2025 Crop outlook: Challenging acreage decisions ahead

When evaluating the outlook for grains, oilseeds, and pulses in 2025, it is essential to consider external factors affecting prices and yields, such as potential tariffs, anti-dumping measures on canola, and the ever-influential weather conditions. Our recent top trends blog addressed the broader impact of possible tariffs and trade barriers related to canola. Any further depreciation in the Canadian dollar will enhance crop prices received by farmers – we estimate that a 1% depreciation results in a roughly 0.7% increase in crop farm cash receipts.

Commodity prices for the 2024-25 marketing year (MY) have fallen year-over-year (YoY) for nearly all crops, but the good news is that prices seem to have stabilized for the upcoming 2025-26 MY and are close to their 5-year averages (Table 1). Prices are expected to be relatively stronger for cereals compared to oilseeds as global stocks-to-use tighten for corn and wheat and we go into details below. The price forecasts do not include the impact of any potential tariffs which would provide downward pressure but could unlock additional demand for Canadian crops from the rest of the world.

Table 1: Crop Prices ($/tonne) for new MY will have significant volatility

Cash crop | 2023-24 | 2024-25 | 2025-26 | 5-Year Average |

|---|---|---|---|---|

Corn (ON) | 240 | 245 | 245 | 265 |

Soybeans (ON) | 610 | 545 | 525 | 595 |

Canola (SK) | 695 | 645 | 600 | 690 |

Peas (SK) | 455 | 420 | 400 | 405 |

Lentils (SK) | 900 | 750 | 670 | 765 |

Spring wheat - (SK) | 335 | 295 | 330 | 330 |

Feed barley (AB) | 280 | 260 | 280 | 285 |

Durum (SK) | 460 | 355 | 425 | 435 |

Marketing Year for wheat, canola, barley, peas and lentils: August 1 – July 31

Sources: Statistics Canada and FCC calculations

A weaker Canadian dollar has the downside of increasing costs when importing inputs and farm equipment. Fertilizer prices may drop slightly year over year, but overall variable costs will likely remain stable nationwide. Tight margins are anticipated, with profitability hinging on commodity prices, 2025 weather, and land costs for individual producers. We will delve deeper into the fundamental supply and demand dynamics within the crop sector, which significantly influence pricing and producer decisions for the upcoming spring season.

Could this be the year that cereal grains experience a resurgence in the market?

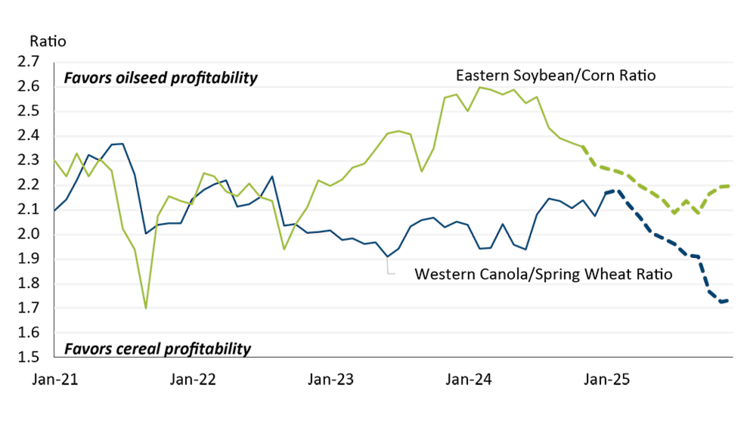

With high prices from 2022 now well behind us, it is important to recognize that they have not declined to pre-pandemic levels. Looking ahead to the coming year, we anticipate that soybean and canola prices will decrease relative to their cereal counterparts, specifically corn in Eastern Canada and spring wheat in the Prairies (Figure 1). These relative price advantages do not necessarily indicate that one crop is more profitable than another; rather, they reflect the current state of local and global supply and demand. This information can be valuable for planning rotation choices for the 2025 crop season.

Figure 1: Cash crop price ratios show advantage moving to cereals in rotations in the year ahead

