Navigating uncertainty for the food sector

COVID-19 has created unprecedented disruptions globally as governments were forced to close portions of the economy and restrict business activities. Closures of manufacturing facilities and ports worldwide limited the movements of goods and reduced demand for commodities. We’re through three-quarters of 2020, and have more clarity on the economic impacts of COVID-19 for food manufacturing along with the risks for the current rebound.

Global recovery uncertain

Global cases of COVID-19 continue to rise. In some regions of the world, governments are dealing with the first wave of the disease while others, including Canada, are dealing with the second wave. As a result:

economic activity will be significantly lower in 2020

full economic recovery is unlikely to be completed by 2021

it could be into 2022 before the recovery takes hold

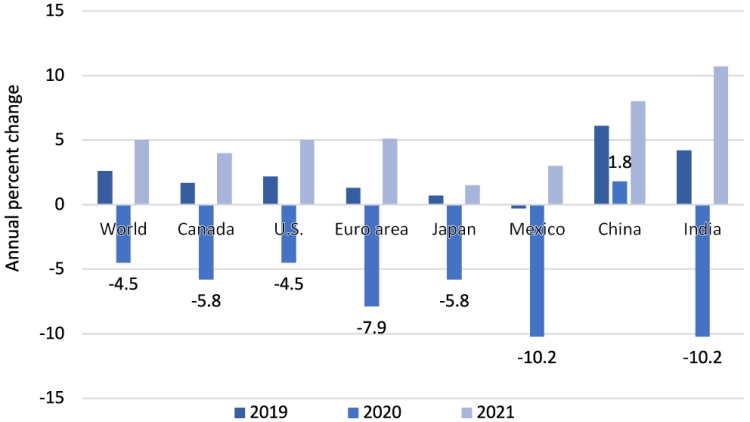

The September 2020 Economic Outlook of the Organization for Economic Co-operation and Development (OECD) suggests global GDP will decline by 4.5% in 2020 and increase by 5.0% in 2021. The global economic output recovered swiftly after the pandemic’s initial shock. However, the economy has lost momentum since then. As a result, the OECD forecasts suggest a hybrid L-shape/U-shape recovery where a sharp decline in GDP is followed by a slow recovery.

Figure 1: Global 2020 recession will be deep

Source: OECD September Economic Outlook.

Economic rebound on the horizon

Canadian economic growth will be dependent on our ability to control any future outbreaks and re-establish a healthy labour market. The OECD calls for Canadian GDP to decline by 5.8% in 2020. Significant government assistance has minimized the potential long-term negative impacts of the economic slowdown as initial forecasts projected a decline of 8.0% in 2020. Canadian GDP growth is projected at around 4.0% in 2021 as the recovery in industries like food service, entertainment and tourism will be slower.

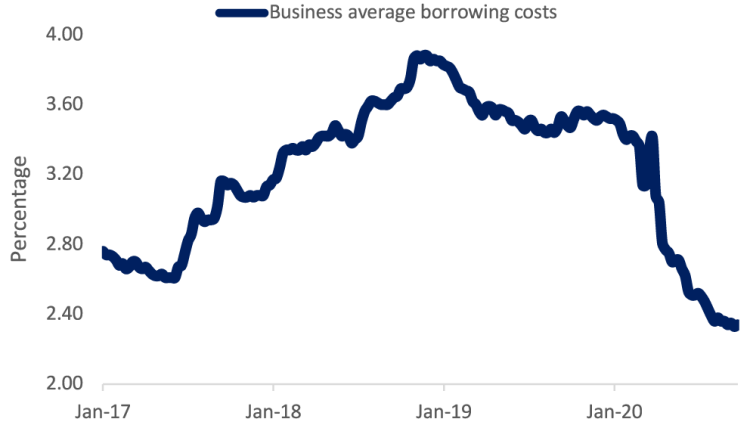

Figure 2: Interest rates to remain near historic lows

Source: Bank of Canada.

Interest rates in Canada and worldwide also plunged as central banks slashed rates to help protect economies from the economic downturn. In Canada, the overnight rate fell to 0.25%. The Bank of Canada was also more aggressive than its peers like the U.S. Federal Reserve and European Central Bank in injecting liquidities in the marketplace when measuring against the size of the economies. As a result, the average effective business interest rates declined from 3.36% at the end of February to 2.34% in late September. With both the Canadian and global economies expected to have a slow, drawn-out recovery, we expect the degree of monetary easing to remain in place for quite some time. It is unlikely that we will see any movement by the Bank of Canada until sometime in 2022 at the earliest.

