Q4 2023 Macroeconomic snapshot: Let’s talk interest rates

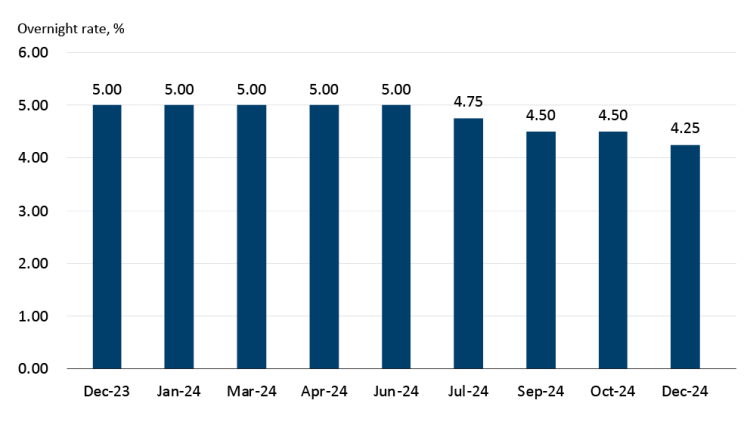

Consecutive quarters of anemic economic growth — combined with inflation data that continues to slowly trend in the right direction — pivoted conversations on monetary policy from interest rate increases to interest rate cuts. FCC Economics expects 75-basis point (bps) of cuts in the overnight rate beginning in the second half of 2024. However, long yields will likely move down much sooner, lowering long-term borrowing costs as well.

Weak economic growth will further lower inflation

October’s release of the Consumer Price Index (CPI) included a mix of positive and negative components. On the positive side, the year-over-year (YoY) inflation rate fell to 3.1% in October which was a significant improvement from the September and August levels (3.8% and 4.0%, respectively). While lower, this rate is still higher than the BoC’s target inflation rate of 2.0%.

However, the data were less positive when looking at core inflation measures (i.e., stripping out more volatile components of the CPI). The BoC’s two preferred measures of core inflation, CPI-median and CPI-trim, both fell in October (3.6% and 3.5%, respectively). While an improvement from prior months, these rates remain elevated and well above pre-2021 levels. Another measure of core inflation — all-items excluding food and energy — actually rose slightly in October, from 3.2% to 3.4%.

Regardless of your preferred measure, the high core inflation rates indicate broader price pressures have not eased as much or as fast as the BoC would like. These stubborn underlying inflation trends are a key reason the BoC kept the overnight policy rate at 5.00% on December 6 and also why we expect it to stay at that level for another couple of quarters.

Continued weak GDP growth in 2024 should bring inflation down to a sustained level that the BoC is comfortable enough to start lowering the overnight rate. The BoC understands that a rate shock is coming for households (e.g., mortgage renewals) and will offer relief as soon as it is convinced that inflation is moving down sustainably. Although the BoC doesn’t see inflation at the 2.0% inflation target until the end of 2025, FCC Economics believes it will get there much sooner.

The main reason is that we are less optimistic about the path of GDP growth. When growth slows — or, as Governor Macklem says, supply and demand in the economy approach a balance — price pressures should ease and inflation rates fall.

Barring an unexpected resurgence in inflation expectations and wage growth, the overnight rate has likely peaked. With expected cuts in the overnight rate, borrowers with variable rate loans will see some relief in the second half of 2024.

Financial markets are calling for a more aggressive downward path in the overnight rate. As of December, 6, they are fully pricing in the first rate cut in June, with a 50-50 probability of cuts occurring as early as April. Overall, markets anticipate a 100 basis point reduction in the overnight rate for 2024.

Figure 1: FCC Economics expects overnight rate cuts beginning in H2 2024

Source: FCC Economics

Will fixed rates go lower in 2024?

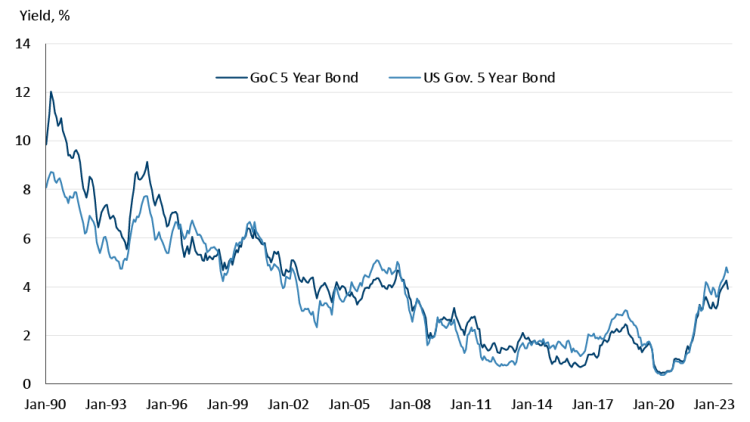

This quarter saw a wild ride in bond market yields. Assessing the movement and yields in bond markets is important as these yields are the primary determinant of borrowing rates on fixed-rate loans.