Sources: Farm Product Price Index and FCC calculations

Large soybean stocks driving market preference for corn planting

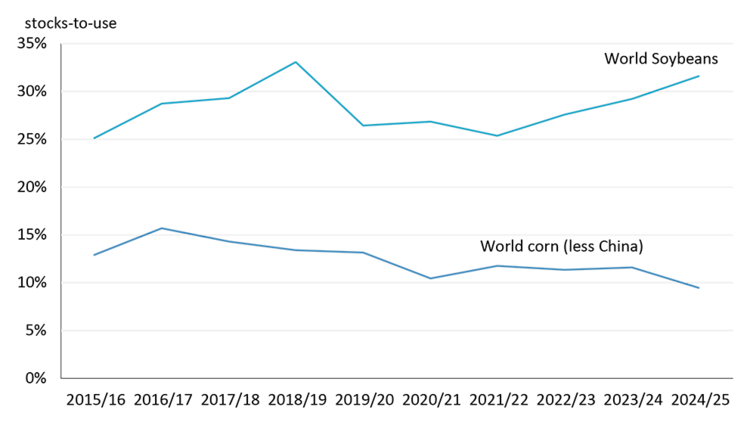

Since the beginning of 2023, cash soybean prices in Eastern Canada have been higher relative to corn, reaching levels not seen in over a decade. However, stocks-to-use ratios for the two global crops are trending in different directions according to data from the latest World Agricultural Supply and Demand Estimates (WASDE) report released by the USDA. The global soybean stocks-to-use ratio has been increasing (Figure 2) due to large worldwide supplies and despite growing global soybean consumption, it has not kept pace with the significant growth in South American production. Brazil alone will produce nearly 40 million more tonnes than it did just four years ago. Uncertainty regarding biofuel tax policies in the U.S. could also limit demand.

Figure 2: Global stocks-to-use ratios for soybeans and corn

Source: United States Department of Agriculture

Heading the opposite direction is global corn stocks-to-use where we have removed China from the calculation. While they are a large producer and importer of corn at times, their stocks don’t get exported and it’s a more accurate way to measure the tightness of global stocks. We would have to go back to the 2012 U.S. drought to find as tight of stocks-to-use. And given the fact that the current ratio of soybean to corn futures contracts is below the 5-year low, this suggests that the market is attempting to influence acreage decisions in the United States towards planting more corn.

Tight canola stocks restrained by soybeans – wheat stocks continue to shrink

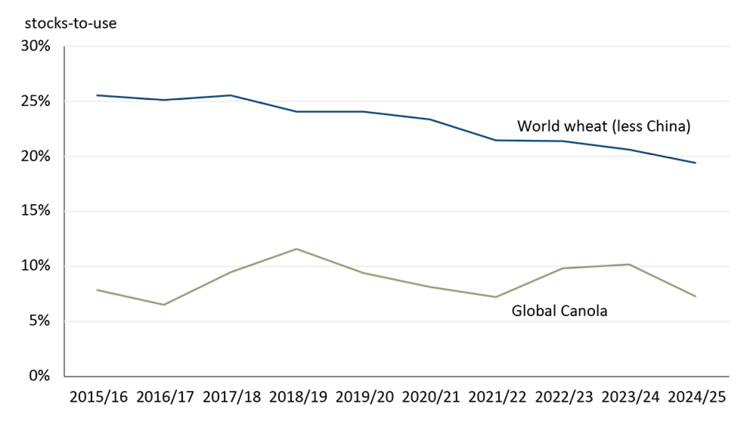

When assessing wheat fundamentals, we again exclude China to gauge global availability. Wheat stocks-to-use ratios are expected to be the lowest since 2007/08, supporting the market (Figure 3). Key factors to monitor include the overwintering of the U.S. winter wheat crop after January's cold snap and the condition of the Black Sea crop in spring. Lower protein wheats are also competitively priced with corn, leading to an increase in their use in animal feed rations globally.

Figure 3: Global stocks-to-use ratios for canola and wheat

Source: United States Department of Agriculture

Global canola stocks-to-use are currently at 7%, which is below the 5-year average of 9%. It is anticipated that supplies will be even tighter in Canada due to a smaller crop in 2024, strong exports, and new crush capacity coming online. The timing of China's conclusion of its anti-dumping investigation remains uncertain, but import restrictions are more likely as we approach the next crop year on August 1st. With China accounting for over 75% of shipments, exports are 10 weeks ahead of schedule. Even if exports to China slow down, Canada needs to export only 2.5 million more tonnes of canola to meet AAFC's target of 7.5 million tonnes in 2024/25. Canola prices are also influenced by the large global soybean stocks. Nonetheless, reduced ending stocks could favorably position the canola market for the 2025-26 period.

For producers making planting decisions this spring, current prices may not accurately predict future trends. In January 2025, price ratios favor oilseeds, benefiting those selling old crops. However, tightening global cereal stocks suggest that demand for corn and wheat is likely to increase in the coming year as shown in Figure 1.

Other crops are mixed for price expectations

All other principal field crops in Canada – outside the four crops discussed so far – represent roughly 25% of the acres seeded each spring, although in certain regions they make up a considerably higher percentage in rotations. An increase in pulse acres this year is possible, but geopolitical issues, particularly import restrictions by India, are noteworthy. Canada began the 2024/25 crop year without Indian import restrictions, while last year they opened only in December. The Indian Government recently extended duty-free pea imports until February 28, 2025. Strong lentil prices suggest a rise in lentil acres in 2025. Barley prices will have support from the cattle feed market but will be limited to corn price increases.

Bottom line

It won’t be easy for producers to decide what to plant or seed this spring. Many factors influencing pricing, such as tariffs or trade barriers, are largely beyond the control of producers and are expected to remain volatile this year. Soil moisture across Canada appears to be more favorable going into spring compared to recent years; however, weather conditions during the growing season will significantly impact production. Producers would do well to focus on things they can control, like understanding and managing their cost of production and making incremental sales when profit opportunities present themselves.

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.