Q3 2024 Macroeconomic snapshot: How low can interest rates go?

On September 4, the Bank of Canada (BoC) cut its key interest rate – the overnight rate – for the third time in their last three meetings. The overnight rate now stands at 4.25%, down from 5.00% in the earlier part of the year. These cuts are the beginning of what is expected to be a multiyear exercise in loosening monetary policy. But just how far could we expect the overnight rate to fall – and what will be the impact on bond yields, borrowing costs and the value of the Canadian dollar? We tackle these questions in this quarter’s FCC macroeconomic snapshot.

Global production and trade flows matter

To understand where rates might be headed, we need to understand where rates have been.

World inflation, which averaged over 17% over the period 1980-1999, fell sharply to single digits in subsequent decades thanks largely to increased globalization. The accession of China to the World Trade Organization in 2001 gave a boost to world trade while generating disinflationary forces across the globe. These events, in turn, allowed central banks to lower policy rates to levels that otherwise would not have been possible. Since the financial crisis of 2008 rates have been particularly low.

Those days, however, are long gone. Global trade patterns are being upended as a result of increasing geopolitical frictions, resulting in ‘onshoring’ or ‘friendshoring’. Multiple governments around the globe, including the U.S., are moving towards more protectionist trade policies. In a reverse of the prior 30 years, these events will likely lessen the trade of consumer goods, meaning that the downward pressures on consumer prices brought by global trade are likely to be less prominent than in the past.

Policy rates set by central banks will need to reflect this new economic reality. BoC Governor Tiff Macklem himself highlighted this reality in June, stating “Interest rates may be easing in many economies, but global interest rates are unlikely to return to pre-pandemic levels. The new normal won’t be the old normal. And if we’re not going back, we’ll all need to adjust.”

What’s the neutral rate of interest?

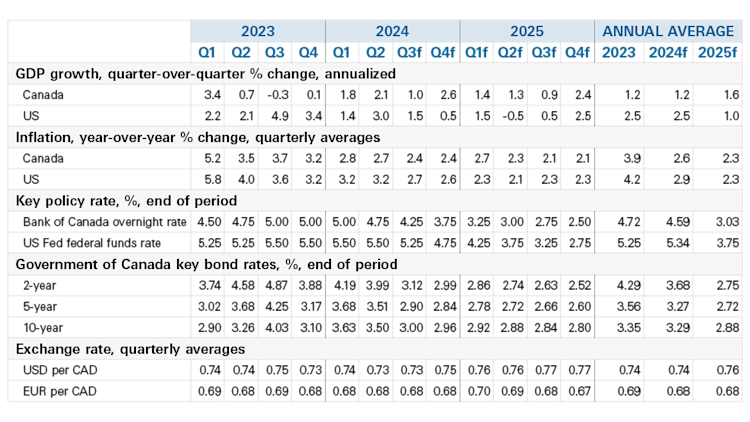

So, where are interest rates expected to settle in this new normal? Economists, including those at the BoC, often refer to a concept called the “neutral rate of interest”. This is the rate at which the economy is neither stimulated nor impeded. This rate is unobservable and can only be estimated using models, which explains why there is much debate within the profession about where it stands. Even the Bank of Canada is cautious on the matter, preferring to give a range (2.25-3.25% according to its latest estimate) instead of a point estimate for the neutral rate. One can interpret the neutral rate as the lowest the overnight rate should fall to, absent a major negative shock like a deep recession. Based on our scenario of a soft landing for the Canadian economy, the overnight rate should continue to fall, albeit not as drastically as it did during earlier recessions. We expect the overnight rate to decline to 3.75% by year-end and to settle around 2.50% by the end of 2025 i.e., near the mid-point of the BoC’s estimated range for the neutral rate.

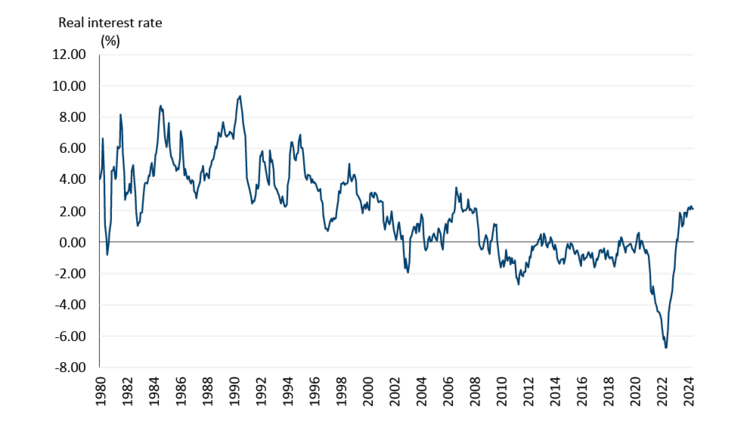

This forecast for the overnight rate seems plausible to us not just because it’s consistent with the BoC’s estimated neutral rate, but also because of what it means for the real interest rate. The real interest rate is the nominal (i.e., stated) interest rate minus the inflation rate. For example, as things sit today with the overnight rate at 4.25% and the headline inflation rate at 2.5%, the estimated real rate of interest is approximately 1.75%, the highest since before the financial crisis of 2008 (Figure 1). This puts a highly levered economy under pressure and it’s no wonder Canadian GDP growth remains well below potential.

