Q2 2022 Macroeconomic snapshot: Economic conditions are tightening

Outlook

Canada’s economic growth is expected to be strong in Q2, as the Canadian economy is largely re-opened. Challenges related to a tight labour market, lingering supply-chain issues and high inflation are offset by robust consumer spending, exports and business investments. The Russian invasion of Ukraine lifted commodity prices, notably energy, contributing to elevating global inflation. Inflation in Canada rose to decade highs in Q1 2022, and the Bank of Canada (BoC) is increasing its policy rate in earnest to combat it. The BoC’s overnight rate increased 50bp on June 1 and now sits at 1.50% compared to 0.25% at the start of the year. We now expect the overnight rate to finish the year at 2.50%.

GDP

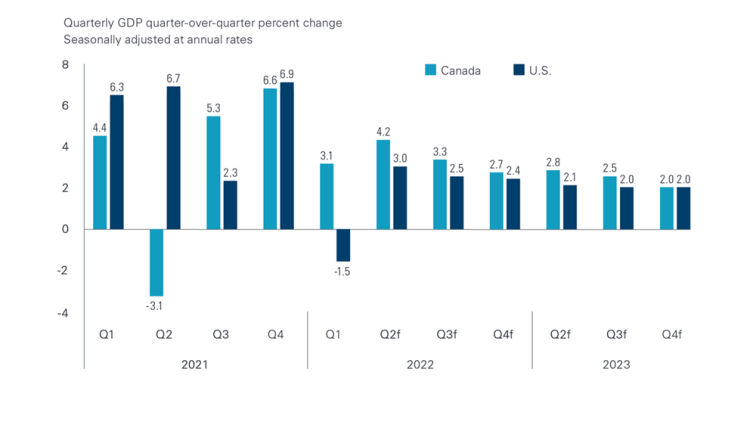

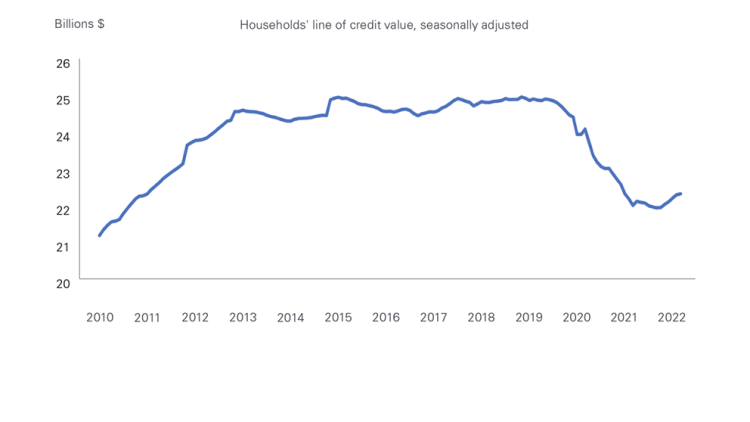

GDP growth was weaker in Q1 compared to Q4 2021 but remained healthy (Figure 1). Inflation is eating into household savings and reducing purchasing power, leading some households to draw liquidity from lines of credit to sustain spending. However, debt outstanding from credit lines remains below pre-COVID levels (Figure 2). U.S. GDP contracted in the quarter. Rumblings of a future recession are growing in the U.S., and Canada is susceptible to weakness in the American economy. The good news is with higher commodity prices and strong overseas demand, Canada’s trade balance has been very healthy compared to the U.S.

GDP growth in Canada is expected to be 4.2% in Q2 before moderating into 2023 into the 2-3% growth range. Foodservices, accommodations and travel spending are picking up, and higher prices will continue to support exports. Supply disruptions continue to limit some upside.

