Top 4 Canadian agri-food exports to watch for the rest of 2023

Overall global trade is expected to flounder throughout 2023 amidst weaker global economic growth, troublesome inflation and geopolitical turmoil, according to the United Nations Conference on Trade and Development (UNCTAD). It’s also changing shape, the UN’s latest report notes, with “friend-shoring” (the prioritization of trade partners with similar political values) and less diversity of trade partners characterizing trade patterns since late 2022.

Production of many agri-food products is expected to increase in 2023 year-over-year (YoY), but some of the same forces could constrain their global trade.

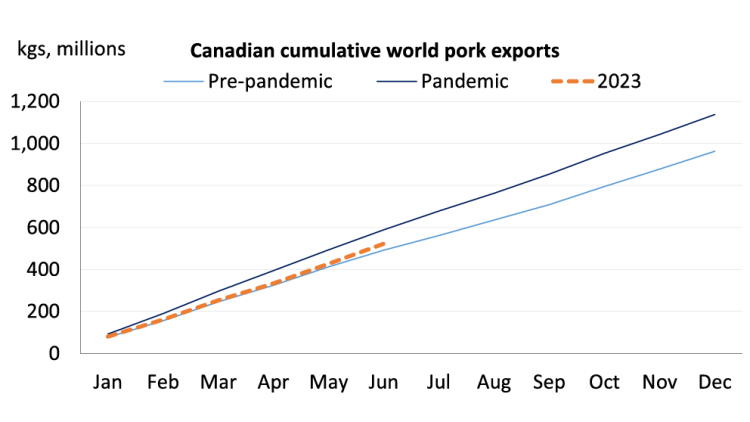

Pork exports

For Canada, export volumes of four of our largest-value agrifood products show uniquely distinct patterns relative to levels achieved during the first three years of the pandemic (2020 – 2022). Pork volumes had fallen from their pandemic highs through the first four months of 2023 when they were more in line with volumes exported pre-pandemic in 2018 and 2019 (Figure 1). Similarly, export dollar values have declined. That was almost all due to a drop-off in our exports to China since 2020, when it was our largest market and our exports peaked.

In May and June 2023, exports picked up to levels that had stabilized YoY. While exports to China were still down, and export volumes to Japan, our third-largest market, had also fallen since 2020 by 21.5%, there was some good news.

Canada’s pork exports to the U.S. thus far in 2023 are 33.6% higher than 2020 volumes. They’ve fallen YoY, but our 2022 volumes were the highest of the last five years by a considerable margin. The pandemic did not boost our pork sales there, and they’ve been growing strongly since.

China, Japan and the U.S. comprised 63% of Canada’s total pork export volumes in 2022.

Figure 1: The pandemic boosted overall Canadian pork exports

Source: Canadian International Merchandise Trade database

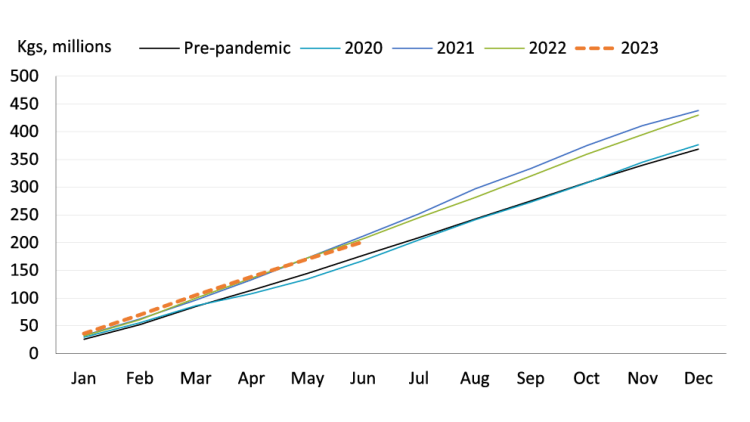

Beef exports

Canadian total beef export volumes since 2018 show an overall slowdown in 2020 and a steady climb through 2021 and 2022. In 2023, export volumes are 7% higher than the five-year average (2018 – 2022) for the first six months of each year (Figure 2) and are on pace to beat the 2020 and pre-pandemic volumes. They have fallen off the pace set in 2021 and 2022. However, while export volumes are below 2021 and 2022, the value of beef exports continues to exceed 2022 record levels.

Exports to the U.S. have driven growth, where three-quarters of Canadian beef exports go yearly.

Figure 2: Beef export volumes rebound after pandemic decline

Source: Canadian International Merchandise Trade database

It’s hard to overstate the importance of the U.S. to Canada’s cattle and beef sectors. As the world’s largest consumer of beef, they take a healthy chunk — nearly half — of our domestically produced cattle and beef, leaving Canadian producers in a precarious position should, as in 2020, exports to the U.S. start to fall off. But growth to other markets has been challenging.

