Q3 2023 Macroeconomic snapshot: Consumer spending weakness emerging

Signs that the Bank of Canada’s (BoC) past interest rate increases are having their intended impact are beginning to emerge. GDP growth in Q2 slightly contracted, underlying inflation trends are pointing in the right direction, and the balance between supply and demand for labour is edging closer to equilibrium. For these reasons, the BoC held the overnight interest rate at 5.00% on September 6th.

We break it all down in this quarter’s Economic and Financial Market Update.

GDP growth contracted in Q2 and is likely to remain low for the rest of the year

Economic growth in Q1 was surprisingly strong (2.6%) but contracted in Q2 (-0.2%) as consumers tightened their wallets amid ongoing inflation and increasing interest payments.

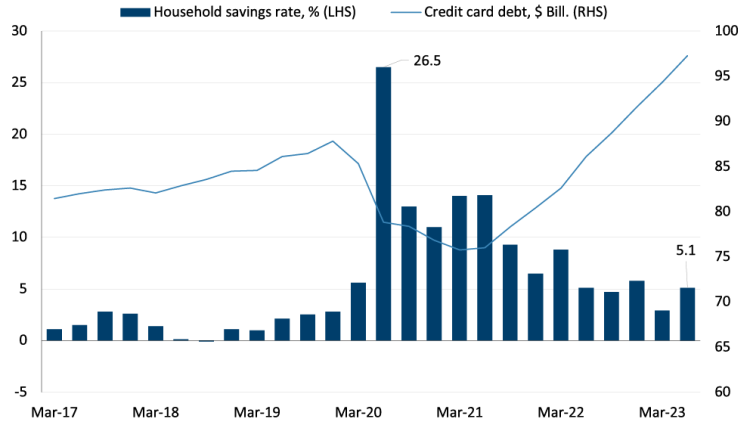

Despite increased demand from high population growth, consumption spending was barely changed in Q2. Savings accumulated during the pandemic have effectively been depleted, with the household savings rate significantly down from the peak during the pandemic (26.5%) when government support programs and lockdowns contributed to the buildup in savings (Figure 1). Credit card debt has also been on the rise (28% increase) since Q1 2021, adding stress to household finances.

Consumer spending accounts for roughly 60% of Canadian GDP, so any continuing weakness will significantly impact GDP growth moving forward.

Figure 1: Household savings rate falls, credit card debt rises in the face of ongoing inflation

Source: Statistics Canada. Data are seasonally adjusted.

FCC Economics sees GDP growth rates between 0.6 to 1.1% over the next four quarters (Figure 2). Complicating the outlook in the second half of 2023 are events that have already occurred that will restrain growth, including wildfires in western Canada, flooding in Atlantic Canada, and the Port of Vancouver strike.

Figure 2: FCC Economics expects growth to remain weak for the remainder of 2023

Sources: FCC Economics, Bloomberg Quarterly GDP quarter-over-quarter percent change. Seasonally adjusted at annual rates.

Underlying inflation trends are pointing in the right direction

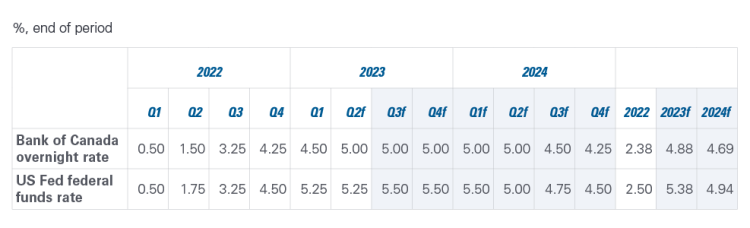

On September 6, the BoC held the overnight interest rate flat at 5.00%. FCC Economics expects the overnight rate to remain unchanged through the rest of 2023 and into early 2024 (Table 1).

Table 1: BoC to hold overnight rate steady for the rest of the year

Sources: FCC Economics, Bank of Canada, The Federal Reserve

Speaking at a luncheon on September 7th, Governor Macklem made it clear that the BoC is committed to bringing the headline inflation rate back to its target of 2.0%. There are two more CPI releases before the next BoC rate announcement on October 25th and those will determine the path of the overnight rate. If the downward trend in core inflation stalls the BoC has made clear that it is prepared to raise rates again. That said, core inflation is trending in the right direction in our view (see below) meaning that, barring any unexpected shocks, the BoC's rate hike cycle is likely over.