Figure 1. GDP growth is expected to moderate to the 2-3% range into 2023

Source: Bloomberg

Figure 2. Households have been taking on more debt to support spending in 2022

Source: Statistics Canada

Central Bank Policy and Bond Markets

The Bank of Canada overnight rate

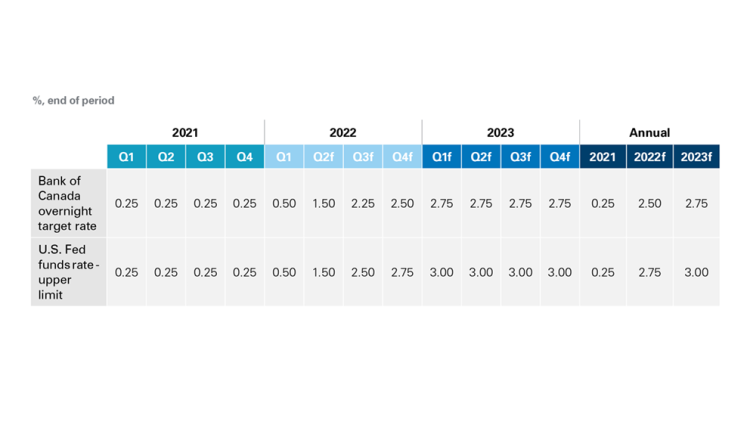

On June 1, the BoC increased its overnight rate to 1.50% from 1.00%. BoC policy will continue to be aggressive towards increasing rates until inflation starting to buckle or see cracks in the economy that push unemployment up. Consensus from financial markets is for the rate to be 2.75% at year-end. The market is expecting the U.S. Federal Reserve (Fed) to be similarly aggressive with rate hikes, projected to raise its policy rate to the upper limit of 3.00% by end of year. Inflation has been more prominent in the U.S., 8.3% in April, down slightly from 8.5% in March.

FCC Economics sees market expectations as a slight overestimation. There is room for the BoC and Fed to raise rates, but we believe the market may not fully account for all headwinds resulting from higher interest rates. We believe the BoC overnight rate will finish the year at 2.50% (Table 1).

Table 1. BoC policy rate still has more room to increase

Source: FCC Economics, Bank of Canada, The Federal Reserve

Rate expectations have increased with inflation. Central banks hope for a “soft landing” by balancing a growing and highly leveraged economy with a tightening monetary policy. A large portion of current inflation is attributed to the war in Ukraine, COVID policies in Chinese manufacturing hubs and resulting supply chain issues. Domestic investments can ease capacity pressures and lower inflation but may take multiple months or years to materialize.

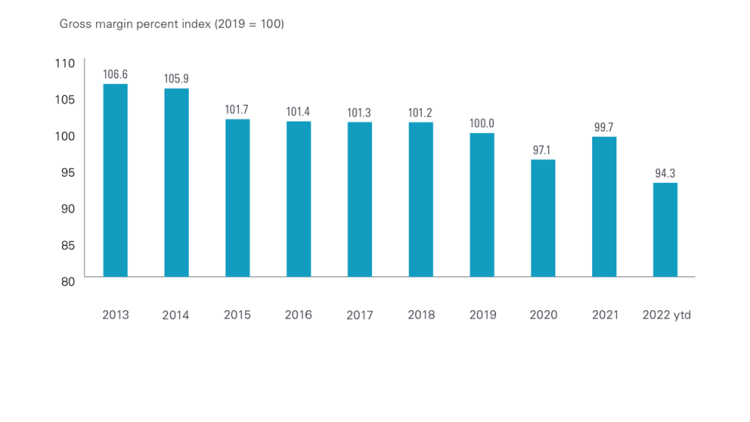

The BoC is targeting inflation by raising interest rates, which will slow consumer demand. The rate hikes could also put businesses with cash flow issues at a disadvantage. Food manufacturing margins are already under pressure in 2022 (Figure 3). Total Canadian manufacturing margins are under pressure as well. Debt levels and declining consumer savings are also concerns, even considering low unemployment and strong GDP growth. Wages are growing but remain below the rate of inflation, which is eroding consumer’s purchasing power.

Figure 3: Canadian food manufacturing gross margins have slid to start 2022

Source: FCC Economics, Statistics Canada

Inflation and fixed rates

Headline inflation from Statistics Canada was 5.8% year-over-year (YoY) in Q1 2022, led by increases in food, energy and shelter. In April, inflation was 6.8% and food inflation was 8.8% after rising 6.7% in Q1. Food inflation is expected to continue to outpace broad inflation in 2022.

