Crop sharing an alternative to high priced farmland

Farmland values at mid-year continued to trend higher even amid tight profitability. While farmland value appreciation rates are slowing, affordability continues to deteriorate. For many operations looking to grow including young farmers, indigenous producers and new entrants to Canada the cost of purchasing land is prohibitive. The cash flow difference to rent compared to purchasing has been historically more attractive, and less risky.

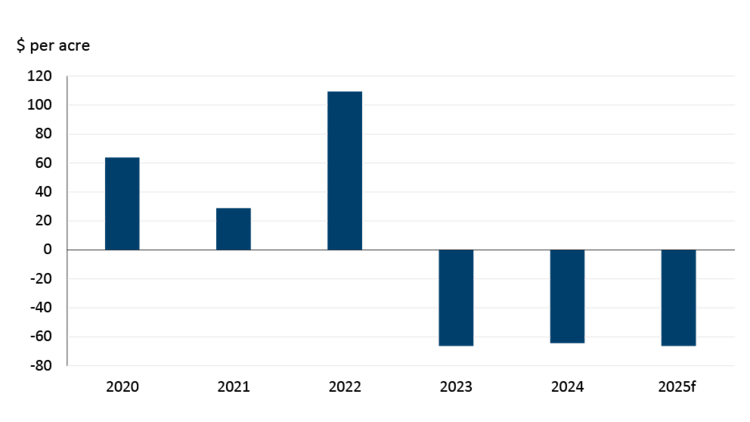

It’s not only the high cost of farmland impacting young farmers’ ability to grow their land base. Strong competition in the rental market has also elevated rental rates. Moreover, lower grain and oilseed prices and elevated input costs imply 2025 could be the third consecutive year of negative margins accounting for all variable and fixed costs under a cash rent arrangement in Saskatchewan (Figure 1).

Figure 1: Saskatchewan farmer returns cash rent canola-wheat rotation

Sources: Statistics Canada, FCC calculations

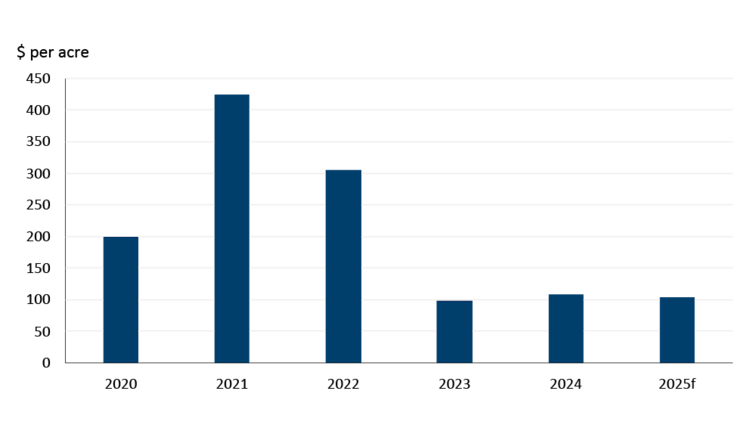

In Ontario, 2025 projections show that it will be the third year of reduced profits for a corn-soybean rotation under a cash rent agreement (Figure 2). While returns on average will vary depending on individual producer land costs, including land that was either recently purchased or is rented, it appears next year will be another lean year.

Figure 2: Ontario farmer returns cash rent corn-soybean rotation

Sources: Statistics Canada, FCC calculations

As a result, farmers will be exploring cost control measures due to declining profitability, including cash rents. The fall months are typically the time of year when rental agreements are renewed. However, farm rents are typically sticky to adjust downward. Landlords might be reluctant to lower rents because farmland values are still trending higher. Also, the rent cuts needed to improve margins could be significant, making landlords hesitant to agree to them.

This is where exploring crop share leasing comes in as it can reduce downside risks in a tighter margin environment. Crop share leases better reflect both revenue and costs of production. Because farmland is becoming less affordable and profit margins shrinking, we decided to review the returns from a crop share lease agreement.

Crop share leases are traditionally based on a one-third/two-thirds or one-quarter/three-quarters split of the crop revenue between the landlord and the producer. Referred to as 2/3 or 3/4 crop share from producer viewpoint. The landlord contributes the land and the one-third or one-quarter of the crop inputs (e.g., seed, fertilizer, chemicals, crop insurance) while the producer supplies all the machinery, labour, and remaining inputs.

How do crop share returns compare?

