Exploring farmland affordability trends through crop revenues

Demand for Canadian farmland was strong in 2021 as low interest rates and high commodity prices offset supply chain and weather disruptions’ influence on farm income. With the supply of available farmland for sale remaining tight, average farmland values increased 8.3%.

This post investigates land affordability by comparing annual land payments against gross revenue generated by different crop rotations in Ontario and Saskatchewan. While the general long-term directional trend for the two provinces is correlated, there are significant annual differences in affordability.

Calculating farmland annual payments

Most farmland is purchased with a combination of equity and debt. And the affordability of farmland is a matter of land prices, financing costs and farm revenues.

Consider a new land purchase with a down payment of 25% and a loan amortized over 25 years. To determine the farmland annual payment, we’ll use the effective average business interest rate (a weighted-average of market interest rates), which averaged 2.3% in 2021, down from 2.7% in 2020. The formula for determining the farmland annual payment is:

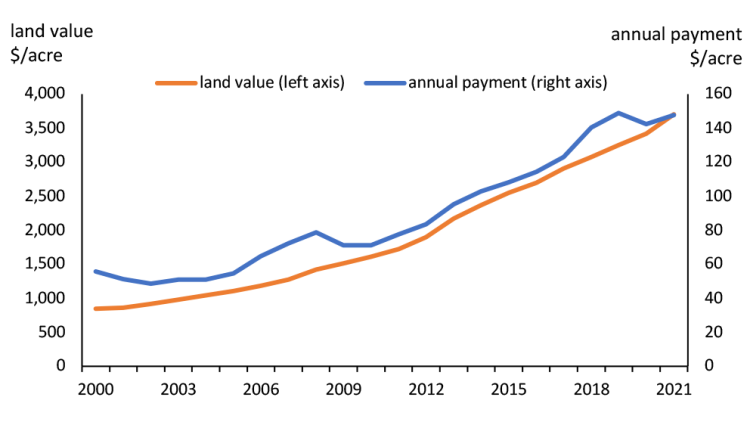

Farmland values and annual payments tend to evolve at the same pace (Figure 1). Over the past 10 years, farmland values have increased on average 7.9% per year, while average annual payments have increased 6.6% per year. The influence of rising land values in 2021 on annual payments was moderated somewhat by declining interest rates.

In our scenario, average Canadian annual payments per acre increased 3.8% to $148/acre in 2021, while farmland values per acre increased 8.3%. Interestingly, the annual payment per acre in 2021 was just below its highest value recorded in 2019; however, farmland values are $450 per acre higher.

Figure 1. Canadian average farmland values vs. average annual payment

Source: FCC Calculations

Crop revenues to measure farmland affordability

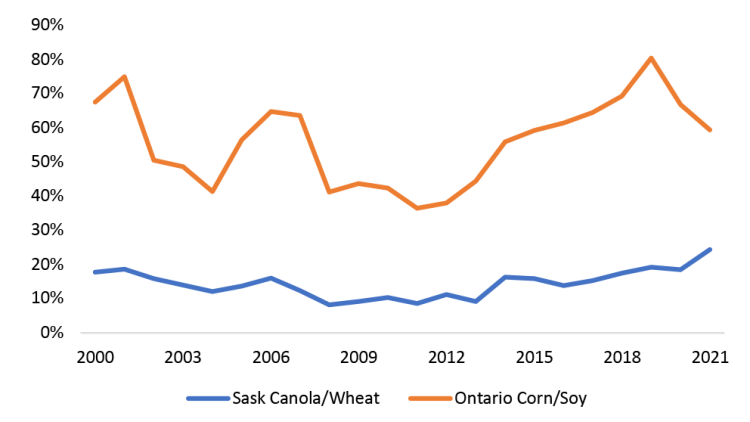

Average provincial yields and prices can yield an estimate of gross revenues for a corn-soybean rotation in Ontario and a canola-wheat rotation in Saskatchewan, which subsequently can be compared against an average annual payment for farmland.

Figure 2. Annual land payments as a percentage of gross crop revenue

Source: FCC Calculations

Saskatchewan farmland values are driven predominately by grain crop revenues. In 2021, this affordability ratio reached 24%, partially due to low crop yields, but land payments were up as well. Saskatchewan’s long-term average is 14% but has not been below that since 2013. Outside of 2021, gross crop revenue has stayed relatively high since 2013, but farmland has just appreciated at a faster rate. As a result, land is at the most expensive point in time in recent history when measured in terms of crop revenues.

Ontario affordability, on the other hand, has improved from the peak in 2019, with annual land payments now representing 60% of the gross revenue generated from a corn-soybean rotation. This is in line with the average since 2000 of 56%. Ontario agriculture is diversified across many enterprise types, including horticulture and livestock sectors that compete for farmland. This diversity makes it hazardous to compare the affordability ratios across provinces.

Ontario historically has significant volatility, with land payments accounting from a low of 37% to a high of 81% of annual corn and soybean revenues. In Saskatchewan, farmland values have been outpacing increases in canola and wheat revenues, leading to a decline in affordability, but there is less volatility per year.

What to watch for in the 2022 farmland market

After 2021’s historic low interest rates, interest rates are forecast to rise in 2022 as the Bank of Canada fights off inflation. Rising interest rates will increase annual land payments. Market volatility for commodity prices and high farm input prices are creating uncertainty for net farm income. Understanding the influence of various interest rates and farm income scenarios on farmland payments is an essential component of a solid financial risk management plan.

Justin Shepherd

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.