2025 FCC Food and Beverage Report: Lower input costs should help improve margins

The annual FCC Food and Beverage Report reviews last year’s economic environment and highlights opportunities and risks for Canadian food and beverage manufacturers for 2025. The report includes projections of annual industry sales and gross profit margins by sector.

Industries featured in the report are:

Grain and oilseed milling

Sugar and confectionery products

Fruit, vegetable preserving and specialty food

Dairy product manufacturing

Meat product manufacturing

Seafood preparation

Bakery and tortilla products

Beverage manufacturing

Key takeaways

A quick glance at the financials of the food and beverage manufacturing sector might suggest that 2024 was an uneventful year, with expenses, sales and gross margins seeing little change compared to the prior year. But in truth, the sector was impacted by several events: inflation started to retreat, the Bank of Canada began cutting interest rates, and tightness in the labour market eased. Last year also saw skyrocketing cocoa prices, elevated cattle prices, and sinking grain prices.

This year is also shaping up to be rather eventful for food and beverage manufacturing, albeit for different reasons. Trade disruptions will take centre stage for the sector in 2025 but the impacts of slowing population growth on labour supply and consumer demand will also play a role in profitability. Businesses going into 2025 in a good financial position and those with diversified markets for both sales and inputs will fare better during these uncertain times.

Slow sales growth predicted for 2025

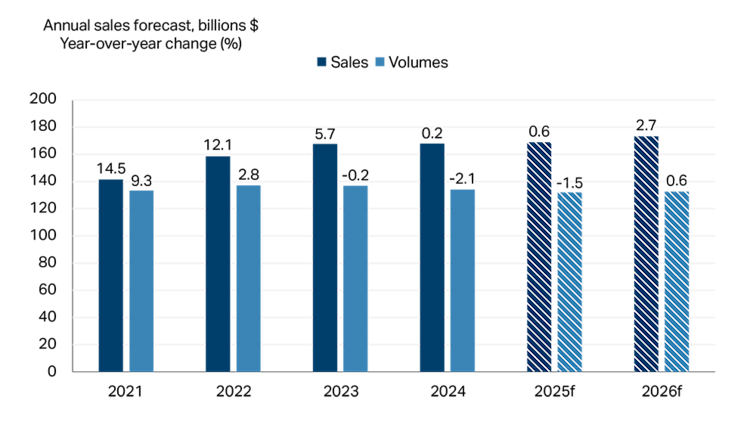

FCC Economics forecasts a moderate increase in food and beverage manufacturing sales of 0.6% this year, from $167.8 billion to $168.8 billion. The beverage manufacturing sector continues to face an adjustment to volumes sold (i.e., sales adjusted for inflation) following a spike during the onset of the pandemic, pulling volumes down for the whole sector over the last two years. In 2024, volumes remained above 2019 levels but are projected to drop -1.5% in 2025. This decline will come in part from the impact of slower population growth in 2025, impacting both food and beverage volumes. The 2026 outlook is positive for the sector with current sales projections up 2.7% and volumes up 0.6% over 2025 levels (Figure 1).

Figure 1: Slow sales growth for food and beverage manufacturing in 2025

Total sales and volumes (in $, billions) are on the vertical axis and shown by the height of each bar. The top number above each bar is the year-over-year growth as a percent. Volumes are sales deflated by a price index (202001=100).

Sources: FCC Economics, Statistics Canada

Despite the relatively flat growth in sales on average, there is variation by sub-sector. Dairy and sugar and confectionery products are anticipated to record double-digit sales growth and strong volumes in 2025, while alcohol beverage and seafood sales will struggle on lower demand. While there are different opportunities and challenges for each sub-sector going into 2025, finding innovative solutions to meet trends in consumer preferences will be a valuable way for all sub-sectors to differentiate products and drive sales.

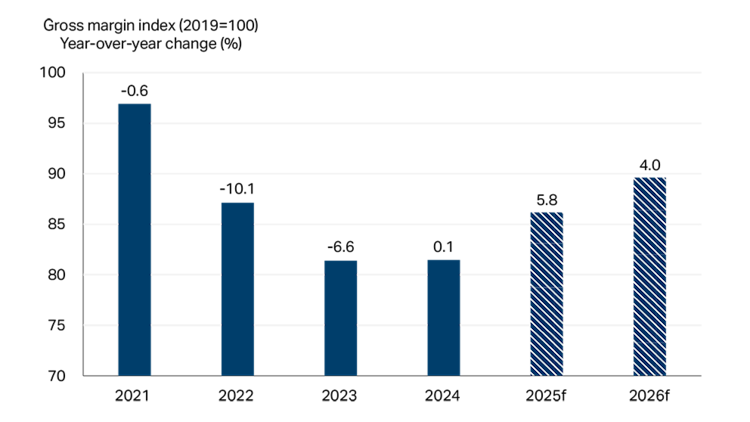

Gross margins likely to benefit from falling raw material costs in 2025

Raw material costs are forecast to decline in many sectors at a faster pace than predicted wage increases, pushing down the cost of goods sold. Combined with the anticipated small uptick in sales, gross margins for food and beverage manufacturing are set to increase on average in 2025 (Figure 2).

