2021 Cattle and hog outlook update: Mixed margins expected

This is the update to our February cattle and hogs Outlook. The update to our 2021 Outlook for major crops was published two weeks ago and the 2021 dairy Outlook update was published last week. Next week, we’ll update the 2021 Outlook for broilers.

China’s seemingly insatiable demand for feed has kept livestock production costs high throughout the rest of the world. Feed costs have most recently fallen somewhat but they’ll continue to take a chunk of revenues from both cattle and hog producers over the next three months. However, profitability in the two red meat sectors is showing different outcomes. Margins are expected to be mixed for Canada’s cattle and hog sectors as finishers and feedlots struggle with rising feed costs in the short term.

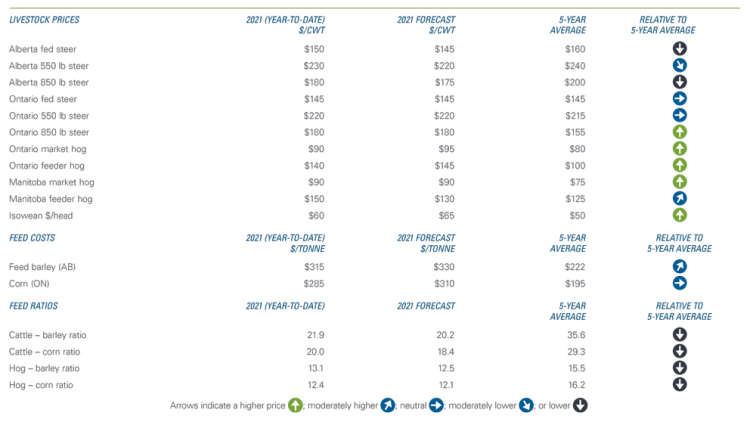

Table 1: Cattle and hog prices continue to rise above 2020’s prices

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations.

In February, we identified African Swine Fever, feed costs and growing global demand for red meats as the three dominant forces impacting profitability of the Canadian red meat sectors. They are still exerting dominance, with the added uncertainty of weather-related impacts on global feed crops in 2021.

Hog sector to benefit from elevated hog prices

Prices should continue to improve over the outlook period from our February outlook forecasts. The average annual prices for each class of cattle and hogs through 2021 remain higher than 2020 prices. While most of this year’s prices are expected to also be higher than the five-year average, Alberta fed and feeder cattle will remain lower as backgrounders and feedlots find themselves sandwiched between high feed costs pushing up slaughter rates and packers buying cheaper cattle now for fall delivery.

Farrow-to-finish operators will continue to benefit from the strong rebound that started last fall. They have much to look forward to in the next three months including the upcoming barbecue season and the enhanced likelihood of reduced restrictions. One possible caution: lingering slowdowns in pork production can impact margins in eastern Canada.

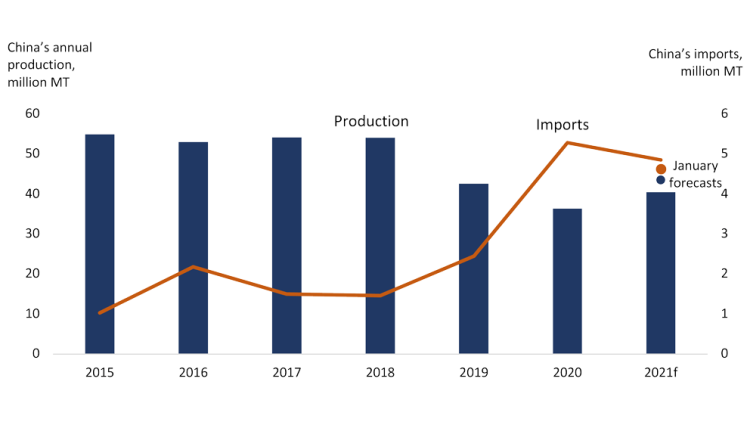

A resurgence of ASF in China and elsewhere across Asia and Europe continues to drive global pork markets and the sharp rise in prices seen since February. It seems highly unlikely that China will be able to manage the virus for possibly another two to three years, prompting speculation that their imports of both pork and beef will remain elevated until an effective vaccine is available (Figure 1).

Demand is also strong in North America, where a growing pent-up demand, the summer season and reopening of food services are fuelling better retail sales and prices. Production in both Canada and the U.S. is expected to remain strong throughout the outlook period.

Figure 1: In April, USDA forecasts stronger Chinese pork imports and weaker production than in January

Source: USDA.

China’s pork imports were at an all-time high in March of this year and their pork production in Q1 is reported to have jumped 31.9% from a year earlier. While it’s certain their demand is strong and consistent with the robust economic rebound of 8.4% projected in 2021 by the International Monetary Fund, that kind of growth in Chinese pork production and imports will, with little doubt, prove to be unsustainable for the rest of 2021. It may also be that they will even have dramatically slowed by the end of the outlook period. In the short term, pork imports may continue to be strong, but at some point, further Chinese imports will depend on their success (or lack thereof) in containing ASF and rebuilding the hog herd.

Hog finishers and cattle feedlots strain with growing feed costs

The hog and cattle markets differ somewhat in their outlook because hog futures have been rising faster year-to-date while cattle futures have declined recently. The North American hog backlog was cleared before the cattle backlog and production was able to respond to increased Chinese demand due to the ASF resurgence. Cattle futures are expected to pick up from their recent declines and stay steady to slightly rising.

Cattle basis levels have improved in the last month to turn positive, as packers have become more aggressive. This implies strong demand from the sector as they continue working through the backlogged slaughter numbers. If basis levels remain strong, the relatively weak margins we expect now could improve by the end of the outlook period.

Feed prices facing sustained pressure from economic recovery and weather

While feed prices are high now, they may face sustained pressures throughout the next three months. The summer is expected to see more driving, stronger fuel demand and more corn and soy used to support them, helping keep prices elevated. Without an improved forecast for moisture, given dwindling stocks and the strong and growing demand for corn, both North and South American production may not be enough in 2021 to meet that demand.

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.