Why off-farm income remains vital to the farm economy

Off-farm income is an essential component of nearly all Canadian farm operations. According to Statistics Canada, over 99% of farm families report some source of off-farm income, with four out of five reporting employment income. Off-farm jobs provide stability to family income and mitigate the variability in farming income. With the June unemployment rate at 12.3% and the lower number of hours worked, the current economic downturn will negatively influence the incomes of farm families.

The Great Lockdown has severe consequences on employment

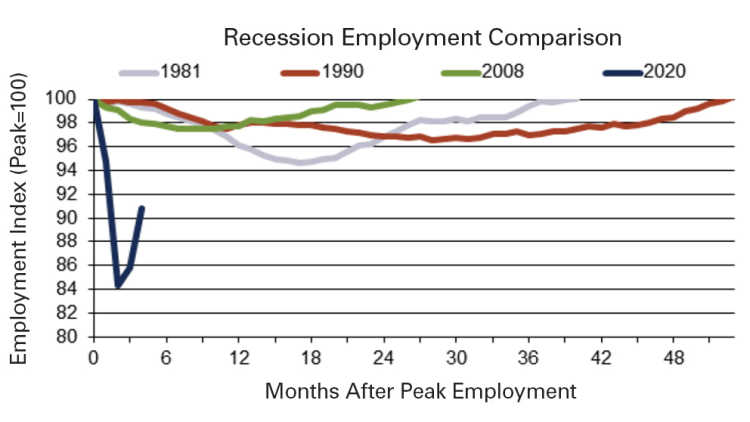

This recession is worse than others in terms of jobs lost (Figure 1). Employment in Canada declined over 15% from February to April and rebounded with strong employment gains in May and June. As a percent of the peak observed before the start of the recession, overall employment is still well below the lows experienced in the prior three recessions.

Figure 1: Number of months after the start of recession for employment to recover to pre-recession levels

Source: Statistics Canada.

Labour market’s influence is different across farming sectors

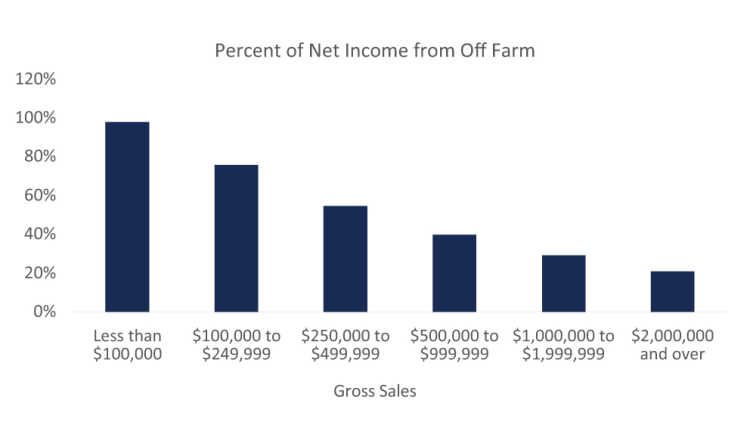

The importance of off-farm income diminishes as farm income increases. Part-time or lifestyle operations will be the most negatively impacted by the current employment shock. Off-farm income accounted for 98% of net farm family income on operations with less than $100,000 in gross sales (Figure 2). These farms are more resilient in the face of a shock to the agricultural economy, but more vulnerable to a general economic shock. But even farms grossing between $500,000 and $1 million in annual sales obtain, on average, 40% of their farm family income from off-farm.

Off-farm income is more important for beef and fruit and vegetable operations, and less so for hog and the supply-managed sectors. Off-farm income accounted for three-quarters of beef operations’ net farm family income from 2015-17 versus 45% for hogs or 35% for dairy farms. Regardless of farm size, job losses from the COVID-19 economic shutdown will mean an increased reliance on farming income for lifestyle expenses and to meet debt obligations.

Figure 2: Proportion of net farm family income generated by off-farm activities

Source: Statistics Canada.

Should you expect a “V”-shaped recovery for the labour market?

Quick recovery in employment is doubtful. The recent Bank of Canada business outlook survey reported that nearly 60% of businesses expected employment to return to pre-COVID-19 levels in the next 12 months. A rebound in sales will trigger an initial surge in job creation, but employment should then rebound at a rate more comparable to the past recession. So an initial V-shaped rebound in employment may soon be followed by a slower pace of employment growth as some businesses struggle under a new economic reality.

Several strategies are available to mitigate pressures on family farm income. One approach is managing household expenditures given reductions in things like meals away-from-home, fuel, and airfare. Canadians also plan to reduce these expenditures as life goes back to normal. Delaying capital expenditures is also prudent, especially as some tend to be made near year-end for tax benefits. A key to weathering these challenging times is the preservation of working capital.

Senior Relationship Manager

James joined FCC as an Agricultural Economics Analyst in 2011 and is now a Senior Relationship Manager in Thornton, Ontario. He also runs a small farm operation with his family. James completed a BSc in Environmental Science and a Masters of Agricultural Economics at the University of Guelph.