Improved outlook on yields likely to boost Eastern margins

Declining crop prices have been challenging for Canada’s grains and oilseeds producers. But a better outlook for Eastern Canadian yields, compared to our January forecasts, points to positive margins there. In the West, a lot of regional variation in estimated yields suggests our January forecast of weak margins is largely unchanged.

Corn prices to stabilize, wheat prices to rise slightly and soy prices to fall in 2024-25 MY

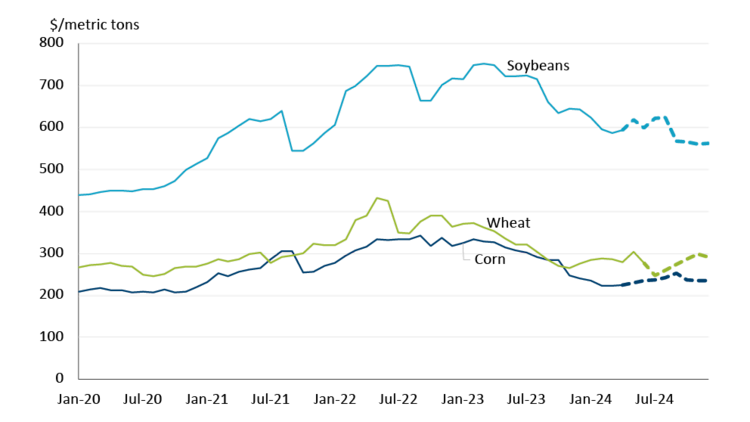

That improved forecast for margins won’t come from better prices for the year, however. FCC Economics’ price forecast has generally declined further for major crops since January. Corn prices will remain close to the bottom seen in the last four years as will wheat. Soybeans will continue falling from their high in February 2023 throughout the rest of 2024 (Figure 1).

Figure 1: Crop prices in 2024 pressured by cooling global demand, bountiful stocks

Source: Farm Product Price Index and FCC calculations

Those prices reflect expectations of global supplies. In its latest WASDE report, the USDA raised its forecast for 2024-25 global production and ending stocks of wheat, based on improved conditions in June in numerous countries including Canada and the U.S. Nonetheless, ending stocks are lower than they were in the 2022-23 and 2023-24 crop years, which is helping to keep wheat prices from plunging further. Global soy production is forecasted to grow 7% year-over-year (YoY) this marketing year, with ending stocks forecasted to be boosted by a significant 19%. Corn production and ending stocks are expected to be in line with 2023 levels, with reductions in Russia after a period of unfavourable weather. A big wildcard in these estimates will be the final tallies of crops in the Black Sea region. Both Russia and Ukraine have struggled with extreme moisture deficits, and any underperformance will be bullish for prices.

Canadian crop production gets a helping hand from good spring rains

We expect higher production (than was initially estimated) to more than offset the impact of declining prices, boosting Eastern Canadian margins in the process. Yield forecasts, in particular, have improved in response to the good moisture levels during spring. As a result, for the remainder of 2024, we expect soybean and corn profitability to strengthen.

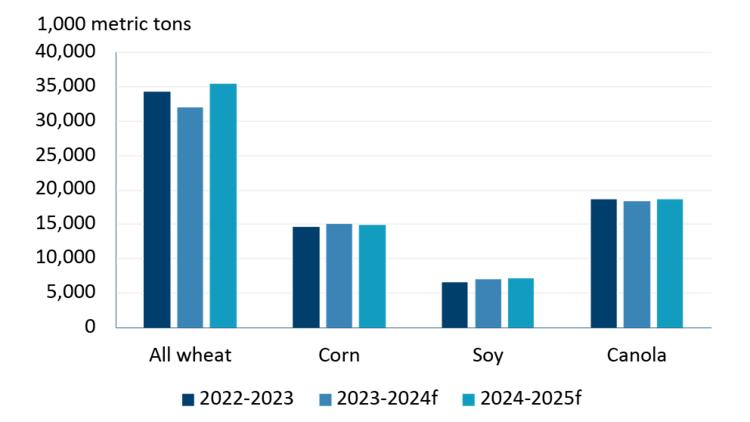

AAFC’s latest production estimates show overall Canadian wheat production will grow YoY in 2024 (Figure 2). Soybean, canola and corn production are now forecasted as stable YoY from what was previously forecasted to be YoY losses. Estimates for each crop except corn were raised between 2 and 3% since AAFC’s June release.