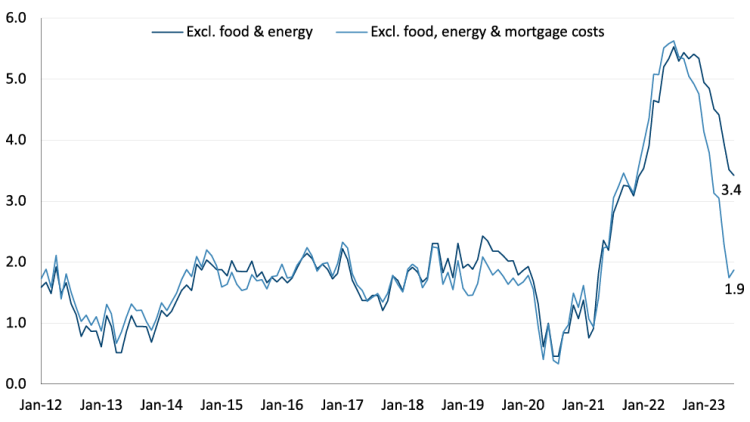

It’s worth noting that the main reason July’s inflation surprised the upside (3.3% Y/Y, up from June’s 2.8%) was energy. In contrast, ‘core’ inflation measures — which strip out volatile components of the CPI, including energy — were at their lowest levels since 2021, indicating deceleration in broader price pressures. Furthermore, if one strips out mortgage interest cost (a function of BoC policy) from core CPI, it is at a mere 1.9% (Figure 3). Simply put, underlying inflation is heading in the right direction.

Figure 3: Measures of core inflation paint a more positive picture

Canadian CPI, year-over-year % change

Sources: Statistics Canada, FCC Economics

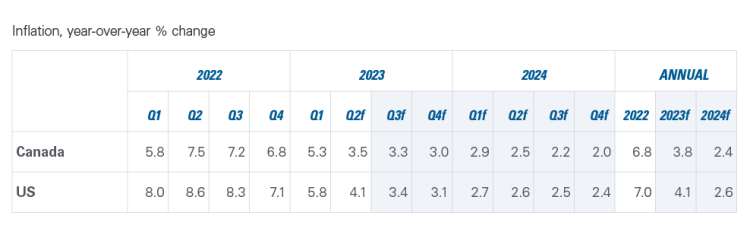

Bloomberg estimates headline inflation should return within the bounds of the BoC’s target range for inflation of 1.0 to 3.0% in early 2024 (Table 2). For its part, the BoC expects this rate to return to target in early 2025.

Table 2: Headline inflation is expected to continue to ease

Sources: Bloomberg, Statistics Canada

Fixed rates to remain flat into 2024

Government of Canada bond yields have risen since spring when the banking sector's stress pushed yields temporarily lower. They have risen since, but the yield curve remains inverted. In fact, the spread between the prime rate and the 5-year GoC has never been as wide as recently, meaning fixed rates — despite the rise in the last 18 months — are historically low relative to the prime rates.

As the BoC begins cutting rates in 2024, the yield curve will become less inverted courtesy of falling short-term yields (e.g., 2-year GoC bonds).

Table 3. Bond yields to fall on the short end in 2024

Sources: Statistics Canada (historical), Major financial institution consensus (forecast)

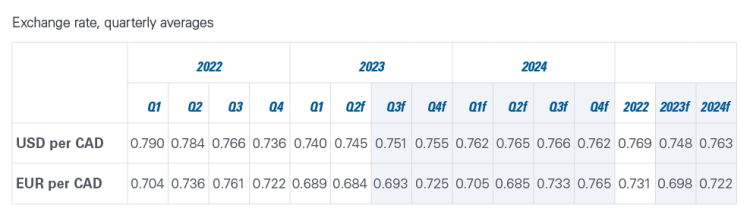

Exchange rates and foreign market commentary

USD per CAD

Considering all the aforementioned economic trends – and the trends we didn’t have time to cover, such as OPEC production cuts – the CAD-USD exchange rate has remained relatively stable. We expect this stability to remain for the rest of 2023 and into 2024 (Table 4).

EUR per CAD

By comparison, the CAD-Euro exchange rate has been more volatile in the last 18 months. Despite the Dutch and German economies entering recession territory, the Canadian dollar lost value relative to the Euro in H1 2023. This volatility will remain for the next 6 to 9 months, with European energy prices this winter influencing this exchange rate.

Table 4: CAD/USD projections are unchanged from the previous quarter

Sources: FCC Economics, Statistics Canada

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.