On the radar: Trends in U.S. ag and food that could impact Canada in 2025

There’s an old adage that says, “when the U.S. sneezes, Canada catches a cold.” This is undoubtably true in the ag and food sectors. And while there has been plenty of speculation about what the outcome of November’s U.S. elections could mean for ag and food policy, there are topics to monitor that will be of importance regardless of the results. In this week’s blog, we focus on three top trends to monitor in U.S. ag and food and what it could mean for Canada.

To what degree will consumers demand ‘made in the USA’ products?

In the spring, the USDA announced a final ruling on voluntary country of original labelling (vCOOL) for beef and pork products. In essence, the ruling says that, starting January 1, 2026, meat processors who display a “Product of USA” label on their beef and pork must only use animals that are born and raised in the U.S. Currently, meat processors in the U.S. are allowed to import Canadian animals, raise and/or slaughter them, and use a “Product of USA” label. It's the latest in a two-decades long saga on country of original labelling for beef and pork products. vCOOL’s predecessor – mandatory country of original labelling (mCOOL) – was repealed in 2015.

At first blush vCOOL seems less worrisome than mCOOL given the voluntary nature of the requirements. However, Canada will face difficulties exporting livestock to the U.S. For example, Canada sends about four million piglets (less than seven kilograms in weight and 21 days old) to the U.S. annually; so, while these hogs would spend most of their life in the U.S., they wouldn’t qualify for a “Product of USA” label under vCOOL.

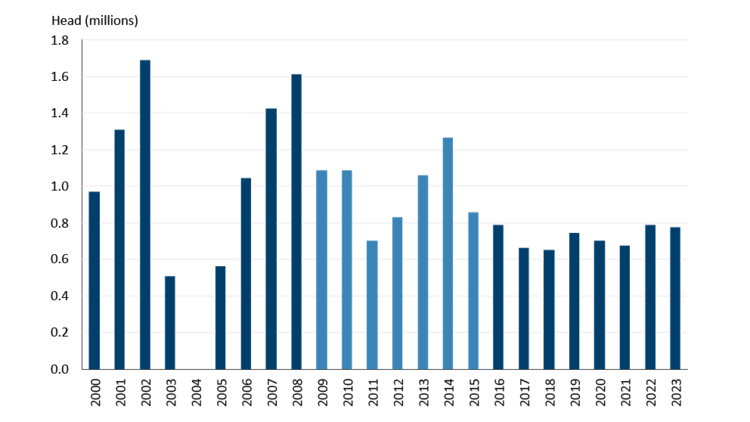

Industry sources are indicating that some processors could begin enforcing the rules by mid-2025. While we don’t expect this to be the end of livestock exports (Figure 1), the impacts could be significant. Basis levels (the difference between the cash price received and futures prices) for live cattle and hog exports are likely to widen and exports of processed meat products could face headwinds. Hog producers could face greater pressures given the decline in domestic processing capacity and increased reliance on U.S. access for slaughter. Quantifying the potential costs of vCOOL is challenging at this point but the WTO ruled the impact of mCOOL (in terms of foregone revenue) was over $1 billion USD annually when it was in effect.

Figure 1: Historical cattle exports to the U.S.

Light blue bars indicate years when mCOOL was enacted.

Source: Canadian International Merchandise Trade Database

Can we expect the U.S. pork industry to stand up for Canadian pigs? Maybe. While Canada is sending nearly 20% of its hogs to the U.S., this only represents 5% of U.S. slaughter volumes, so they can likely make up that difference in their own production. However, the two countries are highly integrated and there will likely be a push for easier regulations, especially for those piglets which spend nearly their entire life in the U.S. but wouldn’t qualify for a “Product of USA” label under the new requirements.

At the end of the day, the American consumer will determine the impact of vCOOL. The North American beef and pork markets are highly integrated and labelling requirements will reroute trade flows and add costs. What is U.S. consumers willingness to pay for such products at a time when meat prices remain elevated?

