Canola meal, oil and seed: a look at profitability across the supply chain

A strong domestic processing industry is one of the reasons canola prices have not declined sharply under current market access constraints. Margins for canola crushers are expected to improve in 2019 with lower export demand leading to weaker producer prices while demand for canola oil and canola meals remains strong.

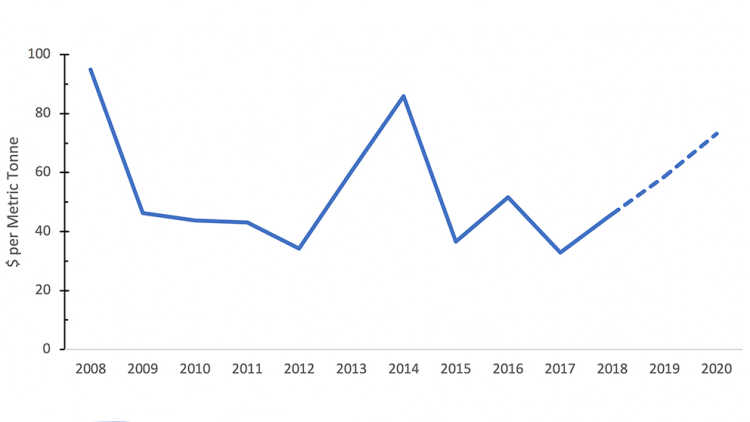

Canola crusher margins projected higher in 2019-20

Strong domestic and export demands for canola oil coupled with continued market access for canola meal have been supportive of canola crush margins (figure 1). Through the first three months of 2019, canola oil prices have averaged $1,000/tonne, 2.0% higher than 2018. Meal prices have averaged $356/tonne, a 3.5% decline.

Crush margins look to be improving through the remainder of 2019-20 due to:

increasing global demand for oilseed meal

market access constraints for Canadian canola seed exports to China

The November 2019 futures contract price for canola is currently $470/tonne, roughly 8% lower than the 2018 average producer price and 2% lower than November 2018 assuming a $35 basis. Yet, uncertainty around the overall canola supply for 2019 provide some upside for prices. Expectations of lower producer prices have shifted seeded acres away from canola. AAFC estimates that canola seeded acres declined 6.6% in 2019 as compared to 2018. Dry conditions across many parts of Western Canada must be monitored. While early, potential for below-average yields and reduced harvested acres could further reduce domestic supply.

Figure 1. Strong demand for canola oil and meal strengthen canola crush margins

Sources: Canola Council of Canada and ICE Futures U.S.

Canola crushing important to Canada’s agriculture and agri-food industry

Over the past 10 years, Canadian canola crushers have on average processed 43% of domestic production as crusher capacity has expanded at a similar pace than production. Canola demand from crushers has more than doubled from 4.14 Million Metric Tonnes (MMT) in 2009 to 9.27 MMT in 2018, a 124% increase.

This has contributed to robust growth in canola production and Canada’s food manufacturing sector. Over the past 10 years, GDP for grain and oilseed milling has expanded at an average annual rate of 5.3% compared to average growth of 2.2% for food manufacturing and 1.8% for the overall Canadian economy.

The investment in Canada’s canola crushing industry has been a strong pillar of food manufacturing growth. It is supportive of the entire supply chain, from primary producers to consumers.

Craig Klemmer

Principal Economist

Craig joined FCC in 2009 as an Agricultural Economist, specializing in monitoring and analyzing the macroeconomic environment, modelling industry health, and providing industry risk analysis. Prior to FCC, he worked in the livestock branch of the Saskatchewan Ministry of Agriculture. Craig holds a Master of Agricultural Economics degree from the University of Saskatchewan.