Biofuel expansion set to grow market for Canadian oilseeds

Canadians filling up their fuel tanks as they head out for summer road trips may not think about it, but biofuels – such as ethanol, biodiesel, and renewable diesel – help make the fun possible. Biofuels are blended with fossil fuels to produce the liquid that powers vehicles. Blending biofuels with fossil fuels can help improve fuel quality and reduce greenhouse gas emissions.

The drivers for biofuel demand and supply in Canada are influenced by federal and provincial policies as well as global factors – especially what happens in the United States. In the last five years multiple major corporations have announced plans to invest and expand biofuel production capacity. Even if some of these plans do not move through to completion, North American biofuel production is set to grow in the upcoming years. That’s bullish for Canadian oilseed producers.

Productivity is key for ethanol plants while renewable diesel capacity grows

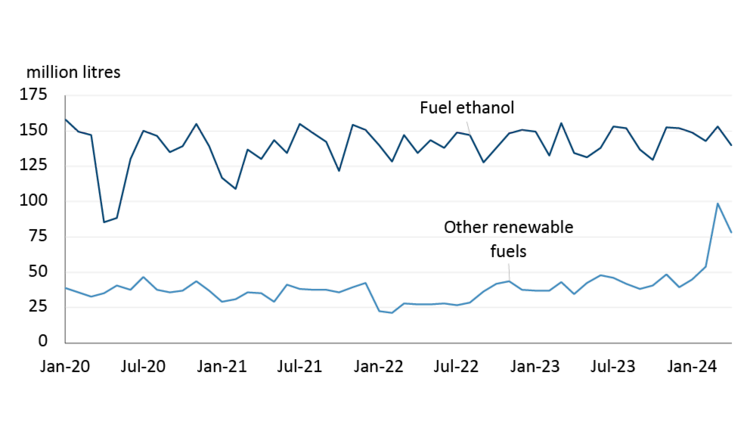

Ethanol holds the title for largest biofuel produced (by volume) in the world. This is true in Canada as well where plants produce nearly 150 million litres of ethanol per month (Figure 1). In recent years, there have been no new ethanol plants built. However, production has increased over time as the existing plants focus on improving productivity by squeezing additional drops of ethanol from each tonne of grain. Canadian ethanol plants also produce small volumes of undenatured ethanol, used in applications like cleaning products and hand sanitizer (not included in this data).

Figure 1: Canadian ethanol production is flat while biodiesel and renewable diesel are increasing

Source: Statistics Canada

Up to the end of 2023, biodiesel made up the majority of the fuel falling under the ‘other renewable fuels’ category in the chart above. The future, though, is in renewable diesel. There are two major reasons why. First, renewable diesel can generate higher carbon credit prices in North America compared to biodiesel. Second, renewable diesel’s chemistry is similar to traditional diesel and thus can be swapped out with ease. Earlier this year, new renewable diesel plants came online and immediately doubled Canada’s monthly production of ‘other renewable fuels’.

Biofuels are making up a larger percentage of finished fuels

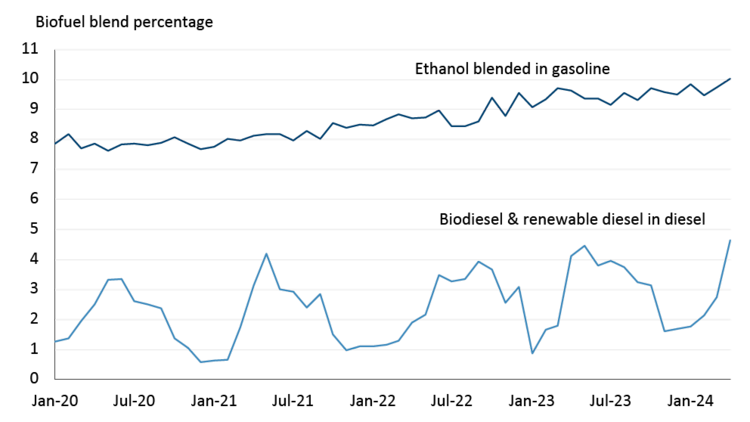

Canadian fuel blenders have continued to increase the amount of ethanol blended into gasoline over time. While federal and provincial blend mandates contribute to this, ethanol is also a relatively cheap fuel enhancer as it helps to raise the octane in finished gasoline. The most recent data point in April shows that ethanol now accounts for 10% of finished motor gasoline, a new high (Figure 2). This data includes exported fuels as well so we cannot say for certain where it is all consumed, but the trend is on point and Canadian consumers continue to use higher blends of ethanol in gasoline.

