2025 Dairy outlook: Cautious optimism amid trade uncertainty

The 2025 outlook for the dairy sector is a little murkier than last year. Slowing and uncertain population growth is likely to slow the growth in dairy product demand and producer prices are expected to remain relatively flat. However, demand is still increasing, and feed costs have eased from their highs of the last few years. We are projecting profitability (on a $/hl basis) to decline relative to 2024, but margins should remain better than the five-year average. The elephant in the room is trade and what the new U.S. administration means for the dairy sector. We discuss it all in our 2025 dairy outlook.

Increased production to drive revenue bump

One thing we know for sure is there will be a very slight decline (-0.02%) in the farmgate milk price. Each year, the Canadian Dairy Commission (CDC) conducts a cost of production survey to understand the average cost of producing one hectoliter (hl) of milk. The results are one of the inputs into determining what adjustment (if any) should be made to farmgate prices every February. By the time the survey results are published they are somewhat dated, so to get a better understanding of more recent costs, the data are indexed (adjusted) to reflect conditions up to August. It’s these indexed values that are used in determining the recommended price changes. The latest study showed that, while inflation was still high last year, feed costs were lower which drove total costs of production lower (Table 1).

Table 1. Indexed total costs fell last year due to declining feed prices

| Survey results | Survey results indexed to August 2024 | Change ($/hl) | Change (%) |

|---|---|---|---|---|

Total costs | 93.09 | 90.36 | -2.73 | -2.9% |

Purchased feed | 23.26 | 20.41 | -2.85 | -12.3% |

Non-feed costs | 69.83 | 69.95 | 0.12 | 0.2% |

Source: Canadian Dairy Commission

While indexed production costs fell -2.9%, the overall inflation rate rose 2.9% in the same period. The National Pricing Formula weighs indexed survey results and inflation data equally, so the adjustment based on the National Pricing Formula was essentially no change.

Our forecasts for total farm cash receipts (FCR) for the sector are shown in Table 2 below. We are projecting 3.0% growth in total FCR, which is nearly entirely driven by an increase in production, given flat prices. The Western Milk Pool (WMP) has already announced two incentive days per month until the end of November to go along with a 2.0% - 2.4% quota increase effective March 1 (the increases differ slightly between the four western provinces). As of this writing, there have been no similar announcements for the P5 region.

Table 2: Dairy farm cash receipts, historical and projected

Year | FCR ($, bill.) | Growth |

|---|---|---|

2020 | 7.13 | 2.0% |

2021 | 7.38 | 3.6% |

2022 | 8.23 | 11.4% |

2023 | 8.55 | 3.9% |

2024 | 8.89 | 3.9% |

2025f | 9.15 | 3.0% |

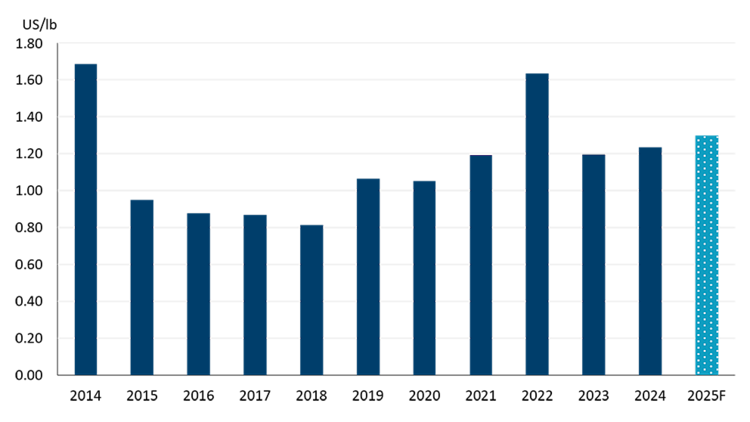

It should be noted that not all of the average blended price is set within the supply management system. Approximately 11% of butterfat (by weight) goes into Class 5 products, a class of milk where all components are determined by U.S. prices (solids non-fat prices in some Class 4 products are also determined by U.S. prices). The USDA is projecting non-fat dry milk prices in the U.S. to average $1.30/lb in 2025, which if it held, would be a 5.4% increase from 2024 (Figure 1). This price, however, is subject to market forces and could move up or down as the year unfolds.

Figure 1: U.S. non-fat dry milk prices forecast offers some price upside in 2025

Sources: Barchart, USDA

With limited upside for price growth, producers will need to carefully manage costs. We expect feed costs to remain low in 2025 but fixed and variable costs will continue to increase, albeit at a slower pace than we saw in 2022 and 2023.