Figure 2: Food and beverage manufacturing gross margin forecast to grow in 2025 and 2026

Sources: Statistics Canada, FCC Economics

A major downside risk to this forecast, however, is the impact of trade disruptions and how the growing season progresses in Canada and around the world. These risks vary by sub-sector, but impacts will be felt disproportionately by businesses whose sales or inputs are concentrated in foreign markets. Trade disruptions will likely lower sales and exports, increase costs, and ultimately put downward pressure on margins. Aside from trade disruptions, several other factors, outside of the industry’s control, can impact the availability of many key inputs, raising costs. Some of these include an aging labour pool, weather related impacts on crops, geopolitical conflicts, animal diseases, and changing consumer preferences.

As such, businesses can look for opportunities to strengthen their balance sheets, invest in processes and equipment to boost productivity, introduce product innovations, and seek diversification towards new markets.

Per capita spending on food and beverage falls

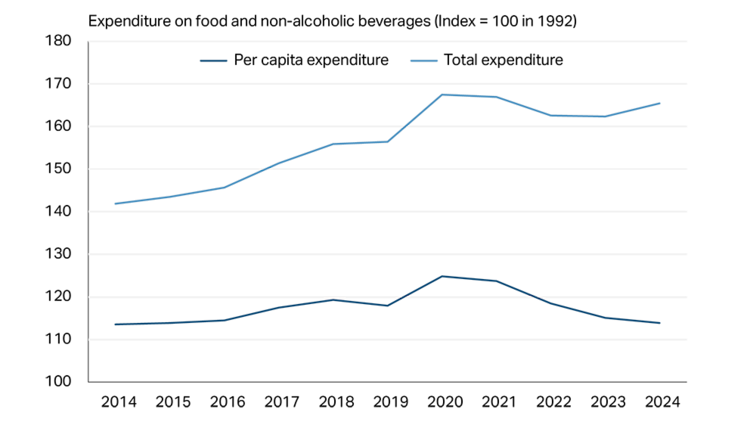

Historically, food and beverage retail sales have fared better than other sectors during difficult economic times as they are necessities. Even so, uncertain economic times do not bode well for consumer demand overall. As Canada’s economy is set for another challenging year in 2025, the food and beverage sector faces headwinds in reversing the downward trend in per capita expenditure.

Despite total household expenditure on food and non-alcoholic beverages bouncing back in 2024, per capita spending hit its lowest level in ten years (Figure 3). Alcohol fared even worse with both total expenditure and per capita expenditure falling for the fourth year in a row.

Figure 3: Per capita food and non-alcoholic beverage spending at a decade low

Sources: Statistics Canada, FCC Economics

Economic uncertainty has led households to tighten their budgets and adjust purchasing habits. Consumers are turning to discount stores, buying in bulk, substituting in less expensive alternatives, being conscious of food waste, and taking advantage of sales and promotions. These strategies contribute to lower per capita spending but not necessarily lower food consumption. However, some reduction in per capita spending comes from households purchasing less food whether due to income constraints, raising concerns for an uptick in food insecurity, or the rise in the use of pharmaceuticals to manage appetite.

Tight household budgets, weak consumer confidence, a decline in Canada’s population growth, economic uncertainty, and trade disruptions all suggest that the sector will find it difficult to boost sales volumes for another year.

Bottom line

There is a lot of uncertainty going into 2025 as food and beverage manufacturers grapple with uncertain international demand because of trade disruptions, combined with weak domestic demand. Although inflation has slowed and interest rates are lower, the consumer remains under pressure keeping sales growth muted for another year. In 2025, consumers will continue to look for value in their food products and watch spending on premium or discretionary items. While labour market pressures did ease in 2024, Canada’s labour pool is aging keeping upward pressure on wages over the long-term. Strength in margins will therefore be dependent on anticipated declines in raw material costs.

Food and beverage manufacturers have a long track record of proving their resilience and adaptability during challenging times.

Senior Economist

Amanda joined FCC in 2024 as an Economist. She has expertise in the food and beverage industries, but also does research on supply management and consumer trends. Amanda comes from Agriculture and Agri-Food Canada where she amassed a wealth of economic, technical and industry knowledge through various positions including policy advisor, project lead and Economist.

Amanda holds a master’s degree in Food, Agricultural and Resource Economics from the University of Guelph. She is also a Board member of the Canadian Agricultural Economics Society where she promotes outreach and the importance of agriculture and food research.