Food processing outlook clouded by uncertainty

The agri-food supply chain is very resilient, but not immune to economic cycles that shift food demand and introduce higher costs. The COVID-19 pandemic will bring a severe recession, and introduce permanent transformations in the supply chain and significant variability in profitability trends of food processors.

Food manufacturing was thriving prior to COVID-19

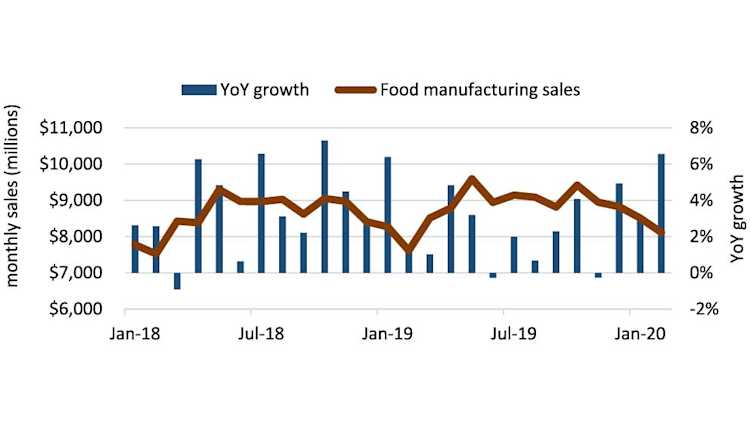

Patterns in food manufacturing sales leading up to the current recession show a healthy food processing sector as year-over-year (YoY) growth in monthly manufacturing sales was mostly positive (Figure 1). Aggregating data at that level can however hide some important trends across different sectors. For example, sales for the bakery, meat or fruit and vegetable preserving sectors have been growing but at a slower pace in the last twelve months.

Figure 1. YoY growth and dollar volume in monthly food processing sales, January 2018 - February 2020

Source: Statistics Canada

We expect food manufacturing sales in March to trend upward. But beyond this short-term horizon, projections are fuzzy. The following trends matter.

1. A new normal for food consumption?

There have been several changes in food consumption patterns:

Consumers were stocking up or pantry loading at the beginning of the crisis.

Food away from home normally accounts for roughly 30% of overall spending. A massive shift towards food at home occurred with food service establishments closing.

Lower household income leads to higher consumption of food products that are deemed “inferior” by economists. Ramen noodles are a good example. The opposite is also true – demand for high-quality and expensive food items is weaker.

Local foods are increasingly on the radar of consumers.

Perceptions of tighter product availability in the future could lead consumers to stock up once again. Food demand in food service establishments will take some time to rebound as confinement measures are gradually lifted and social distancing imposed.

2. Production disruptions weigh on the food supply chain

Some food processors have had to shut down operations as their workforce dealt with COVID-19. Others have seen their costs go up as they raised worker wages and implemented social distancing within their plants. Labour availability is obviously a concern, not only in food processing, but for trucking and seasonal farm production.

Redesigning production processes to supply grocery stores as opposed to food service establishments involves redeploying equipment and other capital. It leads to higher costs which can be passed through at the retail level. That can further change consumption patterns.

3. Logistical challenges cloud demand from foreign export markets

Countries all around the world face different challenges in the food supply chain. Markets that buy food from us may find it difficult to deliver food to their consumers’ purchase points. Foreign demand may also simply be weaker overall because lower income in emerging markets lowers food consumption. Efficient global supply chains are essential for processors to access some inputs that are manufactured overseas.

One unknown is the extent to which the current crisis fuels and supports calls for protectionism that were present even before the pandemic. A lot is at stake. Processed food exports totalled $37.5B in 2019, with a positive trade balance of $8.3B.

Canada’s food supply is showing resilience and adaptability

We should see a shift in the mix of food products being available as supply chains are being redesigned to account for the COVID-19 challenges. Our food supply chain is very resilient, but this crisis is testing its adaptability.

Let’s take a moment to express how grateful we are to all the people working across the food supply chain, from input suppliers, to farmers, to processors, transportation, distributors, and retailers. We are very fortunate to have hard-working individuals providing food to Canadians.

Jean-Philippe (J.P.) Gervais

Executive Vice President, Strategy and Impact and Chief Economist

J.P. Gervais is Executive Vice President, Strategy and Impact and Chief Economist at FCC. His insights help guide FCC strategy, monitor risks and identify opportunities in the economic environment. In addition to acting as an FCC spokesperson on economic matters, J.P. provides commentary on the agriculture and food industry through videos and the FCC Economics blog.

Prior to joining FCC in 2010, J.P. was a professor of agricultural economics at North Carolina State University and Laval University. J.P. is a Fellow of the Canadian Agricultural Economics Society. He obtained his PhD in economics from Iowa State University in 1999.