Canada’s global export markets: A focus on the Indo-Pacific region

As confidence in global trade robustness weakens and established trade partners come and go, Canada is seeking new, growing markets for our ag and food exports. The Indo-Pacific region comprises 40 countries and is particularly significant to Canadian trade, with numerous countries in the region serving as existing or potential, largely untapped export markets.

It’s also a region in which Canada has vested interests in keeping politically stable, environmentally sound and peaceful. In November 2022, Canada launched the Indo-Pacific Strategy. The first of the strategy’s five goals is to promote peace, resilience and security, and the second is to expand trade, investment and supply chain resilience.

Indo-Pacific region newly identified as key export markets for Canadian growth

It’s already an economic powerhouse, comprising more than one-third of all global economic activity. That’s expected to grow to more than half of the global economy by 2040. By 2030, two-thirds of the world’s middle-class population will live there. The region is Canada’s second-largest regional export market (for overall exports and food and ag specifically). And as the economy develops, Indo-Pacific consumers will want new foods and experiences.

Current exports to the region

In 2022, Canada’s 10 largest ag and food exports were (from largest to smallest export dollars) wheat, canola oil, bread, canola seed, crustaceans, dried legumes, pork, fresh beef, soybeans and chocolate. Worth $50.5 billion, the ten accounted for 55% of total ag and food exports. The U.S. was our largest export market for six of those products (the food products); China was the largest market for wheat, canola seed, dried legumes and soybeans – the four ag commodities that made the top 10 list.

Aside from China’s prominence as a market for Canadian ag and food exports, several other countries in the Indo-Pacific region serve as smaller but significant markets. In 2022,

Four countries (China, Japan, Indonesia, and Bangladesh) made up 33.6% of total Canadian wheat exports.

Two countries (China and Japan) made up 62.2% of total Canadian canola seed exports.

Four countries (China, South Korea, Japan and Viet Nam) made up 30.5% of total Canadian crustacean exports.

Four countries (China, India, Bangladesh and Pakistan) made up 40.0% of total Canadian dried legume exports.

Five countries (Japan, China, Philippines, South Korea and Taiwan) made up 48.2% of total Canadian pork exports.

Three countries (China, Japan and Indonesia) made up 41.8% of total Canadian soybean exports.

With that in mind, we looked into Canada’s ag and food exports to four of our largest trading partners in the Indo-Pacific region (China, India, Japan and South Korea) to see what we export and to whom.

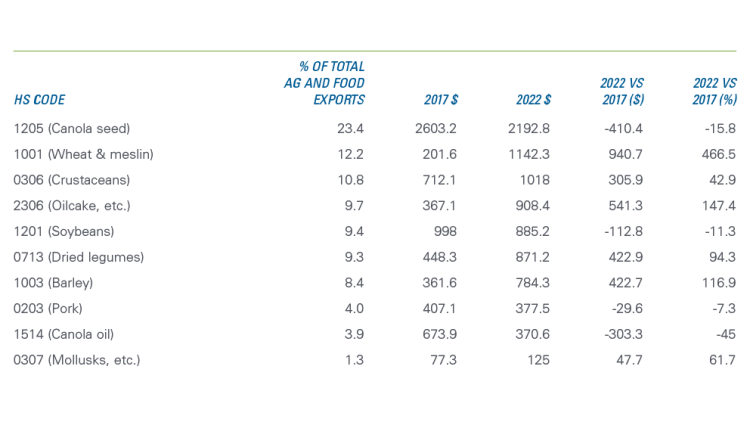

Wheat the big winner of exports to China in 2022

Most of Canada’s largest exports to China are ag commodities (Table 1). The country is, by far, our largest export destination in the region, with ag and food exports totaling $9.4 billion in 2022. Canola seed was our top export, with almost one-quarter of total exports. Crustaceans and pork made up 15% of total exports – notably absent from the list- beef, which has nonetheless made inroads with Chinese importers recently. Wheat exports, our second largest export to China in 2022, grew from $200 million to more than $1.1 billion between 2017 and 2022. Canola seed export values, although enough to clinch the top spot, have been declining in that five-year period, falling 16%. Canola oil exports fell an even steeper 45%.

