Rising interest rates? Use these 2 financial ratios to keep a strong balance sheet

Canadian food and beverages manufacturers have made significant investment in technology, buildings, and equipment to improve overall productivity and efficiency over the past 10 years. Capital investment as a per cent of sales has increased from 1.7% in 2011 to 2.8% in 2021.

Historically low interest rates have facilitated much of these investments. A rising interest rate environment could result in significant financial pressures on an operation if they are unable to adjust.

Canadian food and beverage manufacturing balance sheet

The financial health of the food and beverage industry can be assessed using financial ratios. The debt-to-equity ratio measures the ability for an operation to meet long-term financial obligations and is calculated by dividing total liabilities of the industry by total equity. The debt-to-equity ratio for manufacturers with revenue between $5M and $20M increased to 1.8 in 2020 from 1.7 in 2019 for food as manufacturers took on more debt, while it increased to 3.3 from 2.5 for beverage manufacturing. That means small food manufacturers had 80% more debt than equity in 2020.

The financial picture at the operation level can be significantly different than at the aggregated industry level. There are several factors that will influence the debt-to-equity ratio of an operation. Manufacturers that recently financed an expansion will have a much higher debt-to-equity ratio. Companies that have a higher Debt/Equity ratio than their industry or peer comparison average, should have a strategy to improve their Debt/Equity over time. It is important to monitor your debt-to-equity ratio because it brings flexibility to ensure that a business can borrow more if an investment opportunity arises, or profitability challenges occur.

Rising interest rates can hamper financial strength - but to what extent?

Debt repayment obligations may rise at times when revenue growth is flat/declining and/or interest rates increase. Manufacturers that carry debt on their lines of credit or variable-rate loans will see their interest expenses rise. One way to look at the sensitivity of a manufacturer’s tolerance for interest rate increases is the Debt-Service Coverage Ratio (DSCR = debt service capacity/debt service requirements). This ratio is calculated by dividing net operating income (or earnings before interest, depreciation, and amortization) by a manufacturer’s annual debt service payments. It measures the cash available to pay off debt obligations in that same period.

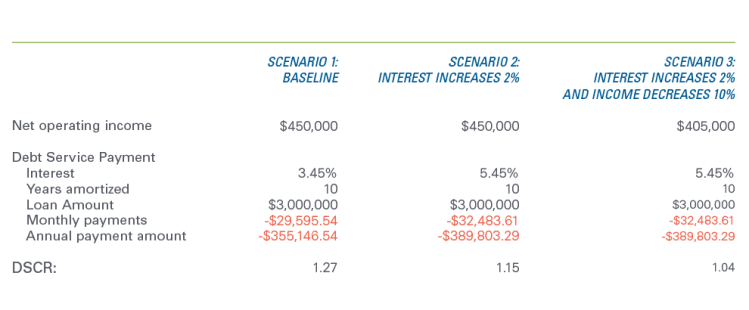

Let’s consider an example: a manufacturer has net operating income of $450,000 and a loan amount of $3,000,000 amortized over a ten-year period. When evaluated at a 3.45% interest rate (current prime rate plus 1% at the end of 2021), the DSCR is 1.27 (see the table below). A 2.0% increase in the interest rate would lower the DSCR to 1.15, indicating a greater drain on net income.

Interest rates are not the only source of risk to consider. A decline in revenues available to service debt will impact a manufacturer’s financial strength. A 10% decrease in net operating income coupled with a 2% increase in the interest rate would decrease the DCSR to 1.04 – indicating a tight repayment capacity.

A DSCR lower than 1 means insufficient funds to meet debt obligations. Conversely, a DSCR higher than 1.25 leaves room to meet unexpected changes in the financial or economic environment. In other words, one dollar and twenty-five cents of income covers one dollar of debt (1.25x DSC). Industry standard is 1.25x. One way to manage interest rate increases is to utilize a longer-term fixed rate if the forecast is for interest rates to rise. Interest rates can have a material impact on the incentive to borrow for capital expenditures or investment. Floating rate facilities such as Lines of Credit will require higher interest carrying costs. Conversations with your lender about debt laddering (paying small debts off in full first) and planning can add significant value to an operations ability to manage higher interest rates.

Rising interest rates and income decline impacts on the debt-service coverage ratio

Manufacturers can’t control where interest rates may go but should focus management decisions to better face unfavourable movements in rates or income. Focus on strategies that control costs and raise revenues and productivity.

Justin Shepherd, Economist

Supply chain risk is everywhere for food and beverage manufacturers. Learn how to manage and assess it effectively.