Which Canadian Ag sectors are the most exposed to U.S. tariffs?

American tariffs on Canadian exports, which the White House had signaled would be implemented this week, have been delayed to March. The only positive from this one-month reprieve is the extra time it gives businesses to prepare for upcoming challenges. As we pointed out recently, the impacts of tariffs, while tricky to gauge, are unambiguously negative for the economy. How bad things get will depend largely on the duration of the trade war.

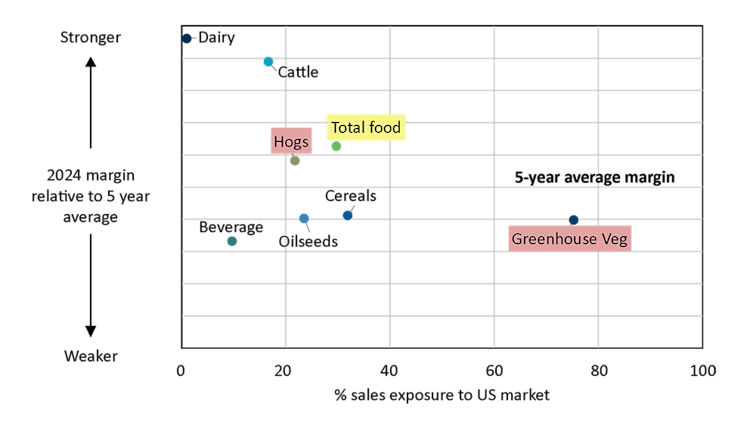

We decided to find out which industries, in the agriculture and food sectors, would be the most vulnerable to a trade war. There are at least two elements to consider here: 1) sales exposure to the U.S. and 2) the sector’s financial situation. Sectors with high sales exposure to the U.S. and who are struggling financially, are arguably the most vulnerable to tariffs.

To gauge exposure for each sector, we calculated the share of total sales that goes to the U.S. And to assess a sector’s financial situation, we looked at last year’s margins and compared that to the prior five-year average. Figure 1 below summarizes the impacts and highlights sectors to watch indicated by either a red or yellow shading.

The greenhouse vegetable sector, for example, is highly reliant on the U.S. market and the sector is coming off a year of weaker margins. This puts the sector in a vulnerable position to absorb any trade shocks.

For the food manufacturing sector, roughly 30% of sales goes to the U.S. in the form of exports. This is significant but within that sector, some sub-sectors have even larger exposures. For instance, fruit/vegetable preserving and specialty food manufacturing is at the highest risk, the sector relying on the U.S. market for almost half of sales, while also struggling with negative margins in recent years. Seafood product and preparation is also in a vulnerable position as margins are tight, while sugar and confectionery is highly vulnerable because the U.S. accounts for over 80% of its sales.

Looking at livestock, hogs are particularly vulnerable given the high exposure to the U.S. and the fact that the sector, despite stronger margins than the previous 5-year average, is coming off multiple years of negative margins, hindering its ability to absorb any impacts to prices or expenses.

Cattle producers are in a better position than others to weather the tariff storm thanks to solid profitability of recent years, particularly for cow-calf (which is shown as “cattle” in the chart below). But one can expect feedlots to have tighter margins and therefore would be more at risk from tariffs.

Figure 1: Sector exposure to U.S. trade relative to margins exiting 2024

Note: Sectors highlighted in red indicate high concern and yellow a moderate concern.

Source: FCC Calculations

Amanda Norris, Senior Economist

Justin Shepherd, Senior Economist