Risk management survey: 3 big opportunities to take back to the farm

Farming success is partly based on the ability of an operation to mitigate key risks. Like everything else in agriculture, risks are continually evolving. Adjusting strategies accordingly is thus vital. Given knowledge and limited resources, what are the most appropriate strategies for long-term success?

FCC Vision Panel surveyed over 2,000 farm operations across the country representing all areas of agriculture to select the risks they feel are most concerning and what strategies they have implemented to manage the risks they have identified. Overall risk tolerance was another variable accounted for.

We focused on five key themes:

Production risk

Marketing risk

Financial risk

Human resource risk

Legal risk

Each theme includes multiple specific risks. For example, within financial risk, we consider the following risks: interest rate, working capital, debt repayment, and operating costs. We constructed a scorecard that measures how producers within a sector match their level of concern (on a scale of 0 to 3) and overall risk attitude with available risk management tools (for example, I have a business plan, off-farm income, utilize accrual accounting to make decisions). A score of 100% would indicate that, for every risk identified, there is an appropriate strategy to mitigate. Conversely, zero would indicate there is no appropriate strategy to mitigate the identified risk.

Here are three takeaways from the survey.

1. Overall risk management response in Canadian agriculture is impressive

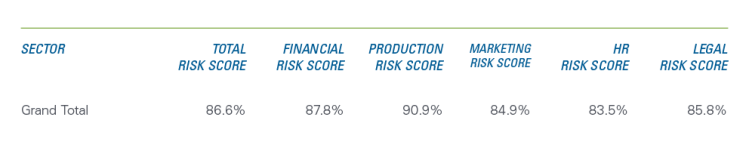

Canadian farm operations have implemented strategies to mitigate 87% of the risks they have identified on their operation, an impressive score.

Table 1: Overall risk score for Canadian agriculture

Not surprisingly, the agriculture sector has achieved the greatest score when identifying and mitigating production risks. Some of the strategies to production risks involve government programs, industry specialists (agronomists, nutritionists, and veterinarians) or production diversification. Conversely, human resource is an area for which more work can be done.

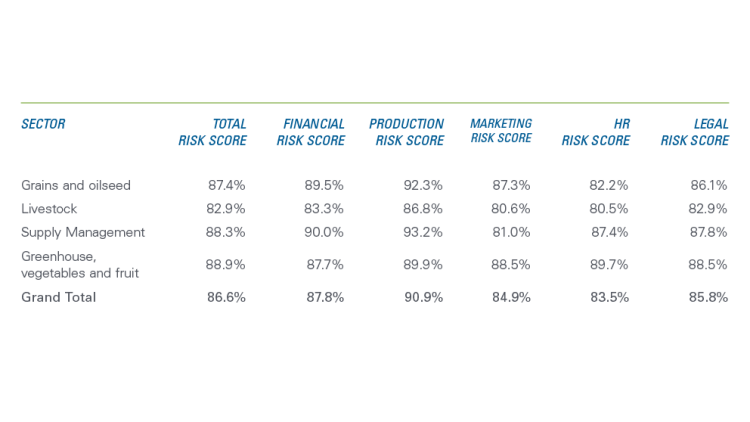

2. Opportunities to deploy risk management strategies greatest in livestock sector

The livestock sector (beef, hogs, sheep and goat) production have implemented the fewest risk mitigation strategies in relation to risk concerns. This observation is consistent for each of the five risk categories, signaling a higher risk tolerance, learning opportunities and adjustments in available strategies/tools to meet the industry risk management needs.

Table 2: Risk score by sector

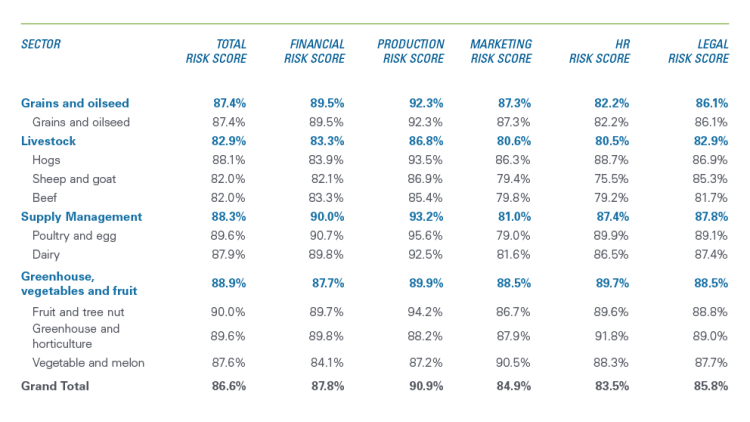

Note that there are large differences between risk mitigation strategies of hog operations within the livestock sector compared to beef, sheep and goat (see Table 3).

3. Human resource risks score the lowest from a risk management standpoint

The human resource risk score is highest for supply-managed industries and greenhouse, vegetable, and fruit operations. This seems a possible reflection of a greater dependency on hired labour and solutions implemented around recruiting/retaining labour in these sectors. Conversely, grains and oilseed and livestock operations are overall more dependent on family labour.

Table 3: Risk score by sub-sector

Canadian farming operations have success implementing risk management strategies for the risks they identify. However, in our increasingly interconnected and digital world, risk management strategies and the sophistication of these strategies continue to evolve. Agriculture producers will need to detect and understand these new risks and adopt them.

Craig Klemmer

Principal Economist

Craig joined FCC in 2009 as an Agricultural Economist, specializing in monitoring and analyzing the macroeconomic environment, modelling industry health, and providing industry risk analysis. Prior to FCC, he worked in the livestock branch of the Saskatchewan Ministry of Agriculture. Craig holds a Master of Agricultural Economics degree from the University of Saskatchewan.