In the last three months, the 5-year Government of Canada (GoC) bond yield rose by approximately 50 basis points and then fell by approximately 100 basis points. The last time the 5-year yield recorded similar volatility was in March, when bank failures in the US caused great uncertainty regarding how the Federal Reserve would respond to the crisis.

Movements in GoC bond yields are tied at the hip to movements in US bond yields. For example, going back to 1990, the correlation between the 5-year yields in both countries is 95% (Figure 2).

Figure 2: Canadian bond yields are highly correlated with US bond yields

Sources: Statistics Canada, US Treasury

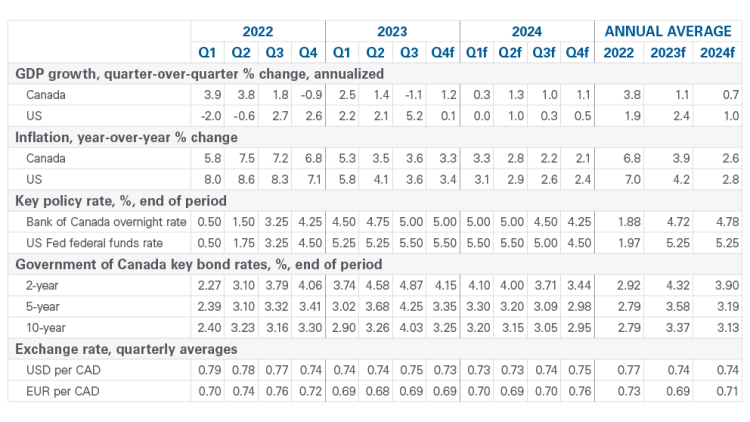

Therefore, U.S. economic events give us cues about future GoC yields. We believe the Federal Reserve is also likely done with rate hikes in this current tightening cycle (Table 1). As markets get more clarity on the pace of US rate cuts, US and Canadian bond yields should continue to decline from current levels. The yield curve could become even more inverted over the near term. But once the BoC starts cutting rates, the inversion should subside, setting the stage for a return to a normal/positively sloped yield curve (which we expect to see only in the second half of 2025).

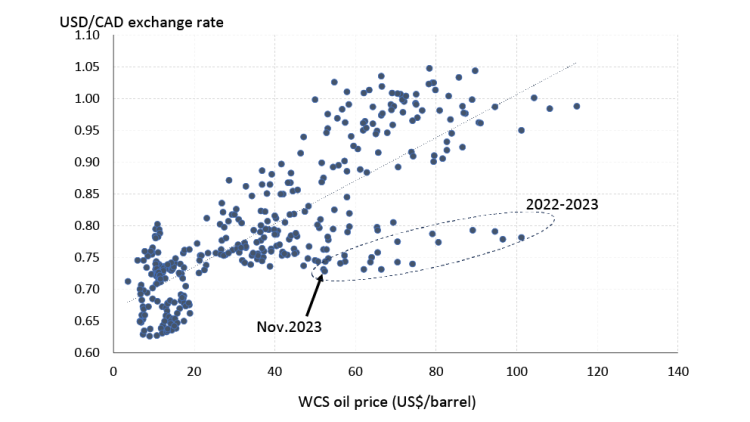

What’s up with the Canadian dollar?

It has been a rough couple of years for the Canadian dollar, as the currency dropped from 78 US cents at the start of 2022 to a multi-year low of around 72 cents recently. This depreciation occurred despite oil prices showing resilience over the period. The major factor behind the loonie’s woes is US dollar strength, which has been fueled by a hawkish Federal Reserve with high bond yields pulling foreign capital into the US. Note that the weakening oil/Canadian dollar correlation started when the Fed began raising interest rates in early 2022 (Figure 3). This is no coincidence.

Figure 3: Canadian dollar looks undervalued based on the current oil price

Sources: Government of Alberta, Moody’s Analytics

USD strength could continue over the near term if uncertainty/fear grips markets, prompting investors to flock to safe-haven U.S. assets like Treasuries. But as in prior cycles, the period of US dollar strength will eventually end. And when that happens, the Canadian dollar will have an opportunity to bounce back.

Summary of forecasts of key economic variables

The table below summarizes FCC Economics’ outlook of select economic variables.

Table 1: Forecasts of key economic variables

Sources: FCC Economics, Bloomberg

Senior Economist

Graeme Crosbie is a senior economist at FCC. His focus areas include macroeconomic analysis and insights and monitoring and analyzing Canada’s food and beverage industries. Having grown up on a dairy farm in southern Saskatchewan, he occasionally comments on the health of the dairy industry in Canada.

Graeme has been at FCC since 2013, spending most of that time in risk management. Graeme holds a master of science in financial economics from Cardiff University and is a CFA charter holder.