Population growth will be a wildcard here. Last year’s increase in demand was spurred in large part by the surge in population. There have been a number of changes to different immigration programs, and population growth is set to slow drastically, putting a damper on demand growth moving forward. Still, preferences for dairy products is growing: we estimate that dairy product sales (by volume) grew 7.0% last year, well above the increase in national population.

On the feed front, 2024 was a better year for forage and grain production in the west but the story yet again heading into 2025 will be how the growing season unfolds. Drought has plagued the west off-and-on for the first half of this decade and, like in most sectors of agriculture, profitability will be driven by how the growing season unfolds.

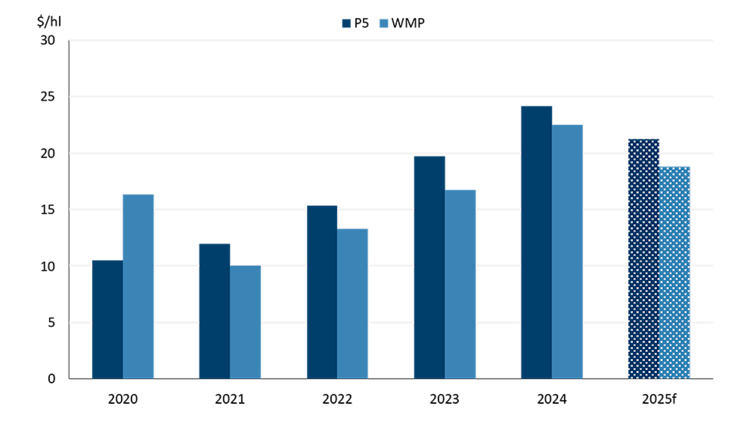

Overall, our models show that profitability in 2025 will be lower than it was in 2024, but still better than the five-year average.

Figure 2: Estimates of average gross dairy margins, 2020-2025

*Gross margin is total revenue less total variable costs (including feed). Fixed costs and return to management are excluded from the calculation. We do not include fixed costs as these vary greatly between operations.

**The calculations use different definitions of cost categories for the P5 and WMP and therefore values are not directly comparable.

Sources: Statistics Canada, Canadian Dairy Commission, Government of Alberta, FCC Economics

What does a second Trump administration mean for dairy?

The Canada-United States-Mexico (CUSMA) trade agreement isn’t set for formal review until 2026, but discussions regarding the future of the agreement as it relates to dairy are likely to ramp up in 2025. CUSMA has a built-in review every six years. In these reviews, the countries can assess the agreement, discuss areas that may need updating, and gauge each other’s interest in continuing the agreement.

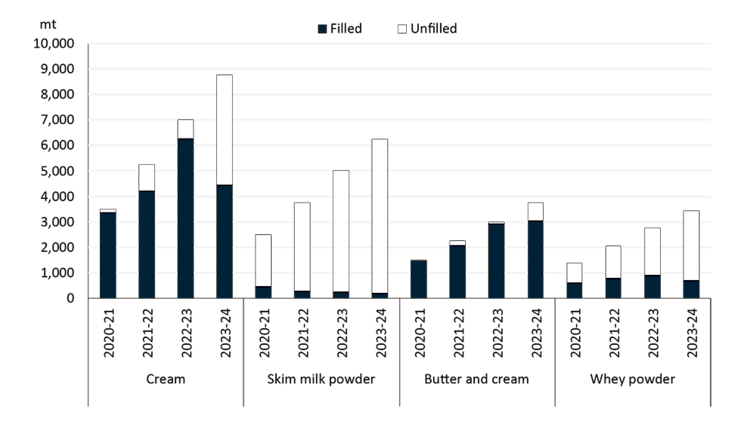

It’s worth mentioning that in the most recent dairy year (August 1, 2023, to July 31, 2024) the fill rates on negotiated imports were not filled under the CUSMA agreement (Figure 3). In some cases, with some products, there were very minimal amounts of imports. Flat U.S. milk production and strong U.S. dairy exports to global markets last year played a role in this. Market access issues could resurface in CUSMA review discussions.

Figure 3: Dairy imports in 2023-24 under CUSMA, select products

Sources: Global Affairs Canada, FCC Economics

Bottom line

Overall, 2025 is shaping up to be a decent year for dairy producers, building on a largely successful 2024. Demand should hold steady even with slower population growth, and feed costs have eased. Still, there are watch items to be aware of as the year unfolds. Keeping a close eye on variable costs will be key given limited upside price potential and variable non-feed costs that remain elevated. Filling incentive days as they become available would help spread fixed costs out over more units of production.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.