Q4 2024 economic snapshot: Another challenging year for Canada

Earlier this year the focus of the Bank of Canada (BoC) pivoted from tightening to easing monetary policy as inflationary pressures eased and to provide some stimulus to a struggling economy. Will the interest cuts that first occurred in June have their intended impact in 2025? Or are there too many other headwinds that will limit the amount of economic activity? We tackle these questions in this quarter’s FCC economic snapshot.

Slowdown in population growth clouding the outlook for consumption

The surge in Canada’s population in the last few years has inarguably provided a boost to the country’s GDP. At the same time, per capita GDP has declined for six consecutive quarters. Looking ahead, the rate of population growth is set to slow in 2025, yet it is difficult to know exactly to what level. For its part, the BoC projects a growth rate of 1.5%. Additionally, Statistics Canada produces a wide range of population growth scenarios. Their lowest-growth scenario projects a decline of -0.9% while their highest-growth scenario matches the BoC’s assessment of 1.5%.

Regardless of the pace of the slowdown, slower population growth would, all else being equal, equate to slower growth in consumption. However, the BoC is anticipating slower population growth will be offset by higher per-capita spending. More specifically, the BoC believes that interest rate cuts will alleviate some pressure on debt payments which would free up cash that could be spent on consumption of goods and services. While we agree with the directionally of this assessment, the degree to which this will occur is up for debate. For consumers with fixed-rate debt not renewing in 2025, the BoC’s recent cuts will have little to no effect. Furthermore, over 1.1 million additional mortgages are still set to renew in 2025, many of which were taken out when interest rates were at record lows. This will offset variable-rate relief seen elsewhere. So, don’t expect a boom in consumption spending next year.

Lower interest rates not a silver bullet for muted business investment

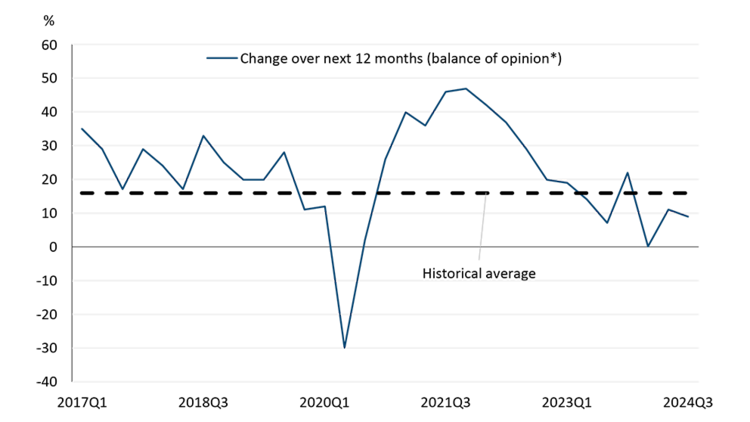

According to the most recent Business Outlook Survey from the BoC, intentions of businesses to invest in 2025 are quite muted (Figure 1). And this isn’t just a flash-in-the-pan, single estimate: the Bank’s metric that captures net investment intentions has been on a notable downward trend since 2021, and in three of the last five quarters the measure has been the lowest it’s been going back to 2017 (aside from the two quarters following the onset of the pandemic).

Figure 1: Business sentiment for investment in the next 12 months remains subdued

*Percentage of firms expecting higher investment spending minus the percentage expecting lower investment spending.

Source: Bank of Canada

Policy uncertainty in both Canada and the U.S. is likely to keep businesses cautious on making further investments. In addition, the BoC noted in the same survey that slack, in the economy (i.e., idle workers and unused production capacity) as a whole is leading to restrained investment.

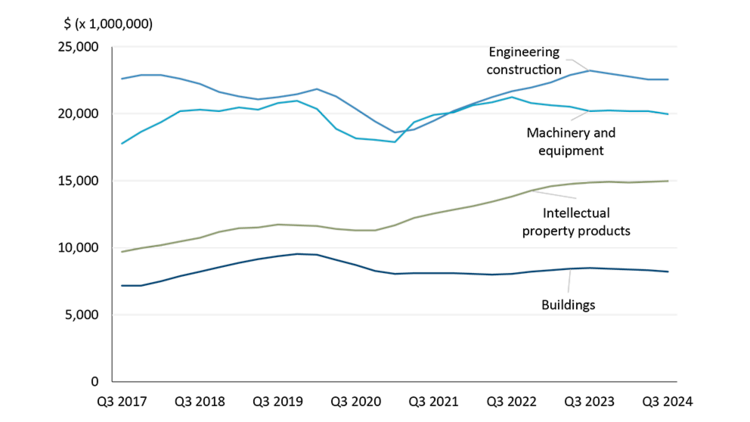

We can see these intentions translate into real-world decisions. Business sector investment has been either flat or on the decline for a few quarters now amongst the four categories of business investment (Figure 2). Even investment in intellectual property products – which has seen the greatest amount of growth since 2017 – has been stagnant since 2023. It’s no wonder Canada’s productivity growth continues to be well below that of the U.S. All in all, we’re skeptical about the BoC’s forecast of business investment contributing as much as 0.4 percentage points to real GDP growth next year (see October’s Monetary Policy Report (MPR)).

Figure 2: Business investment has been flat for several quarters

2017 constant prices. Four quarter rolling average.

