Growth opportunities for Canadian agri-food in the ASEAN market

As Canada looks to further diversify export markets and reduce the marketing risk that comes from an overreliance on the U.S., Asia looms large. China and India are Asian markets that have not been fully tapped yet but ongoing geopolitical tensions are making it difficult to develop more significant trade relations. Another option for Canadian exporters is Southeast Asia, a key area within the larger Indo-Pacific region. Canada’s exports there have grown across the three major categories of agriculture, food and fertiliser, but there’s even more growth that’s possible.

In this post, we identify some food products and ag commodities highlighted in recent research that are currently not reaching their export potential.

The ASEAN market is one of the world’s largest

The Association of Southeast Asian Nations (ASEAN) is a regional intergovernmental organization with 10 member states: Brunei Darussalam, Cambodia, Indonesia, Lao People’s Democratic Republic, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

It’s a region that, in 2023, had the third-largest population in the world at around 679 million - and it’s growing. If the ASEAN were one economy, it would be the fifth largest in the world with a combined nominal Gross Domestic Product (GDP) of US$3.8 trillion in 2023. ASEAN is one of the world’s fastest-growing economic regions, with real GDP projected by the IMF to grow 4.6% in 2024 and 4.7% next year.

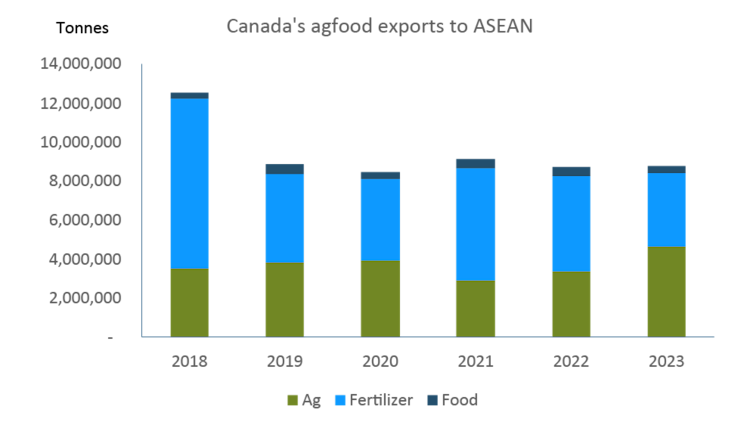

As a group of countries, the 10 member states of ASEAN represented Canada’s fourth-largest merchandise trading partner in 2023. The bulk of that trade is to the six largest countries within the region (Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam), for whom food exports are, by far, the smallest of the three export categories (Figure 1).

This replicates a trend found among Canada’s major export markets outside the U.S. Since 2018, food export volumes have nonetheless grown at an average annual rate of 8.1%, suggesting the market holds promise for further development. Existing growth has come so far without the aid of a trade agreement which, nonetheless, is in the works as of 2021. As an added focus, Canada’s broader, more encompassing Indo-Pacific Strategy (IPS) was launched in 2022, guiding Canada’s diplomatic, trade, defence, security, and development assistance approach to the region for the next decade and potentially boosting Canadian exports further.

Agriculture export volumes have also risen since 2018, growing at an average annual rate of 7.8%. The largest factor underlying the overall drop in our exports to the ASEAN region since 2018 is in the decline in fertilizer exports. Between 2018 and 2023, they fell at an average annual rate of 11.2%. By far the largest category of exports, they’ve been a major influence on our overall trade performance.

Figure 1: Historically, fertilizer tops the list of Canadian agrifood exports to ASEAN

Source: Canadian International Merchandise Trade

The falling volumes lie in stark contrast to fertilizer export values over the same time period. With noted, serious supply chain issues hampering global fertilizer trade during and just after COVID, per unit values of our fertilizer exports grew from $93/tonne in 2018 to a high of $486/tonne in 2022. In 2023, they scaled back to $216/tonne, a big YoY drop but still the highest values in the last six years.

Increased ASEAN appetite for agrifood imports

The region is one of the world’s most susceptible to impacts from climate change, sparking serious concerns about food security and sustainable agriculture. The principal challenge for ASEAN countries will be to guide the development of production practices that can accommodate extreme weather events, worsening climactic conditions and disease outbreaks. As the region works to manage the increasing frequency and strength of natural disasters and difficulties with transitioning to a low-carbon economy, there will be opportunities for Canada to grow its exports of R&D (new technology such as drought-resistance cultivars, etc.), and agriculture, fertilizer and food products and commodities.

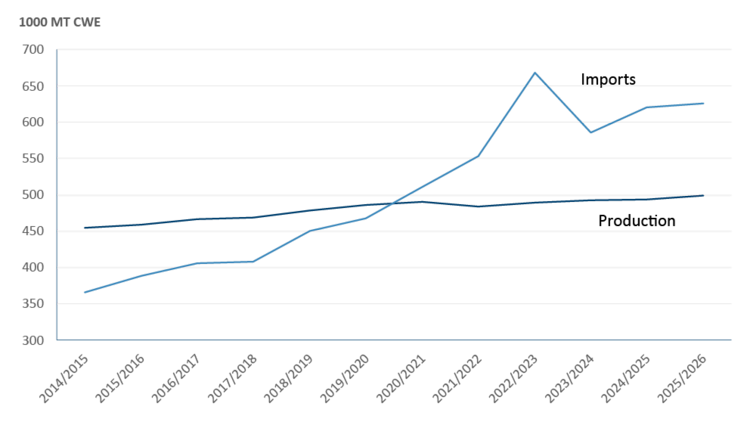

Westernized food options are also becoming more common in the region. Beef consumption (measured as a total of imports and production), for one, is on the rise (Figure 2) and, with limited capacity to produce enough cattle needed to meet that consumption, beef imports have become more important. For the 2025/26 marketing year, the USDA forecasts ASEAN imports totaling 626,000 metric tons (MT), an impressive 60% leap from 2015/16. Overall volumes are still small of course: for perspective, China is expected to import 3.8 million MT of beef in the same period. But, as with China, volumes are growing.

