Labour market challenges to persist amid recent progress

Labour availability remains a significant economic issue across all regions and industries in Canada. Shortages can slow productivity gains, limit growth opportunities and sustain inflationary pressures. And the imbalances between labour demand and supply are particularly acute in the agri-food supply chain. Here’s a look at the recent trends in the labour market and a revisit of our long-term assessment of future labour supply and demand in the agrifood industry published in 2022.

Short-term outlook for labour shortages is improving

The Canadian population growth rate in 2022 was the highest in 65 years (+1,050,110; +2.7%), mostly driven by international immigration. This influx of people has contributed to alleviating labour shortages. A few indicators suggest the Canadian labour market remained on solid footing in the first half of 2023. Job vacancies are the number of vacant or unfilled positions an employer is looking to hire, usually reported at the end of the month. Job vacancies declined to the lowest level observed since the second quarter of 2021, the fourth consecutive drop. Year-over-year and adjusted for seasonality, both job vacancies (-210,690; -21.3%) and job vacancy rate (-1.2 p.p.) declined, while the number of payroll jobs increased (+509,355; +3.1%). The recent decline in job openings and the rising jobless rate suggest labour market tightness is diminishing.

Job vacancies and vacancy rates declined year-over-year in the agriculture and food processing sectors. Payroll jobs recorded a decrease (-6,225; -2.7%) in the agriculture industry, while the food processing sector registered an increase of 2.2% (+5,655 jobs).

Projected gap between labour supply and demand continues to narrow

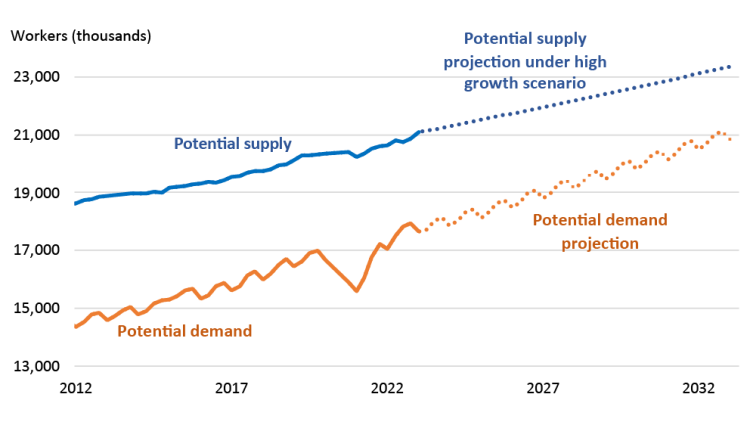

The long-term labour market outlook rests on labour supply and demand projections. Labour supply projections come from a 2019 Statistics Canada study and haven’t been updated relative to our 2022 analysis published. Yet, we know that population growth is accelerating, and chose to focus on the high labour supply growth scenario reported by Statistics Canada (Figure 1), which aligns with the recent annual increase in the Canadian labour force.

Labour demand projections were computed as a function of the annual growth in Gross Domestic Product (GDP). The updated long-term projections illustrate a shrinking gap between potential labour supply and demand. It suggests that any labour market tightness will continue yet may not be as significant as projected last year under a strong population growth scenario.

Figure 1: Changes in potential labour supply and demand in Canada

Sources: Statistics Canada and FCC calculations

The inverse relationship between the ratio of potential labour supply to potential labour demand and the vacancy rate can be leveraged to evaluate the extent of future labour shortages. As the ratio decreases, labour supply becomes less available relative to labour demand and thus leads to higher job vacancies and vacancy rates. Conversely, an increase in the ratio would suggest an expansion in labour supply relative to demand, leading to fewer vacancies.

The projections suggest that the ratio of potential supply and demand will decline from 2022 to 2031, largely due to the influence of economic growth on labour demand surpassing the influence of the scenario of strong growth in labour supply. Labour challenges are expected to persist as Canadian employers compete for a limited number of skilled workers.

Agri-food industry staring at a tight labour market

There’s been a steady decline in agricultural labour since the early sixties because of technology. However, a rising global population and rising incomes drive food production growth. Thus, labour demand in the agriculture and food processing sectors is expected to reflect the growing global food production needs.

We project that the average vacancy rate for the entire economy will climb from 4.7% in 2021 to 5.8% in 2031 (Table 1). The trend in the food processing and agriculture sectors is identical but doesn’t jump up nearly as much because average vacancy rates were already elevated. The average vacancy rate goes from 5.4% in 2021 to 5.5% in 2031 for food processing and from 4.7% to 5.0% for agriculture.

Our most recent projections point to a tighter labour market in food processing relative to projections made a year ago (numbers between parentheses in Table 1). Conversely, the labour market in agriculture is projected to be less tight as the average vacancy rate in 2026 and 2031 is now forecast at a lower level (4.8% relative to 5.6% for 2026 and 5.0% relative to 6.3% in 2031).

Table 1: Vacancy rates related to potential labour demand and supply under high population growth scenario

Sources: Statistics Canada and FCC calculations

Bottom line

Labour challenges are going to persist. And any improvement suggested by these projections is conditional on high population growth and a sustained pace of automation in the industry.

The labour shortage in Canada requires a multiprong strategy and innovative solutions for a sustainable and prosperous future of the agri-food industry. Sustained and skilled immigration and automation on the farm and within food processing plants are two solutions to boost productivity gains and ease pressures in the labour market. Investing in education and training programs and enhancing working conditions to attract and retain skilled workers are worthwhile avenues to explore.

Senior Economist

Isaac Kwarteng is a Senior Economist at FCC, focusing on long-term economic research and forecasting to support strategy and risk. He also supports the CEO’s office with information and data requests.

Isaac joined FCC in 2023 from the Government of Saskatchewan, where he worked for a decade in economic, research and statistical roles.

Isaac received his master’s degree in economics from the University of East Anglia in the UK. He also has a master’s degree in statistics from the University of Regina and is currently enrolled in the Ph.D. program.