2021 farm cash receipts could reach a record high

We feared the worst for the farm sector at the start of the pandemic, but 2020 ended on a positive note for Canadian agriculture. Statistics Canada’s estimates revealed Farm Cash Receipts (FCR) increased by 8.1% to $71.7 billion in 2020 (+5.7% excluding cannabis). Total crop receipts increased by 14.2% to $41.9 billion (+10.2% excluding cannabis). It was more difficult in the livestock sector as receipts declined 0.8% to $26.4 billion. FCR were up for chicken (0.8%), hogs (1.5%), and dairy (1.9%) but down for cattle (-4.9%) and turkey (-4.2%).

Our 2021 FCR forecasts outline a positive outlook for revenues in Canadian agriculture along with a few risks and headwinds in some sectors.

Strong prices to lift receipts for grains, oilseeds and pulses

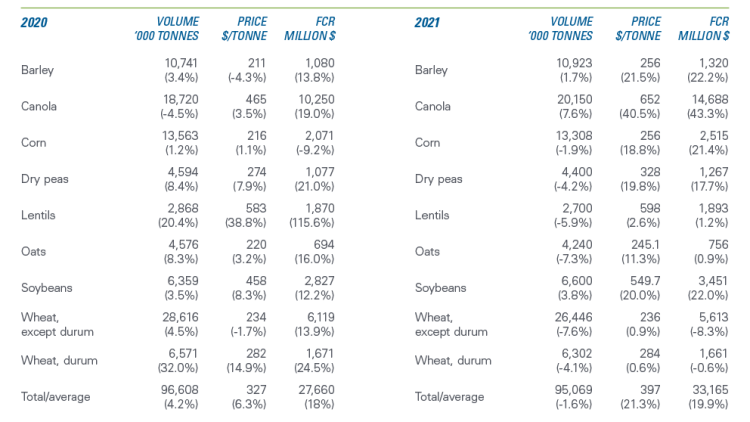

Table 1 presents estimates of production volumes (crop-year basis) prices and FCR (calendar year basis) for Canada’s main crops. Production estimates from Agriculture and Agri-Food Canada point toward lower production in 2021 for most crops except for barley, canola and soybeans, for which acreages are expected to increase. Futures signal strong prices for 2021, although they should decline following the harvest of the new crop.

We expect total FCR for the selected crops to grow an impressive 20% in 2021, driven by high crop price forecasts. But there exists downside price risk. Crop prices have been volatile lately and supported by strong import demand from China, which should not be taken for granted in today’s geopolitical climate.

Table 1: 2021 FCR forecasts for selected crops

Notes: Production estimates from Agriculture and Agri-Food Canada March Outlook for Principal Field Crops are measured on a crop-year basis. Prices for 2020 are calculated from Statistics Canada table 32-10-0077. FCR for 2020 are from Statistics Canada table 32-10-0046. Prices and FCR for 2021 are FCC forecasts.

Challenging year ahead for the cattle industry

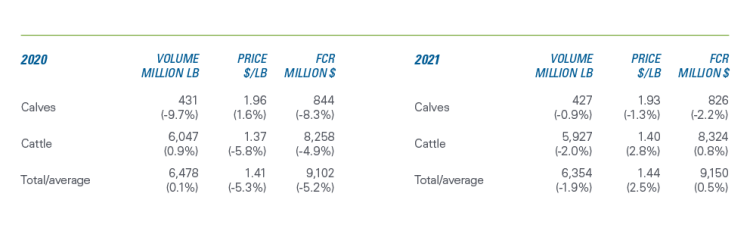

With demand depressed because of restaurant closures and backlogs created by temporary closures of packinghouses, 2020 was brutal to cattle producers. Market signals point toward receipts moving sideways in 2021 (Table 2).

As of January 1, the number of beef cow was down 0.4% year-over-year, and the number of calves under 1 year was down 1% year-over-year. Cattle weights were up in 2020, but we expect a return toward more normal weights in 2021. Taking these data into consideration, we forecast small declines in the volume of calves and cattle marketed in 2021. Futures do not point toward a price recovery in 2021. Overall, we forecast total receipts for the cattle industry to stay near their 2020 level.

Table 2: 2021 FCR forecasts for calves and cattle

Notes: Prices for 2020 are calculated from Statistics Canada table 32-10-0077. FCR for 2020 are from Statistics Canada table 32-10-0046. Prices and FCR for 2021 are FCC forecasts. Volumes are calculated by FCC from the values for FCR and prices.

Strong 2021 hog receipts with some downside risk

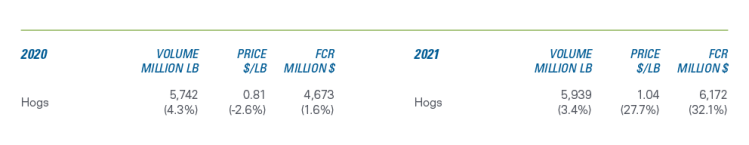

There were a lot of ups and downs in 2020 for hog producers, with demand from restaurant dipping, exports to China growing and temporary closures of packinghouses. 2021 is set to be a lot better to hog producers from a revenue standpoint (Table 3).

January 1st total hog inventory and the size of the breeding stock declined marginally from last year. Nonetheless, we expect strong prices to support a 3.4% growth in production. Driven by the demand for belly meat, hog prices have been on the rise since the beginning of the year. We forecast an average hog price 27.7% higher than in 2020. In total, we forecast hog receipts to increase by 32% to a record $6.2B. This forecast comes with the downside risk that China could reduce its pork imports, lowering hog prices in North America.

Table 3: 2021 FCR forecasts for hogs

Notes: Prices for 2020 are calculated from Statistics Canada table 32-10-0077. FCR for 2020 are from Statistics Canada table 32-10-0046. Prices and FCR for 2021 are FCC forecasts. Volumes are calculated by FCC from the values for FCR and prices.

Dairy receipts continue to grow

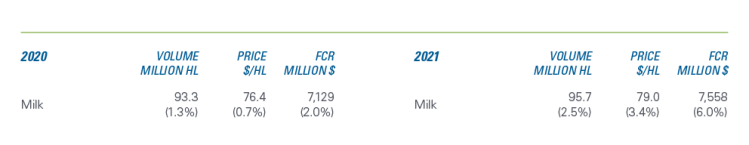

The dairy industry fared well in 2020 despite the pandemic shock that forced production cuts. Receipts grew by 2% from a 1.3% growth in volume and 0.7% increase in the farm price.

The outlook for 2021 is promising as the demand for milk remains strong. We forecast receipts to grow by 6% in 2021 – a rather strong growth rate for the dairy sector. It comes from expectations that growth in 2021 will continue along the trend set in recent years.

Table 4: 2021 FCR forecasts for dairy

Notes: Prices for 2020 are calculated from Statistics Canada table 32-10-0077. Volume for 2020 are from Statistics Canada table 32-10-0113. FCR for 2020 are from Statistics Canada table 32-10-0046. Values for 2021 are FCC forecasts.

What to watch for the rest of 2021?

The forecasts above reflect current market conditions and expectations for the rest of the year. Of the many variables that can impact FCR for the rest of 2021, the Canada-US exchange rate deserves particular attention as it is currently at a two-year high. The continued strength of the Canadian dollar could weaken FCR prospects for 2021.

Article by: Sébastien Pouliot, Principal Economist