China has used a single instance of BSE found on a Canadian operation in 2021 to justify halting all beef imports from Canada, a ban still active in 2023. Japan, the second-largest market for Canadian beef, while important is low volume but a focus on high-end cuts. Although our exports to Japan have grown between 2018 and 2022, they’ve remained low volume, with 13.5 million kilograms shipped there this year. This compares to the 160 million kilograms sent to the U.S. in the first six months of 2023. The situation is another reminder of the urgency to get more Canadian red meat exports over European borders.

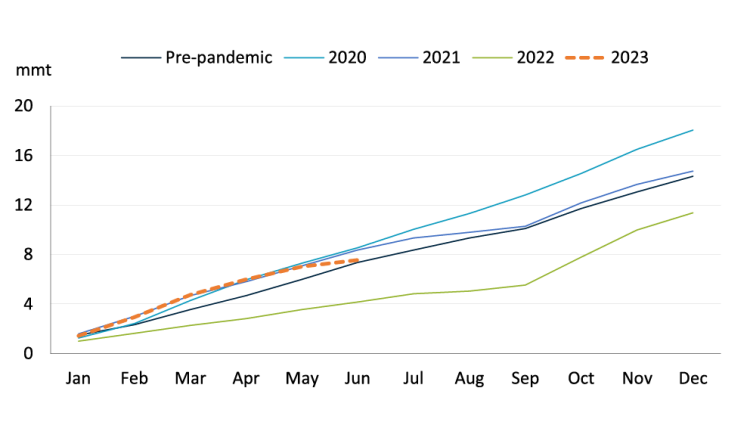

Canola exports

Canadian canola export volumes are seeing some much-needed growth in 2023 after a steep decline in 2022 when supplies from the drought-ravaged 2021 crop weren’t available. And the re-opening of China’s border to Canada’s canola in 2022, after three long years of Canadian producers needing to find alternate markets, is also helping (Figure 3).

Figure 3: The year of the pandemic’s start and the 2021 drought impact on canola exports

Source: Canadian International Merchandise Trade database

The impact of the 2021 drought on canola exports was felt in a 29% YoY decline in that year’s export volumes, followed by a further 32% YoY fall in 2022. Droughts elsewhere in key regions growing oilseeds used in vegetable oils, along with the growth of oilseed use in the rapidly expanding biofuels market, have produced a global shortage. In Canada, the extent of the damage wiped out the gains made in 2020, when exports climbed 42.8% YoY. Exports to Japan, our second-largest market, drove most of those gains, while growth in our exports to China is driving this year’s growth. In fact, China was the top destination for Canadian canola each year except in 2020, between 2018 and 2022.

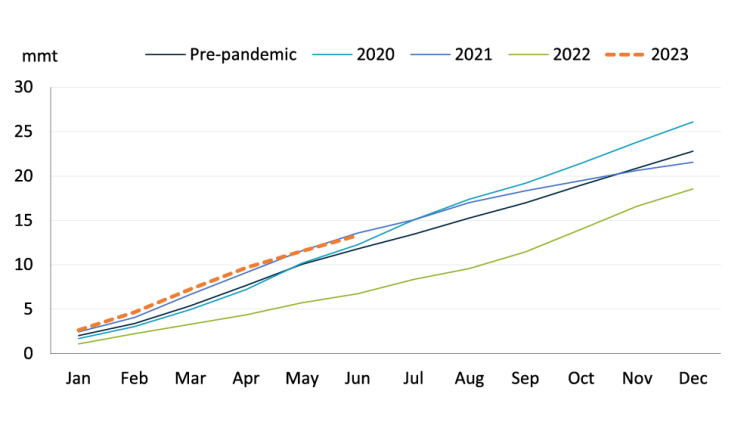

Wheat exports

Overall, wheat exports climbed 14.6% YoY in 2020. The pandemic has boosted Canada’s wheat exports from the second quarter of 2020 until August 2021 (Figure 4). This coincided with a period during which concerns about food sovereignty and security were heightened by concerns of supply chain chaos, and the boosted volumes would have likely continued had the 2021 drought not also hit Canadian wheat hard. Post-harvest exports in 2021 dropped off a cliff, and 2022 export volumes were lowered by 50% for the year, despite the YoY production growth in the 2022 crop.

Figure 4: 2023 wheat exports pick up where 2022’s growth led

Source: Canadian International Merchandise Trade database

In 2023, the evident growth in 2022 picked up even more momentum. Exports to date are on pace to equal the volumes exported in the first six months of 2021 before the impacts of the drought were felt. While China, our largest export market for wheat, led the gain in 2020, it was also a leader in 2021 and 2022. But this year, growth in our wheat exports is also driven by increases in other key markets. Japan, the U.S. and Indonesia have either boosted or stabilized their import volumes of Canadian wheat over the last four years. Despite reduced export volumes for both wheat and canola, strong global grain and oilseed prices following Russia’s war against Ukraine meant the value of Canadian exports rose sharply as production recovered in the fall of 2022.

Given the severity of the current drought impacts on Canadian crops and livestock, export volumes will likely be impacted for the remainder of 2023 and into 2024. However, exports remain equally important to Canadian agriculture and may offset the impact of reduced volumes. The value of exports will largely depend on global supply and demand fundamentals and prices of both crops and livestock.

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.