2021 Broiler outlook update: Higher prices in the chicken supply chain

This is the final update to our 2021 broiler outlook. Our grains, oilseeds, and pulses outlook update was published three weeks ago, the dairy outlook update was published two weeks ago, and the cattle and hogs update was published last week.

Average gross revenues for Canada’s broiler producers are expected to climb in 2021 YoY, in response to several factors. For one, Canadian prices for live chicken will reflect rising feed costs due to the dual impacts of limited supply and strong global demand for feed grains (Table 1).

Table 1: Gross revenues pushed higher by feed costs ($/kg)

Sources: Calculations by FCC based upon Chicken Farmers of Ontario farm-gate minimum live price estimates, and British Columbia Chicken Marketing Board cost of production formulae comparison, CME futures, Statistics Canada and USDA.

A rebound in production

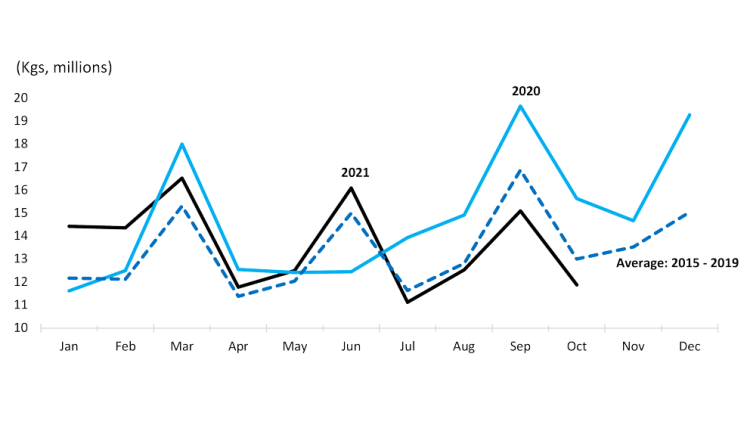

Canadian chicken slaughter has fully rebounded from the slowdowns produced by COVID-19 labour disruptions and weakened demand (Figure 1). Pre-pandemic, 2020 started with production more than the previous 5-year average (2015 – 2019), but it slowed over the summer months to under that average. Between August and December, it regained a momentum that has slowed intermittently throughout the first half of 2021. As of June (to October) of this year, chicken slaughter has soared past the 2015-2019 average and year-over-year levels. Domestic production allocations for the outlook period (Nov 21-Jan 15) call for an increase of 2.8%.

Figure 1: Canada’s chicken slaughters in late 2021 easily exceeds year-over-year levels

Sources: AAFC, Monthly Poultry Slaughter Report.

Demand continues to strengthen

Overall foodservice sales, including sales in both dine-in full-service (restaurants) and limited-service (drive-through) businesses, have grown throughout 2021. In August, total foodservice sales reached a level just 2% lower than pre-pandemic activity. However, there’s a difference between full and limited-service establishments.

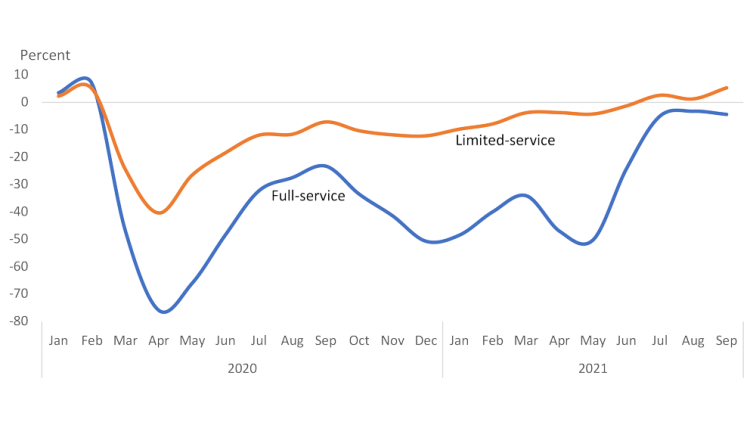

As of September, limited-service food sales were above their pre-pandemic levels, while full-service sales were below (Figure 2). Trends in restaurant reservations for October and November suggest that the uptick in full-service sales has reversed to lose some of the gains made over the summer months, due at least in part to COVID’s fourth wave impacts this fall.

The pandemic’s overall influence on foodservice sales is highlighted in Figure 2. Each month in the chart shows the difference between 2019 and 2020, and 2019 and 2021. While drive-throughs and take-outs took a hit at the start of the pandemic, the toll exacted on full-service businesses was deeper and longer-lasting. The course of the pandemic in Canada is charted here: the first wave of Canadian infections began in January 2020 and lasted five months. The second wave started in September 2020 to recede in February 2021. The third wave, largely curtailed by the recent vaccine roll-out, was short-lived, peaking in April, and the fourth wave was first detected in July.

Figure 2: Full and limited-service food sales relative to 2019, monthly

Source: Statistics Canada.

In a year marked by high inflation, there is some good news. Higher retail prices for chicken won’t necessarily lead to weaker demand as competing proteins are also expensive. YoY inflation for chicken stood at 8.3% in October. Beef inflation remains stronger at 14.0 while pork stands at 8.8%.

Rising feed costs pressure margins

Rising feed costs continue to impact Canada’s broiler sector in 2021. The Eastern broiler feed price is expected to average 27.5% higher in 2021 than its 5-year average. The Western feed price, which had already risen higher than in the East, is still expected to average 14.4% higher than its 5-year average (Table 2). The recent mudslides have only added to those concerns around Abbotsford, B.C. where western broiler production is concentrated. This year, shortfalls in feed grain production, tight domestic and global stocks and continuing strength in global demand for corn and wheat are driving prices higher are.

Table 2: Feed costs to be more costly in the West throughout 2021 ($/tonne)

Sources: Calculations by FCC based upon Chicken Farmers of Ontario farm-gate minimum live price estimates, and British Columbia Chicken Marketing Board cost of production formulae comparison, CME futures, Statistics Canada and USDA.

Imports supported 2020 Canadian chicken supply – but they dip in 2021

In 2020, Canadian chicken imports from the U.S. jumped beyond their previous 5-year average, with imports in both September and December just shy of reaching 20 million kgs (Figure 3). Canadian slaughter slowed in May 2020, but storage stocks were plentiful enough to meet the lower demand. However, by July’s summer barbeque season, they were depleted more than the reduced Canadian production could keep up with. The three hardest-hit months of Canada’s broiler slaughter were June, July and August. During that period, Canadian imports of chicken in 2020 skyrocketed, peaking in September.

Figure 3: Canadian imports of chicken from the U.S. take a major plunge in 2021

Sources: Statistics Canada. Poultry Import Report, Monthly Breakdown.

Several other factors helped produce the gain in imports: the Canadian dollar was trading lower, U.S. chicken production had not faced the same slowdowns seen in Canada, and different chicken parts were unusually cheap to import.

January 2021 started with imports also very high, but despite a sharp rise in June, they’ve fallen in the second half of the year. As of October, Canadian imports from the U.S. were 8.8% lower than the 2015-2019 average and 24.1% lower YoY.

Bottom line

Though COVID’s fourth wave appears to have waned, a fifth wave looms and the displacement of chicken consumption from dine-out to retail and reduced demand may not be over. Profitability for 2022 will depend on holiday celebration and winter consumption trends.

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.