Figure 2: Canada’s 2024-25 wheat production to increase; other major crops show no real YoY gains

Source: AAFC

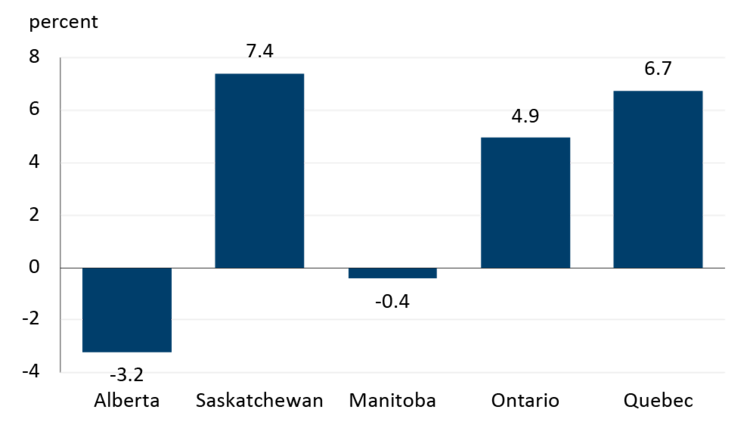

Those forecasts were produced before the latest data show some expected losses in yield estimates for crops in Manitoba and Alberta, with the likely outcome the production forecasts will, again, be revised lower in AAFC’s next release. That said, Western Canadian yield estimates have all increased since pre- and early season estimates. In February, 100% of western Canada was experiencing the kind of dryness that correlates strongly with lowered yields in September. But between March and June, moisture levels improved almost everywhere – and in some regions, the saturated ground even prevented normal seeding. Now, compared to their respective 5-year averages, FCC Economics is forecasting canola/wheat yields to be 0.4% lower in Manitoba, 7.4% higher in Saskatchewan and 3.2% lower in Alberta. Ontario will see corn/soybean yields average 4.9% and Quebec, 6.7% higher than their five-year averages (Figure 3).

Figure 3: Estimated 2024/25 yield vs the 5-year average

Source: Statistics Canada, FCC Calculations

Volatile Western weather in the 2024-25 crop year to date has produced historic drought conditions in early spring to excess moisture in late spring and, in late July, too-dry conditions again. Taken together, it spells yields that may trend roughly in line with the five-year average.

Midway through the crop year, conditions are showing some weakness

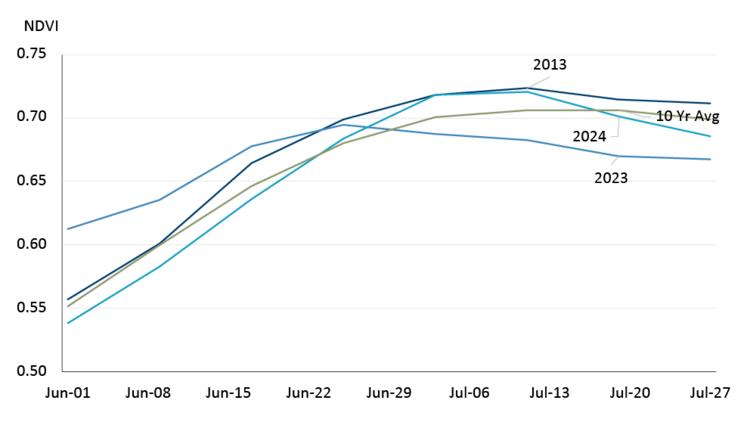

Late in July, conditions are starting to show some weakness in Manitoba, Saskatchewan and Alberta, despite the crop having reached impressive levels. The Normalized Difference Vegetation Index (Figure 4) measures the density of vegetation using satellite imagery. Higher values show greater vegetation density or better growth patterns. But just as important is the shape of the curve. Once crops have emerged, the right balance of heat and rain is needed to allow plants to flower optimally. The navy-blue line on Figure 4 shows the trajectory of plant growth in 2013, the last year Western Canada had a bumper crop, with an elongated curve of high values throughout the summer months. That meant the flowering period could happen stress-free.

The chart shows the potential this crop had to becoming a bumper crop in 2024 with a high peak in the curve. Topping out in early July, its decline suggests crops are starting to run out of moisture with large swaths of the prairies being very hot/dry during flowering heading into August.

Figure 4: More rain and less heat are now needed to maintain elevated yield estimates

Source: GIMMS Global Agricultural Monitoring, FCC Calculations

Bottom line

Under the current scenario, with crops likely to abort some flowers in some regions due to dryness, projecting yields is tricky. But it’s safe to say that, for Western and Eastern crops, the outlook for yields is better than it was in January but worse than in June after the crop was seeded. Our forecasts show strengthening margins compared to our January outlook for canola, wheat, soybeans and corn.

At this point in the 2024-25 crop year, rain is needed to finish the crop. But because of the relatively better start to the year, the overall situation should be a grade higher than 2023, when a good start was negated by a lack of in-season rain.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.