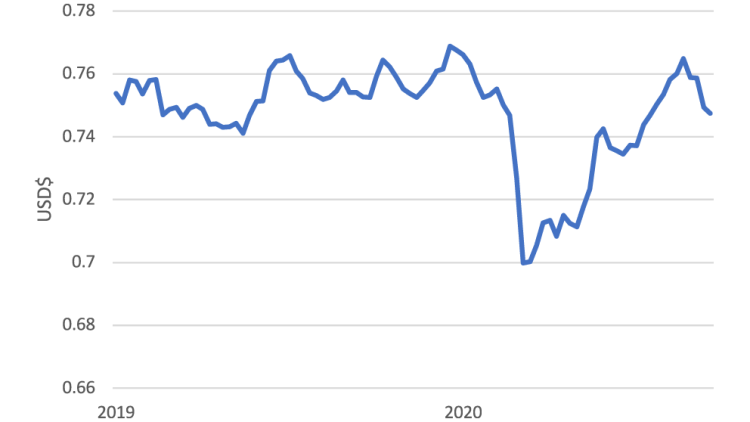

Canadian dollar to increase slightly and trend mostly sideways in 2021

With little movement in interest rates expected in 2021, the global economic recovery, demand for Canadian exports — notably resources — and risk tolerance of investors will determine the loonie’s value. As economic growth begins to take hold, expect to see investors moving away from “safe havens” such as the U.S. dollar and the Japanese yen into more commodity-driven currencies such as the Canadian dollar or the Australian dollar. Currently, the Canadian dollar is trading around 75 cents. We expect the Canadian dollar to fluctuate significantly over the next few months and into 2021, but to hover around 76 cents.

Figure 3: Volatility seen in 2020 could continue into 2021, hovering around 76 cents

Source: Bank of Canada.

Labour market is rebounding slowly

Household expenditures drive approximately 60% of the Canadian economy. Thus, a healthy labour market is essential to a strong Canadian economy. Before the pandemic, Canadian unemployment was very low (5.6% in December 2019). There was variability across provinces: Ontario and Quebec recorded an unemployment rate of 5.3% while lower commodity prices resulted in a 7.0% unemployment rate in Alberta. The tight labour market supported wage growth and consumer spending.

However, higher wages influence competitiveness. The average wage in food manufacturing has increased by 11.3% between 2014 and 2018. Total labour compensation has gone from representing 56% of output value to 64% in 2019. And the value of output per hour worked slightly declined. This raises serious questions around productivity at a time COVID-19 introduced many disruptions in the food supply chain. Labour costs have increased further as food manufacturers implemented social distancing within plants, procured PPE to employees and boosted pay to incentivize workers.

Table 1: Comparison of labour compensation and output in food manufacturing

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|

| Total labour compensation vs output | 56% | 57% | 59% | 60% | 60% | 64% |

| Total compensation per hour worked | $32.90 | $34.05 | $34.34 | $35.09 | $35.23 | $36.40 |

| Real output per hour worked | $58.36 | $60.12 | $58.42 | $58.64 | $58.65 | $56.96 |

Source: Statistics Canada.

August’s wage inflation within manufacturing was 6.1% vs last-year's increase of 4.2%. The number of those employed within Canadian manufacturing has increased since April’s decline of 17.7% but was still down 4.9% as of August, meaning the total cost of labour is up year-over-year with fewer employees on the books.

Canadian population growth has slowed, mostly due to border restrictions

Immigration accounted for more than 80% of the 1.1% population growth in Canada between July 2019 and July 2020. Border restrictions have already resulted in a weaker level of immigration.

More manufacturing jobs are filled by immigrants than in most industries (31.6% for food vs. 25.6% in all industries, according to the 2017 data). In an industry where the cost of labour has outpaced output growth since 2015, finding labour of all skills at a competitive price from a smaller labour pool might prove challenging. Passing on higher wages and costs to consumers may also be difficult in the current recessionary context.