The fallout from biofuel tax credit changes

Starting January 1, 2025, tax credit changes in the U.S. regarding biofuel production will take effect which could hinder the growth of Canadian biodiesel production. This raises the question: with potentially limited demand for refined canola and soy oil from domestic fuel companies, does that mean Canadian production of canola and soy oil will face headwinds in finding buyers at a time when additional crush capacity is coming online?

At present, the U.S. offers a tax credit ($1 per gallon) to blenders for mixing biodiesel or renewable diesel with conventional diesel. This tax credit is vital for supporting profitability, given that biodiesel and renewable diesel prices significantly exceed those of conventional diesel. Other government policies like the federally administered Renewable Fuel Standard or California’s Low Carbon Fuel Standard have credits that also contribute to biofuel plant profitability. Historically, nearly all Canadian biodiesel has been exported to the U.S. to take advantage of some or all these credits.

However, under the Inflation Reduction Act, this tax credit has shifted from a blender to a producer credit, making only U.S. produced biodiesel or renewable diesel eligible for the credit starting next year – the inputs however can still come from abroad. This leaves Canadian refiners at a disadvantage. Canadian biofuel experts argue that without a similar credit in Canada, new domestic biofuel facilities will face difficulties getting built.

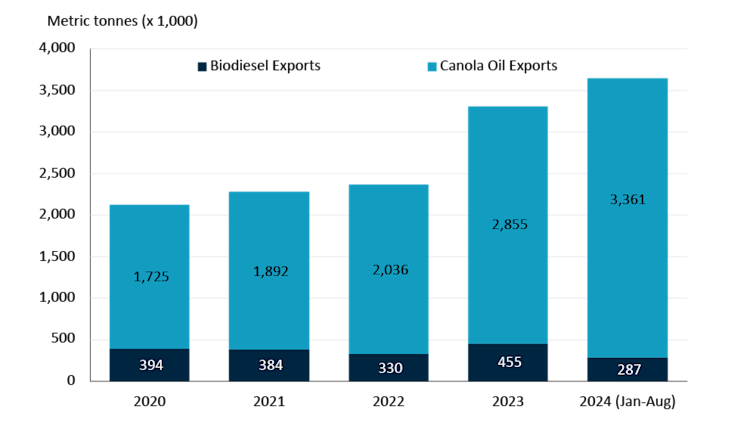

Canadian crushers continue to export canola oil to U.S. facilities, and they've been very active in 2024, setting a record already only eight months into the year (Figure 2). Even as some U.S. farm groups push to exclude foreign feedstocks from receiving credit in the future, for now Canadian oilseed crushers maintain strong profitability, driving demand for canola, amid increasing oil exports to the U.S.

Figure 2: Canadian exports to the U.S. of canola oil (crude and refined) and biodiesel

Sources: Statistics Canada, Canadian International Merchandise Trade Web Application

The U.S. Farm Bill will require a refresh

U.S. Farm Bills cover multiple years and a wide range of agricultural and food programs. For agricultural producers, it includes commodity insurance programs, price supports and other programs like conservation.

Farm bills are typically set for a period of five years. However, when the most recent Farm Bill expired in 2023 it was given a one-year extension. This extension expired on September 30, 2024, and negotiations on the next long-term deal will start in the new year.

Canadian producers need to monitor the Farm Bill for possible impacts. Changes in support prices or insurance programs could alter crop decisions of U.S. producers. For instance, better insurance for corn might lead to more corn planting in the U.S., pushing prices down. Ultimately, choices made on U.S. farms significantly affect futures markets and, consequently, Canadian prices for both grain and livestock.

Bottom line

These are only three of the trends to be mindful of stateside as the new year approaches. There are others that will potentially have impacts. Depending on who wins the election, these policies will be approached very differently. These include the potential use of tariffs that will affect trade flows and prices, and the Canada-United States-Mexico Agreement (CUSMA) review coming in 2026. Canadian ag and food business owners should remain attentive to developments in the U.S. but must prioritise managing their own risks and controlling the variables within their operations.

Article by:

Justin Shepherd, Senior Economist

Graeme Crosbie, Senior Economist