Outlook for livestock feed input suppliers mixed

FCC Economics helps you make sense of the top economic trends and issues likely to affect your agribusiness in 2023.

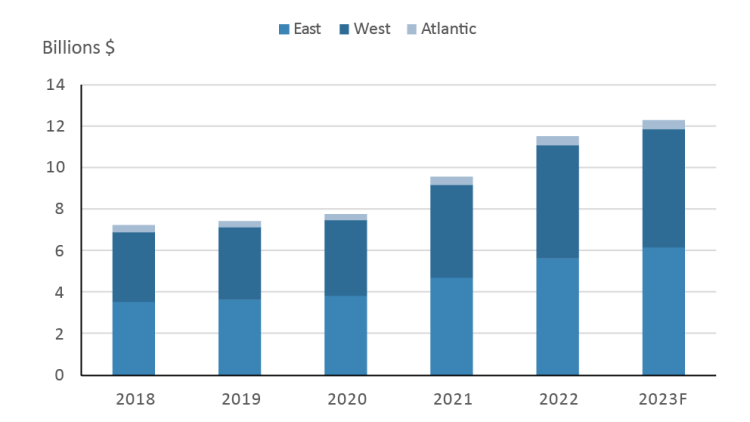

The Canadian commercial feed market (for example, pelleted rations for cattle, dairy, hog and poultry) grew over 20% in 2022, reaching a record $11.5 billion in sales. Most of this growth was driven by increases in feed grain prices stemming from Russia’s war against Ukraine. The livestock sector has faced numerous years of tight feed supplies and expensive feed grains. High feed costs have pressured profitability throughout the Canadian livestock industry, including feed mill operators, as volatile commodity prices negatively impacted their margins.

We are projecting the Canadian commercial feed market to grow 6.6% in 2023 to $12.3 billion, driven by strong livestock receipts and feed grain prices that remain historically high. The Eastern Canadian commercial feed market is expected to have the largest growth at over 9% in 2023 to $6.1 billion. Eastern Canadian growth is driven by its large dairy sector and an expanding poultry sector. In Western Canada, we are projecting a 4.0% increase in feed sales to $5.7 billion, largely due to drought conditions and the need to purchase feed. In Atlantic Canada, we are projecting a 7.6% increase in feed sales but recent flooding in Nova Scotia could change that projection.

Figure 1. Canadian commercial feed market sales

Sources: Statistics Canada and FCC calculations

Drought conditions have once again led to rising feed costs

Feed grain prices did trend down through the first half of 2023. However, drought conditions in North America have once again led to rising feed costs. Drought conditions have resulted in stressed pastures and reduced hay crops. Provincial crop insurance agencies in Western Canada have moved quickly to allow producers to move poor crops into alternative uses (for example, grazing or baling), which provides some relief to the drought-stricken livestock sector. Corn imports have also risen as the feedlot sector braces for tighter feed supplies as we head into the fall calf-run and winter 2024 feeding. Some cow-calf and feedlot operations have worked with their local feed mills to utilize screening rations with supplements to maintain herds and make up for poor pasture conditions.

The fall calf run has already begun in regions facing extreme drought conditions that are forcing either an earlier weaning of calves or culling of cattle. Increased numbers of cows and heifers are heading to slaughter. A continued contraction of the North American cattle herd was expected as indicated in our top charts to monitor in 2023, but we now expect further contraction. Getting through the drought conditions will be key for these operations. The good news, if any during a drought, is sales are occurring at strong prices, providing cashflow for operations to re-build their herds once pasture conditions improve. However, rebuilding cattle herds following drought and culling is a multi-year initiative. The drought’s impact on herd size will ultimately impact feed mill sales into 2024 and beyond. We are currently in a weather market, with volatile feed prices and a market that could now go in either direction depending on weather and its final impact on overall North American production.

North American hog sector expected to contract

In addition to high feed costs, profitability challenges in the pork/hog sector are having impacts throughout the supply chain. The North American hog sector is going through an economic down cycle. Hog herd size is expected to decline as the number of sows bred and farrowings decline across North America. A decline in the hog herd means reduced feed demand in the short run and will weigh on the commercial feed market as farrowings are reduced and fewer hogs are finished in Canada. Hog production declines are expected to occur as the North American sector adapts to reduced pork demand. The current contraction in the hog sector is likely temporary as the hog sector expansion phase will once again return. The hog production contraction and expansion cycle is much shorter than beef at approximately four years.

Challenges in both the cattle and hog sectors will have far-reaching consequences for red meat production in North America and agribusiness input suppliers.

Expanding poultry sector an area of growing opportunity

Canadians love chicken and eggs. Per capita chicken meat consumption is up 16% since 2010 and eggs are up 32% (Figure 2). Canada’s population recently hit 40 million people and is growing at a record pace. Canada’s population has a direct impact on the feed supply business, particularly in Eastern Canada with its larger presence of supply managed sectors (for example, poultry and dairy). Along with having nearly half of the Canadian population, Eastern Canada’s immigration levels are rising, which is good news for the Canadian poultry industry (and to a lesser extent the entire livestock industry) and, subsequently, the commercial feed industry.

Figure 2. Canadian per capita consumption of selected meat proteins

Source: AAFC

Growth of oilseed crush disruptor to feed rations

The Canadian canola crush sector is currently undergoing expansion driven by increased emission reduction mandates (for example, clean fuel regulations) that are increasing biofuel demand. The crush sector is expected to add approximately 4.5 million tonnes of additional crush capacity by the end of 2024, and 2-plus million additional tonnes in the years following. The additional capacity represents over 3.5 million tonnes of additional canola meal produced. The increased meal will either be exported or used domestically. The most likely scenario is increased use in feed formulizations and feed ingredient additives. In the longer term, how livestock is fed in North America will continue to evolve as the expanded soybean and canola crush sector disrupts the industry. It will structurally change what we feed livestock, especially if a surplus of meals become available and cheaper for the livestock sector.

Bottom line

Challenges in both the cattle and hog sectors will have far-reaching consequences for red meat production in North America and agribusinesses input suppliers. Feed mill profitability is expected to be volatile in the short term, but the future looks bright in the long term with additional supplies of feed options, including canola meal and canola screenings, and opportunities to integrate soymeal into feed rations. A growing Canadian population will continue to demand domestically produced meat.

Senior Economist

Leigh Anderson is a Senior Economist at FCC with experience in agricultural markets and risk. He specializes in monitoring and analyzing FCC’s portfolio, industry health and providing industry risk analysis. In addition to his speaking engagements on agriculture and economics, Leigh is a regular contributor to the FCC Economics blog.

Leigh came to FCC in 2015, joining the Economics team. Prior to FCC, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.