Source: Statistics Canada, FCC Economics

Export growth potential and the looming threat of tariffs

No economic outlook for the Canadian economy in 2025 would be complete without addressing the elephant in the room: the potential for tariffs on exports to the U.S.

The Canada-U.S.-Mexico Agreement (CUSMA) is slated for review in 2026, and the path towards an updated agreement is unlikely to be smooth. President-elect Trump has threatened to impose a 25% tariff on Canadian and Mexican goods imported into the U.S. The economic impacts of this threat will depend on what (if any) tariff rate the White House eventually picks and how Canada and other trade partners respond. GDP growth should be negatively impacted as exports are curtailed. While at the same time the Canadian dollar can be expected to depreciate amid U.S. dollar strength, the latter fueled by the tariffs and the likelihood of higher U.S. interest rates than would otherwise be the case due to higher U.S. inflation.

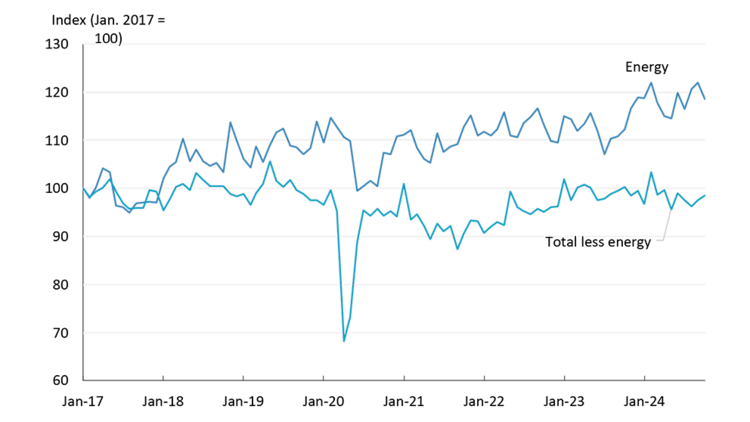

The energy sector looks vulnerable on paper with 97% of its exports heading stateside, although the sector could be somewhat shielded by the lack of appetite among U.S. policymakers to accept the repercussions (e.g., higher U.S. gasoline prices). Within the context of GDP growth, continued energy exports are very important as they have been the major driver of export growth since 2017 (Figure 3).

Figure 3: Energy exports have driven total export growth for several years

Source: Statistics Canada, FCC Economics

The Trans Mountain pipeline expansion from Alberta to the BC coast may provide some relief because the country now has capabilities to divert some oil exports away from the U.S. to other destinations; overall, though, the reliance access to the U.S. market remains. Regardless of market access, demand may not suffice: our current forecast for West Texas Intermediate (WTI) oil in 2025 is $70/USD with slower global GDP the main drag on low oil prices.

A weaker loonie is typically bullish for exports, all else being equal; however, if the cause of the weaker loonie is U.S. tariffs, the opportunities to increase exports via a weaker currency is limited. If tariffs were enacted, grain and oilseed producers may be able to slightly cushion the blow for two reasons. First, these commodities are largely storable, meaning production can be set aside until trade tensions ease and/or alternative markets are found (these commodities are also highly uniform and globally traded, offering further opportunities for trade diversification). Among the different agriculture sectors, livestock exports stand to lose the most in a situation where tariffs are enacted given the high degree of integration with the U.S. Simply put, we find it difficult to digest the BoC’s October MPR forecast of exports contributing as much as 1.5 percentage points to real GDP growth next year.

Bottom line

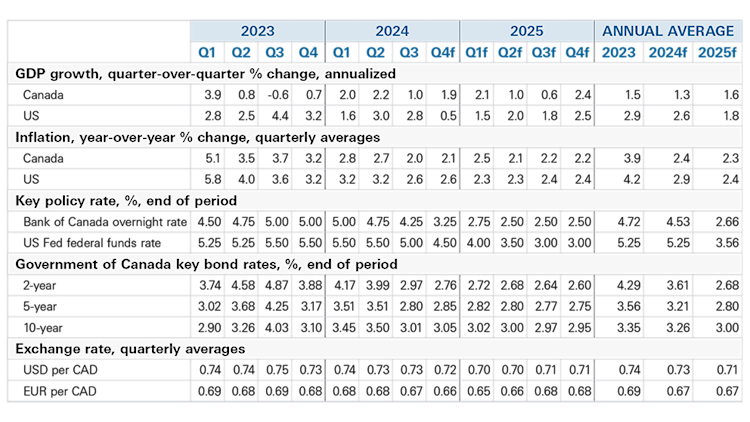

Despite the BoC’s interest rate cuts, the Canadian economy is set for another year of lackluster growth in 2025. We are currently forecasting GDP growth to be around 1.6% in 2025, or half a percentage point lower than the BoC’s forecast for the year, simply because we’re less optimistic than the central bank about domestic demand (particularly housing and business investment) and exports.

Amid such a dull economic outlook, we believe the Bank of Canada will have to further reduce the overnight rate, the latter likely stabilizing near the estimated neutral rate of 2.50% in late 2025. But don’t expect rates at the longer end of the yield curve – which are the primary determinant of fixed-rate loans for borrowers – to fall much from here given that they’re tied to U.S. Treasuries and therefore U.S. inflation. As for the Canadian dollar, it’s hard to be optimistic about its prospects given the declining short rates and the imposition of tariffs by the U.S.

Summary of forecasts of key economic variables

Sources: FCC Economics, Bloomberg

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.