Figure 2: Growth of ASEAN beef/veal imports outpace growth of domestic production

Source: USDA PSD

As the ASEAN economies continue to develop, several sociocultural characteristics of the region serve as possible hurdles for Canadian exporters to overcome. Almost 90% of Indonesia is Muslim, which limits Canadian pork exports to that country. In fact, just over four in ten of the ASEAN population is Muslim (mostly Sunni), followed by Buddhism (18%) and Christianity (17%).

But pork remains an important source of animal protein. The good news for Canadian pork producers is that, during the pandemic, ASEAN production fell slightly while domestic consumption was stable. The USDA has forecasted both to grow over 2% in each of the following years. The impressive growth though lies in the region’s imports. The 2024/25 year’s imports are forecast by the USDA to grow 8.4% and the 2025/26 year's growth is expected to grow a further 3.2%.

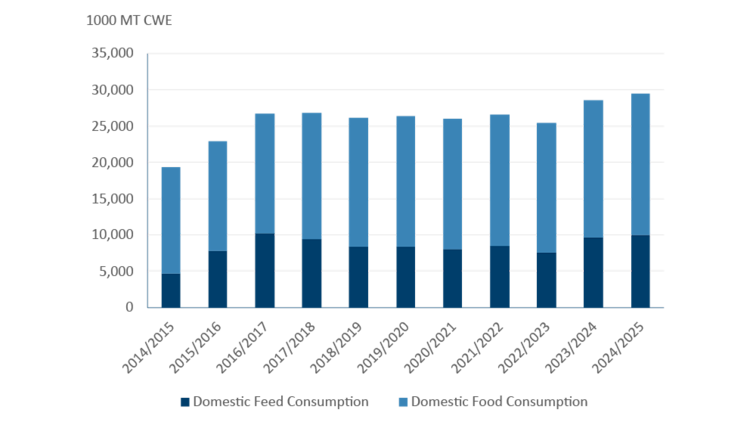

Rice is a food staple in Southeast Asia, as it is throughout the broader Asia. But wheat, Canada’s largest ag export, is another commodity that’s gaining traction in Asia (Figure 3). Overall consumption has grown at an average annual rate of 4.6% per year over the last decade, but within that, wheat consumption as feed has grown even faster (9.8% per year average). The solid growth in the use of wheat as feed suggests the growing importance of animal-based sources of protein in daily food consumption.

Figure 3: Growth of feed consumption as percentage of overall wheat consumption shows ASEAN focus on red meat sector

Source: USDA PSD

The potential is there for Canada to increase market share

There are measurable opportunities for Canada to increase its market share. According to the International Trade Centre (ITC), Canada is currently exporting below its potential to the ASEAN region. The ITC estimates “potential exports” as a function of supply capacities in Canada, demand conditions in the target market, and bilateral linkages between Canada and the target country. “Unrealized potential” can be simply the difference between potential and actual exports, but it can also reflect gaps in individual countries’ demand for goods not captured in the measure of potential for the entire region. Thus, unrealized potential can be greater than the difference between potential and actual exports.

According to the ITC, Canada is currently underperforming in our exports of potassium chloride, a high-value commodity, to Indonesia, Malaysia, Thailand, Vietnam, and the Philippines. We are also exporting less wheat than we could have to Vietnam and the Philippines, and lower volumes of swine cuts to countries like Singapore and Vietnam. The table below shows the top 15 agrifood products for which Canada has unrealized export potential to the ASEAN region – cumulatively amounts to $1.6 billion.

Table 1: Top 15 products for which Canada has unrealized export potential to ASEAN countries

Unrealized potential ($, millions) | |

Potassium chloride as fertilizer | 1046.1 |

Wheat | 163.0 |

Potatoes, fresh/prepared/preserved/frozen | 117.2 |

Live bovine animals | 73.8 |

Frozen crabs | 51.5 |

Rapeseed oil | 51.0 |

Swine cuts frozen | 35.3 |

Oilcake of soy bean oil | 28.7 |

Corn | 21.0 |

Bovine,sheep and goat fats | 19.0 |

Pig & poultry fat | 14.0 |

Bovine cut frozen | 12.0 |

Peas | 7.7 |

Food preparations | 7.6 |

Swine offal frozen | 3.3 |

Sources: International Trade Centre, FCC calculations

Bottom line

Amid geopolitical uncertainties that threaten to derail global trade, Canadian exporters would do well to consider their marketing efforts in the growing ASEAN market. There are opportunities to capitalize on the region’s increasing appetite for agrifood products and commodities, particularly in countries where our exports are below what they could be. As we showed in this report, there is indeed more than $1.6 billion of unrealized export potential.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.