighted back in August that chicken stocks of frozen chicken were historically high heading into 2024 and how a return to more historical levels of frozen stocks would bode well for production in the latter half 2024 and into 2025. This has turn out to be the case. Inventories as of November 2024 were nearly 12% lower than November 2023. Stocks of frozen chicken are now in line with seasonal norms (Figure 3).

Figure 3: Stocks of frozen chicken have been reduced since beginning of 2024, within seasonal norms

Sources: Statistics Canada, FCC Economics

All-in-all, if we assume a population growth rate of 0.5%, and prices for beef and pork evolve in line with current expectations, our forecast is for a 1.2% increase in production in 2025. Should population growth come in lower than this estimate, so too will broiler production growth, though it’s likely to remain positive. Conversely, should beef and pork prices increase more and/or chicken prices remain flat, broiler production growth could see a small increase above our estimate.

Egg production challenges possible with recent avian flu outbreak

Avian flu made a resurgence in North American towards the end of 2024. The USDA reports that since October 2024 over 120 commercial flocks have been impacted with over 32 million birds being affected in the U.S.

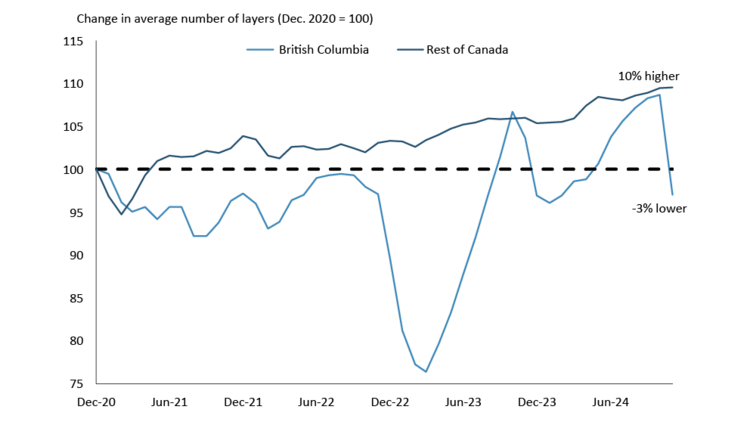

In Canada, there are currently 84 infected locations as of early January. The vast majority of cases are in flocks in BC. The province of BC was also most impacted by the big outbreak of Avian flu in 2022-23 and the number of layers correspondingly fell sharply. At the peak of the last outbreak in early 2023, BC had only 76% as many layers as in December 2020. As of November 2024, the number of layers in the province is 3% lower than December 2020, with the number falling 10% between October and November alone. This single month decline was the largest decline since February 2023, a reflection of the impact of the various outbreaks that have occurred recently (Figure 4).

Figure 4: BC layers were hit hard by the avian flu in 2022-23

Sources: Statistics Canada, FCC Economics

As of November, Canadian egg producers had produced over 820 million dozen eggs in the previous 12 months – a record high. The holiday season – a time when egg demand runs high – is also now in the rearview mirror. An easing of demand in the early part of 2025 should allow for supplies to be rebuilt if required.

When bird flu hit in 2022-23, egg prices remained stable in Canada compared to the U.S. For example, in January 2023, the inflation rate for a dozen eggs in the U.S. hit 150% year-over-year. Egg prices in Canada for that same month rose only 4%. While higher prices are likely in the face of a prolonged outbreak, consumers and processors should see some stability, particularly as increases in other production costs at both the producer and processor level have stabilized compared to 2022-23.

Bottom line

The slowdown in population growth may lower total demand, but demand for chicken on a per capita basis remain strong. The continued price increases of alternative proteins – especially beef – should provide a further boost to chicken demand. The spread of avian flu remains the biggest risk to individual producers and the sector as a whole in the year ahead.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.