Canada’s export performance builds resilience in face of trade disruptions

Over the next three weeks, we’ll explore global patterns in agricultural and agri-food trade, focusing on Canadian top export products and destinations and the relationship between price volatility and export performance. These posts will build on the insights from our recently released trade ranking report Navigating Trade Disruptions and Volatility.

Trade tensions have defined agricultural markets in 2018. That matters to a country like Canada. Canadian agriculture depends on the health of global markets to export large portions of our production. Although relatively small – in 2017, we were the 38th most populous country in the world – we produce more than enough to feed Canada and well beyond. For that reason, we are a powerhouse in the global agriculture and agri-food markets.

Diverse exports of agricultural commodities and food

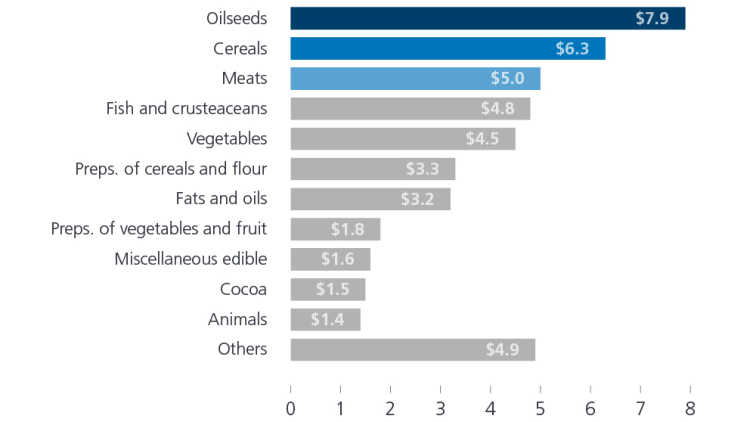

Canada exports a wide variety of food and agricultural commodities, totalling US$46.2B in 2017. Oilseeds, cereals and meats represent 41% of all exports of agriculture and food products (Figure 1). All three categories recorded export growth in 2017: the value of meat exports increased by 6.6% over 2016, cereals by 11.6% and oilseeds by 9.4%.

Figure 1: Oilseeds, cereals, and meats represent a large share of Canada’s ag and agri-food exports

Value of 2017 Canadian exports in USD, billions

Source: UN Comtrade

A diverse export product mix should help sustain the overall performance of the Canadian agriculture and agri-food industry from disruptions in trade relationships that occurred in 2018.

Top exporter of agricultural commodities

Canada remained the 5th largest exporter of agricultural commodities in 2017, a position held since 2011. U.S., China, the Netherlands and Brazil have maintained their world ranking positions for the fourth year in a row. Together, the top five countries accounted for 40% of ag exports in 2017.

Canadian exports of agricultural commodities totalled US$25.9B, accounting for 5.2% of the world’s total ag exports. This export performance also represents a 5.0% increase in the value of ag exports relative to 2016.

Knocking at the door of top 10 agri-food exporters

Canadian agri-food exports reached US$20.4B in 2017, accounting for 3.1% of the world’s total agri-food exports. It is a 6.6% increase in the value of our ag food exports relative to 2016. It makes Canada the 11th largest exporting country in that category.

Germany, the Netherlands, U.S., Brazil and France are the top five exporters of agri-food products, with a market share of 34% in 2017. U.S. is the world’s leading exporter of meats and miscellaneous edible preparations, while Germany is the world’s largest exporter of dairy products, milled products, cereal preparations and cocoa. China picks up first place in world exports of meat preparations and vegetable preparations. Brazil is the top exporting country for coffee and sugars.

Diversifying export markets is key strategy

World economic growth has been revised downward for 2018 and 2019. Yet the world’s appetite for Canadian agricultural commodities and food continues to grow. Our large import markets – U.S., China and Japan – will always be central to our success, but developing new markets can help minimize risks and meet ambitious export goals, particularly in this uncertain global economic environment.

Agricultural Economist

Amy joined the FCC Economics team in 2017 to monitor agricultural trends and identify opportunities and challenges in the sector. Amy grew up on a mixed farm in Saskatchewan and continues to support the family operation. She holds a Master in Applied Economics and Management from Cornell University and a Bachelor in Agricultural Economics from the University of Saskatchewan.