Table 1: Top 10 ag and food exports (millions, $) to China between 2017 and 2022

Source: Canadian International Merchant Trade database

India has the greatest potential to grow

India has been on Canada’s radar as a trade and diplomatic partner for a while. India will become the world’s largest country (by population) in 2030 and is considered the world’s largest democracy.

Canada’s food and ag exports to India are surprisingly small, given the strength of the familial ties between the two: one in five recent immigrants to Canada was born in India. But in 2022, Canada’s exports totaled just over $450 million, and 87.2% of that was dried legumes (Table 2). Wheat made up another 8%.

Table 2: Top 10 ag and food exports (millions, $) to India between 2017 and 2022

Source: Canadian International Merchant Trade database

Of the four largest non-U.S. Pacific partners, India has the greatest potential to grow as an export market. Legume export dollars declined between 2017 and 2022, partly because of the strained relations and the highly variable weather conditions affecting India’s domestic legume production.

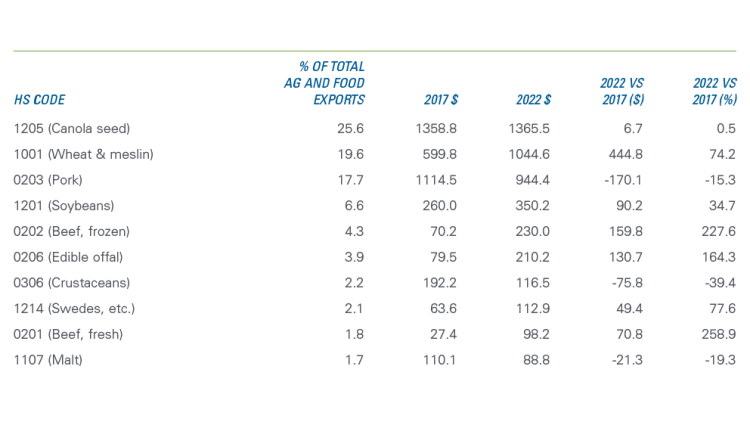

Japan has a 50/50 split between food and ag exports

Japan is the only other G7 country in the region and is one of Canada’s top export markets for food and agriculture. Their small land base and population of 125.7 million mean the country’s a net importer of food and ag.

With their 2021 GDP of $6.2 trillion, Japan ranks in the top 3 export markets for five of Canada’s top 10 ag and food exports. These exports totaled over $5.3 billion in 2022. Canola seed exports accounted for just over one-quarter of Canada’s total exports, with wheat making up 20% and soybeans another 7% (Table 3). Food exports comprise nearly half of Canadian food and ag exports, with pork leading the way (18% of total exports) and beef (frozen, fresh and chilled) accounting for 6.4% of total exports.

Table 3: Top 10 ag and food exports (millions, $) to Japan between 2017 and 2022

Source: Canadian International Merchant Trade database

The last five-year period saw pork exports to Japan decline in value, but beef export values increased significantly: frozen beef grew from $70 million to $230 million, and fresh/chilled beef rose from $64 million to $113 million. There’s room to grow here, too: as a member of the CPTPP, Japan will provide preferential access to Canadian exporters. A separate bilateral economic partnership agreement between Canada and Japan is currently in negotiations.

South Korea a growing food market for Canadian exports

South Korea represents a growing and lucrative food export market for Canada. It’s the only major economy in the region that shares a signed free trade agreement already in force with Canada.

Each of Canada’s top 10 exports to South Korea grew in value between 2017 and 2022 – the only country of the four to do so (Table 4). Meat comprises the largest export category, with 33% of total exports (and 44% counting crustaceans). Frozen beef exports increased from $21.5 million in 2017 to $168 million in 2022, and pork exports grew more than 70% in the same period. Soybeans and wheat are the only ag commodities to make the top 10 list, accounting for 15% of total exports in 2022.

Table 4: Top 10 ag and food exports (millions, $) to South Korea between 2017 and 2022

Source: Canadian International Merchant Trade database

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.