Figure 2: Ethanol blend in gasoline continues to trickle upwards while diesel blend is seasonal

Sources: Statistics Canada, FCC Calculation

Going forward, the percentage of ethanol in gasoline will continue to increase to meet compliance with provincial and federal mandates. It’s unclear, however, if the rise in ethanol consumption can be sustained, especially considering the electrification of the automotive sector. With 100% of new light duty vehicles sales set to be zero emission by 2035, eventually the total demand for motor gasoline will start to shrink and, even with higher blends of ethanol, there could be lower total demand for the biofuel.

The demand for biodiesel and renewable diesel blended into diesel are heavily influenced by seasonality in Canada. Biodiesel has strict limitations on its use in winter due to cold weather viscosity issues. Blending during winter falls to near zero before ramping up in summertime, reaching nearly 4% of the diesel blend. Renewable diesel does not suffer from the same limitations and can be used throughout the year. Looking ahead, more renewable diesel production in North America will allow for more consistent year-round blending which should increase the total biofuel percentage blended in diesel.

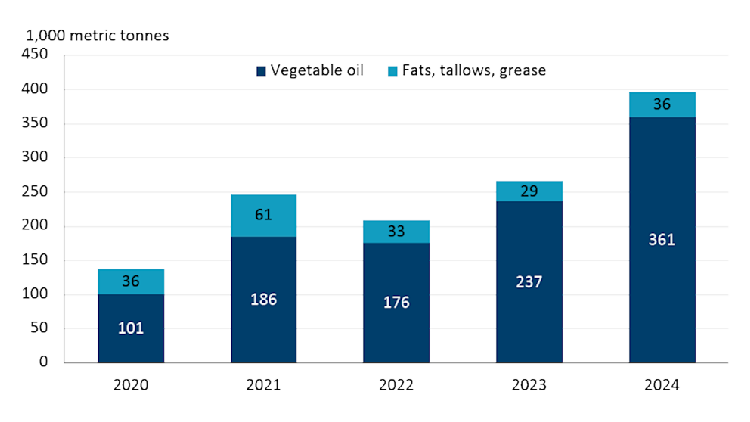

Vegetable oils are the primary input to biodiesel and renewable diesel

In Canada, increased renewable diesel production is being supplied primarily by vegetable oils so far, up 51% through the first four months of the year (Figure 3). Fats, tallows, and greases are often preferred as a feedstock/input due to their lower carbon score, but supplies are constrained in Canada. Rather than importing these products, renewable diesel plants are using domestically crushed canola or soybean oil.

Figure 3: Inputs into Canadian biodiesel and renewable diesel production (Jan-Apr)

Source: Statistics Canada

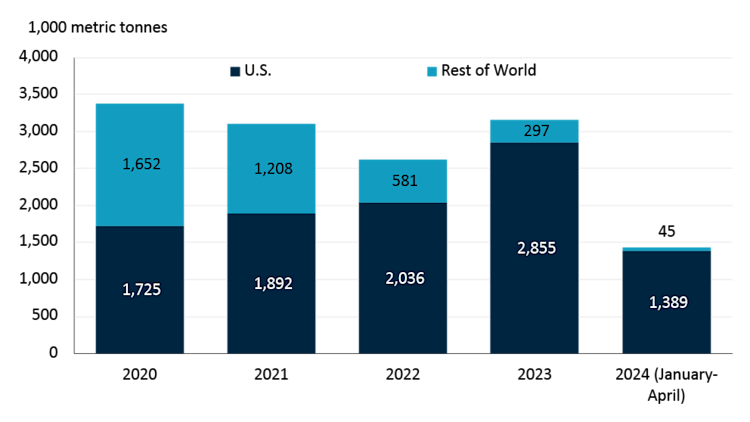

In the U.S., current biofuel tax structures and new credits coming into effect in 2025 via the 2022 Inflation Reduction Act are driving demand for inputs, including Canadian canola oil. Nearly 1.4 million metric tonnes of canola oil were exported to the U.S. in just the first four months of the year, putting 2024 on track for a record annual tally (Figure 4). The new policy will shift to a producer tax credit, meaning only U.S. production of biodiesel or renewable diesel will be eligible to collect it, potentially harming Canadian biofuel exports. For now, however, canola oil producers are taking advantage of the increased demand to fill U.S. capacity and, as a result, we can expect the majority of oil to flow south.

Figure 4: Canadian combined exports of refined and crude canola oil

Sources: Statistics Canada, Canadian International Merchandise Trade Web Application

Bottom line

Canada’s oilseed producers are set to benefit from the boom in biofuels across North America. Rising blend rates in gasoline, coupled with increasing oilseed crush capacity and government support over the coming years will further enhance the sector. That’s not to say the industry is without risk. Much depends on U.S. policy not only with regards to renewable fuels but also trade, both of which have potential to squeeze Canadian producers. For now, however, the future looks bright.

Justin Shepherd

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.