5 small steps that help you move towards bigger profits

Let’s start with a baseball analogy. A .300 batting average versus .250 is just one more hit every 20 at-bats. It doesn’t sound like much, but when you replicate it over a season it can really add up.

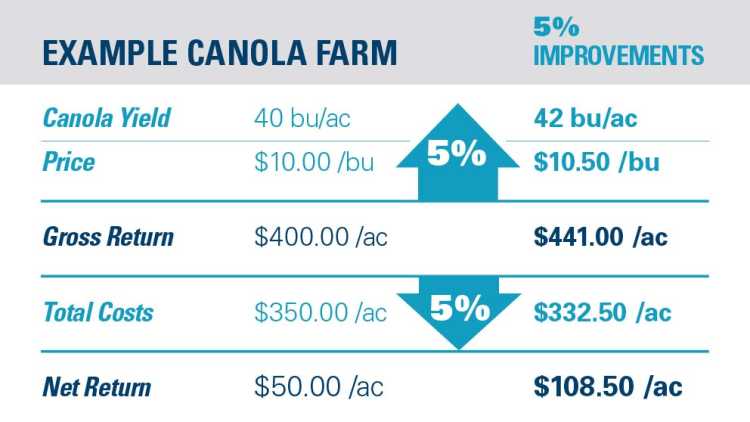

Now imagine a canola farm that’s had a 5% improvement on yield, a 5% on marketing and a 5% decrease in costs. In theory, this should only be a 15% improvement – but it adds 117% more to the bottom line.

How big is that in a typical farm commodity?

The example canola farm here had a net return of $50 an acre. Doing three things 5% better each made it $108.50 – more than double. If you draw 50-mile pockets in Western Canada, in many of those pockets one farmer will make $100 an acre more than his peers, proving the 5% difference can be huge.

Ways to work towards a 5% improvement

A good relationship with your agronomist can help improve efficiencies. Is there a better macronutrient package? Have you used potash or seed treatments? How good is the germ on your seed? Have you looked at thousand-kernel weight?

Investing more inputs may seem counterintuitive cost-wise, but using more inputs often correlates directly to your gross margin. That said, sectional control on our farm led to an eight per cent decrease in inputs with no change in yield.

What is your overlap difference on autosteer? Can you get 24-hour shifts because of autosteer? What is your real depreciation? What are wages to third parties, fuel, custom work, leases, the cost to get it done?

Two farms could grow the exact same number of bushels and sell for the same price, and one could make $100 an acre more simply because it is more efficient. One question is this: Am I over-equipped? How many more acres could I farm with my same equipment line plus or minus one human?

Consider accrual accounting – recording revenues and expenses when they’re incurred, not when cash is exchanged. I wish accountants, consultants, insurance agents and bankers would force it on agriculture. It completely changes the relationship with lenders. Knowing your debt-to-equity ratio and debt servicing ability completely changes how well you can plan for the future.

The bottom line: have a plan and know your cost of production. If you always lock in profits, it’s difficult to go broke.

From a AgriSuccess article.

Knowing your cost of production and your cash flow needs are essential elements of a good marketing plan.