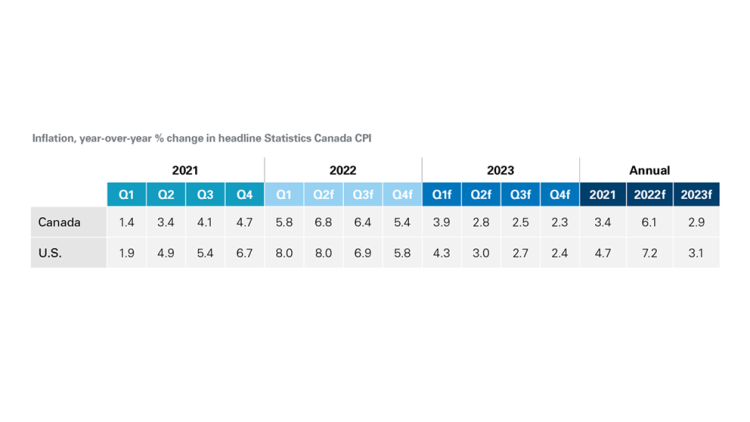

We expect inflation to remain elevated for the remainder of the year but its pace to slow into the 2-3% range in 2023 (Table 2). The Russia-Ukraine war caused a spike in oil and other commodity prices making short-term projections incredibly murky.

Table 2. Headline inflation will start to decline to 2% in 2023

Source: Bloomberg, Statistics Canada, FCC Economics

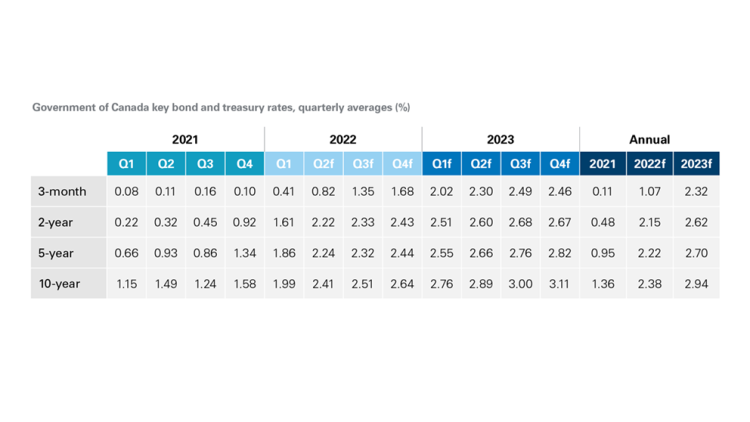

Government bonds and treasuries have continued their torrid pace (Table 3). For the past two years, the bond-buying from central banks (quantitative easing) has helped keep yields down while inflation rose. As a result, these bonds were generating a negative inflation-adjusted yield. With central banks now letting their holdings expire (quantitative tightening), inflation plays a larger role in determining bond prices as investors expect a positive inflation-adjusted return.

Fixed-term lending rates have been increasing in line with higher bond yields. We expect the trend to moderate, assuming inflation slows down.

Table 3. Canadian bond yields expectations continue to rise

Source: Statistics Canada (historical), Moody’s Analytics (forecasts)

Exchange rates and foreign market commentary

USD per CAD

The CAD has been falling compared to the USD in recent months, and demand for the USD has increased as a haven since the Russian invasion of Ukraine. The CAD value has increased against other currencies as commodity prices rise, but demand for the USD has outweighed the CAD. We expect further deterioration in the value of CAD per USD based on the assumption that oil and other commodity prices will decline (Table 4).

EUR per CAD

The European Central Bank (ECB) will likely start raising rates and stop its asset purchases in July. The ECB has stressed that tightening will be more gradual than its North American counterparts, and this is noteworthy as inflation is major concern among Western Europeans. Any increases in the ECB policy rate will increase its value relative to the CAD. But with Canada’s plan to increase rates already fully in swing and demand for Canadian commodities strong, it’s unlikely to erase gains. For momentum to swing back in favour of the EUR, we need to see improvements in the Russia-Ukraine war and a decline in European energy prices.

Table 4. CAD projected to decline against USD and continue gain against EUR

Source: Statistics Canada, FCC Economics

FCC attempts to provide accurate and useful information and analysis. The contents herein have been compiled or derived from sources believed to be reliable, however, FCC cannot guarantee the accuracy of the information contained in this report. All estimates and opinions within this report constitute judgments as of the date of this report and are subject to change without notice. FCC makes no representation or warranty, express, or implied, in respect to this report, and takes no responsibility for any errors or omissions which may be contained herein. FCC accepts no liability whatsoever for any loss arising from any action or decisions taken by any reader of this report based on information provided in this report.

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.