To rekindle economic growth, the BoC will have to engineer a much lower real interest rate. By bringing down the overnight rate to around 2.50% by end of 2025, and assuming a stable inflation rate of 2.0% by then, that would imply a real rate of interest of 0.50%, which is roughly what it was before the 2020 recession, when Canada was registering decent GDP growth.

Figure 1: Real interest rates highest since 2007

Overnight rate data not available prior to 1996. The overnight rate used in the calculation before that date is implied, calculated as the bank rate less 25 basis points.

Sources: Statistics Canada, FCC Economics

What about the yield curve and borrowing costs?

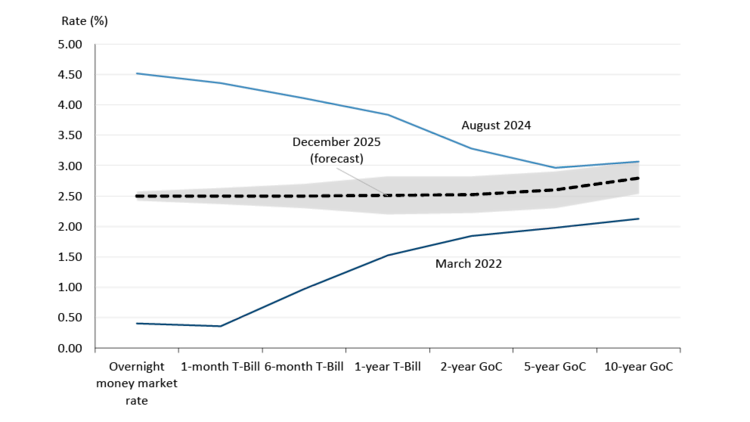

The declining overnight rate will naturally affect the yield curve. Understanding movements in the yield curve is important as the curve is the foundational component of most fixed-rate loans. Since mid-2022, the yield curve has been in an inverted position, meaning yields at the short end of the curve have been higher than yields at the long end of the curve. This remained the case as of August 2024. The timing and size of movements in the yield curve are difficult to predict and can fluctuate quite a bit in a given month. What we know is that short-term yields are heavily influenced by the overnight rate, so as the BoC continues to cut the overnight rate into 2025, short-term yields will correspondingly decline. On the other hand, longer-term yields move alongside changes in expectations of the overnight rate, inflation, and the general economic outlook. As inflation (and maybe more importantly, expectations of what inflation will be in the future) slows and the economic outlook weakens, longer-term yields generally move lower, though the likelihood for longer-term yields to fall significantly from where they are today is low (Figure 2).

Figure 2: Yield curve remains inverted, but the inversion should unwind with further BoC rate cuts

The lines in the above represent the average yield for each bill/bond during March 2022 and August 2024. The December 2025 dotted line represents FCC Economics’ most recent forecasts, with the shaded grey area representing a potential degree of variance that yields could fluctuate within based on recent historical volatility.

Sources: Statistics Canada, FCC Economics

Canadian dollar finds support with anticipation of U.S. rate cuts

With interest rates falling, the casual observer would not feel optimistic about the Canadian dollar. But as we’ve explained before, there are other factors at play (besides Canadian rates) that could be supportive of the loonie. Indeed, since bottoming out to a 2024 low in early August, the loonie has appreciated over two cents per USD. Much of this appreciation can be attributed to growing clarity from the U.S. Federal Reserve that interest rate cuts are imminent stateside.

Bottom line

Our forecast of the overnight rate settling at around 2.50% by the end of 2025 assumes a soft landing for the Canadian economy, a scenario whereby inflation is brought under control without causing significant economic damage. That said, given the many risks hanging over the Canadian economy including global trade, a stretched consumer, and a jittery housing market, we acknowledge the possibility of a deeper downturn than what we’re currently anticipating. Should that undesirable scenario materialize, the BoC would then bring down the overnight rate well below the estimated neutral rate to provide stimulus, as it did during the recessions of 1991, 2009 and 2020.

Summary of forecasts of key economic variables

Sources: FCC Economics, Bloomberg

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.