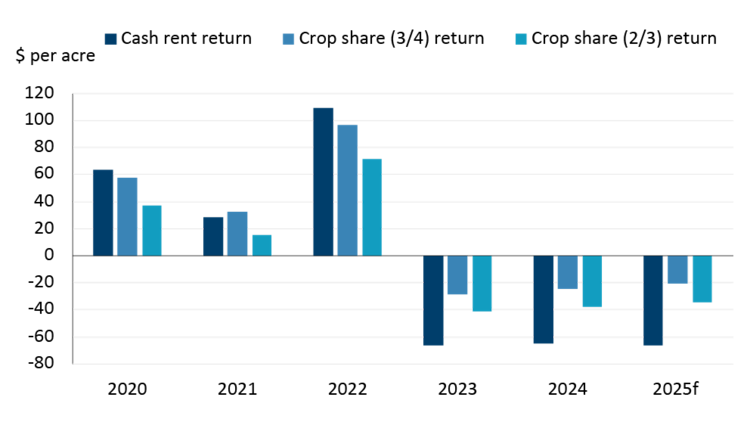

We simulated returns utilizing the traditional crop shares mentioned above. Overall, our results reveal returns really depend on the crop year and individual crop type. In Saskatchewan, the producer profitability under a cash rental agreement is higher during years of overall positive margins. In 2021, crop sharing on a 3/4 crop share basis resulted in improved margins. This was because, despite negative returns on wheat, stronger returns on canola led to higher overall cash rental returns compared to a 2/3 crop share lease. Overall, during years when the profitability is negative crop sharing results in reduced losses (Figure 3).

Figure 3: Crop share versus cash rent Saskatchewan farmer returns

Source: FCC calculations

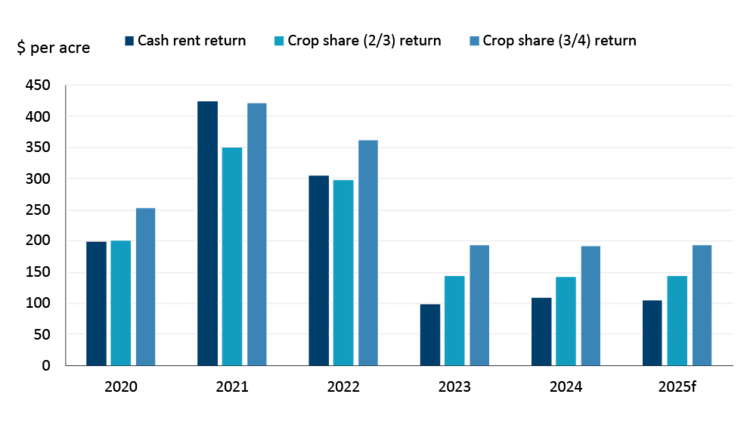

In our Ontario simulation, the 3/4 crop share usually gave the highest return, except in 2021, where cash rent was slightly better (Figure 4). A 2/3 crop share agreement improved returns during times of tighter profitability, like the last two years (2023-2024) and the upcoming year. We found that crop sharing was more beneficial when returns were close to negative in Saskatchewan, while in Ontario, it was more advantageous when returns were positive but tight. This difference is due to high land costs relative to total costs.

Figure 4: Crop share versus cash rent Ontario farmer returns

Source: FCC calculations

Risk mitigation and preserve cashflow

As shown above, farm losses are still possible under a crop share lease agreement. However, under a crop share arrangement, in the Saskatchewan example, losses can be mitigated on average by 40%. When farmers experience ongoing cash losses and multiple years of negative margins, it can significantly affect their cash flow. This compounding impact can make it harder for them to cover operating costs or meet debt obligations. For young farmers starting out, the downside risk of negative margins occurring early in their operation is of more concern. Older farmers with strong balance sheets and sufficient cash flow are likely to weather lean profit margins better.

Why would landlords share in farm losses?

Landlords might be open to sharing in farm losses for several reasons. They may want to build strong, long-term relationships with farmers, ensuring mutual success over time. They have a vested interest in their tenants’ long-term success. Landowners may have more input into the land management decisions to maintain the long-term sustainability of the land. By sharing the downside risk during lean years, landlords can also benefit during boom years. In certain situations, landlords (e.g. retiring farmer) may be able to retain their farming status for tax purposes. Over time, crop share leases could be structured to average out to be equal to cash rents.

Tight supply expected to keep farmland elevated

The supply of farmland is expected to remain tight even as the average age of farmers trends higher. With advancements in technology, more farmers will continue to farm into older ages. Even when farmers retire, not all land is listed for sale. The retiring farmer may stop farming the land themselves but, for personal reasons, might not want to sell the farm. This limited availability of farmland for sale has been and will continue to be a crucial driver of farmland values.

What does all this mean, and how is it related to crop sharing? Some retiring farmers would love to continue farming in some form and remain connected to the land. They would be in an ideal position to partner with young producers looking to expand their acreage.

Bottom line

Our projections are currently tracking tight to negative margins for 2025. If realized this will be the third year in a row of losses for most Canadian grain and oilseed producers. Crop share leasing shouldn’t be overlooked as an option. While all farms could benefit from reducing cash flow impacts during years of tight margins, young farmers likely have the most to gain. Furthermore, crop sharing offers a viable alternative to high priced farmland for young farmers, allowing them to lease land from established farmers or landowners. Both farmers and landowners can consider crop sharing in their broader strategies given such leases can help mitigate risks.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.